Speculation ahead of November’s Budget that the tax-free lump sum limit on pensions could be slashed by chancellor Rachel Reeves has prompted retirees to withdraw as much as they can now, but doing so could leave pensioners in a pickle later in life, according to Adrian Murphy, chief executive of Murphy Wealth.

At present, retirees can take out 25% of their pension up to £268,275 as a one-off, tax-free lump sum. However, fears over whether the chancellor will lower this figure could be causing some to act early.

Murphy said: “ Rumours about the limit for tax-free lump sum withdrawals is only compounding the situation and prompting many people to make drastic decisions about their pension pots.”

On top of this, the chancellor has formerly suggested plans to make pensions liable for inheritance tax (encouraging retirees to spend their wealth rather than hold it to pass on to loved ones).

“The decision to bring pensions into people’s estates for inheritance essentially reversed years of financial planning and advice. Before, in many cases, the last asset you would draw on for income was your pension, because it could be passed on tax-free to your spouse or children,” said Murphy.

“Now, though, more retirees are opting to spend the wealth they have built up in this wrapper, rather than letting it inflate the size of their estate and pass on a potentially large tax bill to their families.

“It is obviously a very positive choice to enjoy your money, or enjoy seeing your family use the wealth you pass down to them. However, with the tax changes being made and the ongoing rise in the cost of living, it has seldom been more important that you do so in a sustainable way that won’t leave you short in later retirement – particularly in the latter stages, when the cost of care may need to be taken into consideration.”

There has already been a growing trend of people making use of the lump sum. Data from the Financial Conduct Authority (FCA) revealed the number of individuals doing so rose from 163,500 to 211,000 in the past two tax years, up 29%.

The amount withdrawn has also increased from £11.25bn during the 2023/24 tax year to £18.1bn in the 12 months up to the end of March 2025, an average of £85,782 per pot.

But Murphy Wealth found that taking the full allocation could knock as much as a decade off the longevity of a pension.

Assuming 8% total contributions over 40 years with an average UK salary of £37,430, an individual would be putting away £2,994 per annum or just under £250 per month.

With average annual investment growth of 5%, they could have a pension pot of £362,399 by the time they reach 65, with a 25% lump worth £90,560. This is a similar amount to the average withdrawal, the firm said.

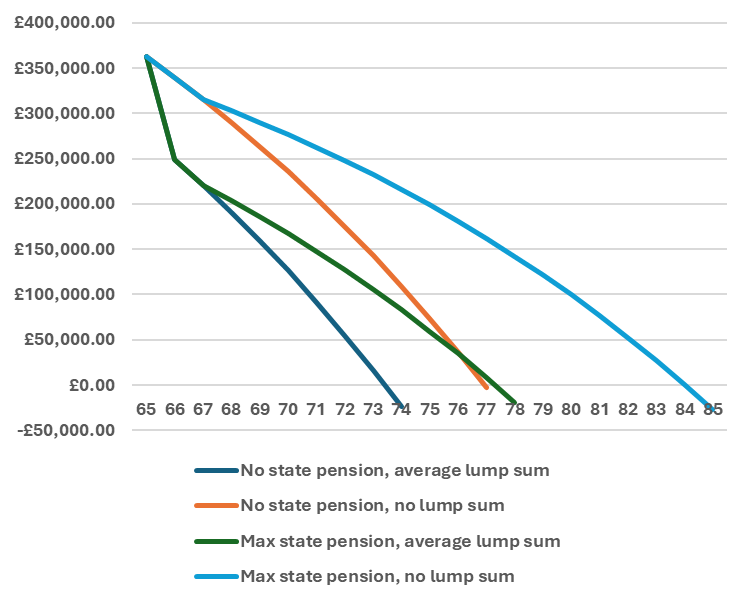

If they were to take this average out and live on a ‘moderate’ income of £31,700 – as defined by the Pensions and Lifetime Savings Association (PLSA) – the individual in question would run out of money by the age of 74, assuming no state pension contributions.

How long the average pension pot will last with and without taking out a lump sum

Source: Murphy Wealth

Adding in the full state pension, expected to be £12,535 from next year, their retirement pot would likely last until they are just 77.

In contrast, by eschewing the tax-free lump sum, this would increase their pension longevity from 74 to 77 (without the state pension) and from 77 to 84 years old with the government contribution.

Murphy said: “Taking out a large tax-free lump sum may seem like a good option now, but it can significantly reduce the longevity of your retirement pot – in the two most extreme examples, by as much as a decade. As these figures show, over the long term, it can have quite serious financial implications for your retirement.”

Savers should speak to a professional adviser who can help make the money last longest, recommended Murphy, who cautioned against acting in haste based on rumours ahead of the upcoming Budget.