It’s fascinating to see which stocks are doing the heavy lifting when a sector outperforms. If competing managers believe the same companies offer the best chances of edging their trusts ahead of their benchmarks, and beating their peer group, it’s worth analysing these companies.

So I asked the research team at the Association of Investment Companies (AIC) to pore through each of the ten investment trusts in the Global Emerging Markets sector to find out which stocks were the most commonly held in their portfolios.

Let’s remember that global emerging markets investment trusts have been some of the star performers of 2025. The average global emerging markets trust has gained 30% over the past year, compared to 20% from the average investment trust. That suggests some of the most dynamic companies in the world are based in emerging markets.

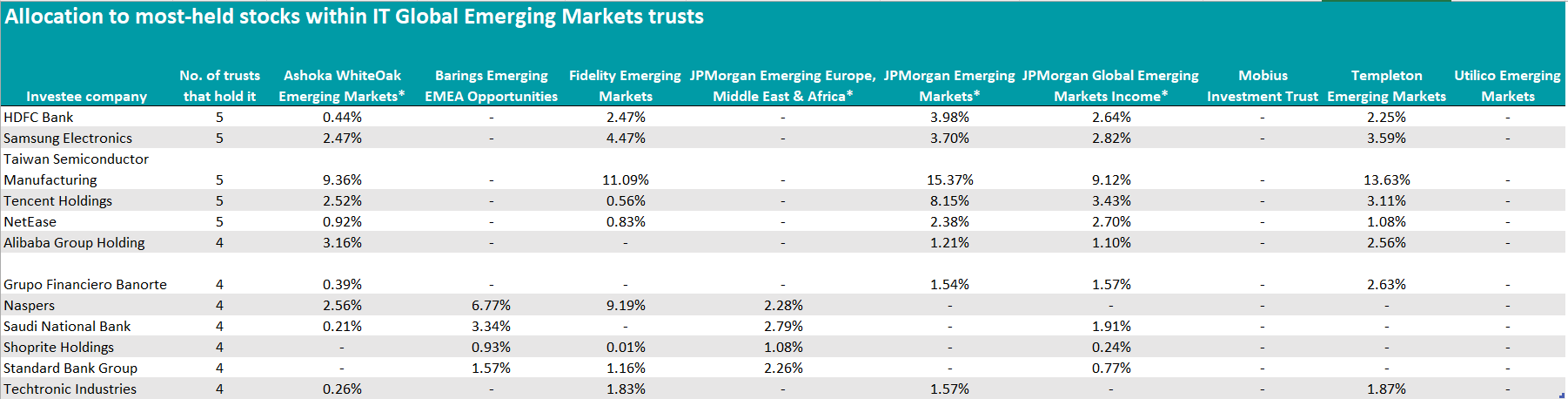

The research revealed that Taiwan Semiconductor Manufacturing Company, Samsung Electronics, HDFC Bank and Tencent holdings are the most commonly held companies. These feature in the portfolios of five global emerging markets trusts – half of the investment trusts in the sector, as the table below shows.

Source: The Association of Investment Companies. Data as of 31 August 2025; * = Data as of 31 July 2025.

Taiwan Semiconductor Manufacturing Company is the world’s leading manufacturer of semiconductor chips, accounting for 70% of the global market.

TSMC is “simply too integral to ignore”, as John Citron, co-manager of JPMorgan Emerging Markets Investment Trust, told me during a casual chat recently.

“As the world’s largest contract chipmaker, it is central to the global technology supply chain and powers the AI boom, 5G rollout and high-performance computing that define the digital economy. Its unrivalled technological edge and dominant market share make it a linchpin of global innovation and a company you want to own for the long term.”

But while TSMC has become a household name, many in the list have much lower profiles, at least here in the UK.

For example, HDFC is a leading growth stock in India, according to JP Morgan’s John Citron. He said: “HDFC Bank helps investors tap into India’s growth story. As the country’s leading private lender, it combines scale, profitability and prudent risk management with a huge runway for expansion in digital payments, consumer credit and wealth management. In a rapidly growing economy with a rising middle class, its market leadership makes it a compelling long-term investment.”

Naspers is an enormous South African company that owns a variety of brands, many through its investment arm, Prosus. For example, Just Eat, the well-known delivery service is ultimately owned by Naspers.

And Naspers’ founder Koos Bekker famously made one of the most successful investments in history when he paid $32m to buy a 46.5% stake in Tencent in 2001. An investment that ultimately grew to a value of more than $100billion, which has helped to fund numerous investments for Naspers in the years since.

Chris Tennant, co-portfolio manager of Fidelity Emerging Markets, told me: “We remain very positive on Tencent, and the reason we hold it at the Naspers level is because of the substantial improvement in its capital allocation approach. Naspers’ management team has changed, the incentives have shifted, and they're now focused on selling-down loss-making businesses and buying back shares to reduce the discount which Naspers trades on versus the value of its holdings, which is very value accretive to shareholders.”

Tencent is itself one of the most-held stocks within the emerging markets sector. It is China’s leading technology giant and the company behind the ubiquitous WeChat “super App”, which is used in China for everything from messaging and picture sharing to mobile payments.

The next most-held companies are NetEase, the tech giant best known for its games division, online retailer Alibaba, Grupo Financiero Banorte, a leading Mexican financial services company, and Saudi National Bank. Each held by four of the ten trusts in the global emerging markets sector.

Finally, another stock that is not well known in the UK but some of its subsidiaries are is Shanghai-based Trip.com, the internationally diversified travel platform. It is a hugely successful business in its own right even though its best-known brand in the UK is probably Skyscanner.net.

Chris Tennant, co-portfolio manager of Fidelity Emerging Markets is bullish on the name. He said: “We see particular opportunities in ‘experiences’ categories in China such as travel and music streaming, and one core position is Trip.com. This is China’s leading online travel agency, with similar dominance to the likes of Booking.com, but with a better value proposition for the consumer. Spending has lagged in Chinese travel, but we are now starting to see recovery in this space, and it remains an underpenetrated category with much better scope for growth vs consumer goods categories like apparel.”

Every single one of these stocks has made solid gains this year, with some enormous returns from some stocks – a great reason to choose active managers who can identify these spectacular opportunities.

Annabel Brodie-Smith is communications director at the Association of Investment Companies. The views expressed above should not be taken as investment advice.