The ‘Magnificent Seven’ stocks of Alphabet, Amazon, Apple, Nvidia, Meta, Microsoft and Tesla are expensive by price-to-earnings standards but are actually more reasonable than investors may think when looking into the future, according to three top fund managers.

Many have questioned the price of the US market, which F&C Investment Trust manager Paul Niven noted currently trades “near the top of its historic range”.

It has been led higher in recent years by the Magnificent Seven stocks, which have benefited from the artificial intelligence (AI) boom, leaving them trading at an “even greater premium”.

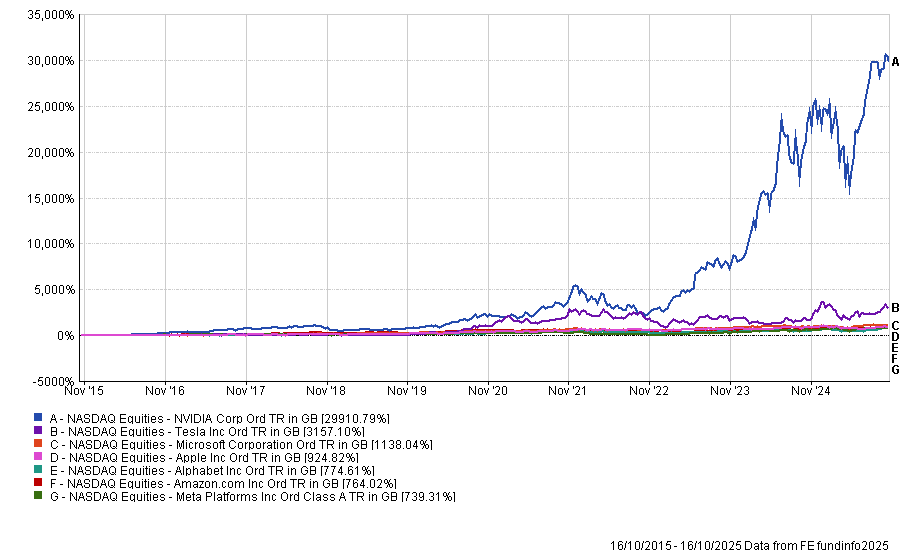

Raheel Altaf, Alpha Manager of the Artemis SmartGARP Global Equity noted that these stocks have also produced “truly exceptional returns in the past decade”, with Meta’s 739% return the lowest total return posted by a member of this cohort over the past 10 years, as data from FE Analytics shows.

Total return of Magnificent Seven over past 10 yrs

Source: FE Analytics. Total return in Sterling.

On average, an investor now has to pay around 28x forward earnings for the Magnificent Seven, although current price-to-earnings (P/E ratio) ratios are less kind.

Among these stocks P/Es range from 200x for Tesla, down to 25.8x for the more reasonably rated Meta. Nvidia, perhaps the most popular of the companies, trades at 51.5x, according to data from Google Finance.

These valuations have led some to argue that the current market resembles the tech bubble in the early 2000s, when stocks ran higher on the buzz of the internet before coming back down to earth.

James Thomson, FE fundinfo Alpha Manager of the Rathbone Global Opportunities fund, said while comparisons between current circumstances and the dot-com bubble are understandable, they are two very different situations.

“Demand in the dot-com era was largely based on belief rather than fundamentals,” he said, while today the US tech stocks have significantly better balance sheets, including an enormous amount of cash.

“I’m not going to tell you that the Magnificent Seven are screamingly cheap, but in the dot-com bubble companies were regularly valued on 20x to 40x sales. There’s quite a gulf between then and now,” he said

Are they worth the price?

Niven said, while valuations are “rich”, the strong competitive positions these companies enjoy justify the asking price. Part of this is the earnings portion of the P/E ratio, with the companies posting an average 26% growth last quarter, compared with just 7% for the wider market.

“However, given the extent of growth you’re getting, we actually think you’re paying a reasonable price for that cohort of stocks,” said Niven.

Additionally, these stocks are the main contributors to the artificial intelligence (AI) boom, investing huge amounts of capital expenditure (capex) in the new technology.

Thomson agreed, noting that many of the companies are “mission-critical businesses” with pricing power and unique products that have “no real substitutes anywhere else”.

“If you have these subscription, mission-critical businesses, such as Amazon or Microsoft, that have become highly recurring and built into corporate and household budgets, I think they deserve to trade on higher multiples,” he continued.

Which do these veterans own?

Altaf owns Nvidia, Meta and Alphabet in his top 10 positions. “I’d argue those three are reasonably valued,” he said.

However, he was less keen on other members of the Magnificent Seven and pointed to Tesla, Apple and Microsoft as being “somewhat overvalued”, adding that he was concerned by their deteriorating growth.

Thomson has taken some profits from mega-cap tech so far this year, reducing his allocation to the Magnificent Seven down to 12%, noting that the index’s 25% allocation towards the Magnificent Seven is “too aggressive and risky”, as one left-field event could send the whole index reeling.

However, he is “very supportive” of Nvidia, which controls the full ecosystem of semiconductor chips, hardware and software, giving the stock a “substantial moat around the business”.

The Rathbones manager was also constructive on Amazon, Meta, Alphabet and Microsoft, which are set to invest more into the burgeoning AI space than the rest of the market combined next year.

“How do you compete against that?” the Alpha Manager continued. “When four companies are bringing that level of capital spending to the market, it is pretty difficult to ignore them.”

Niven is also underweight most members of the Magnificent Seven other than Nvidia and Meta, noting that a higher allocation to such a small number of stocks can be risky, particularly because there is “less of a valuation cushion than we would like”.