Indian equities have struggled this year compared to other Asian markets, but Jason Pidcock, manager of the Jupiter Asian Income fund, has kept faith.

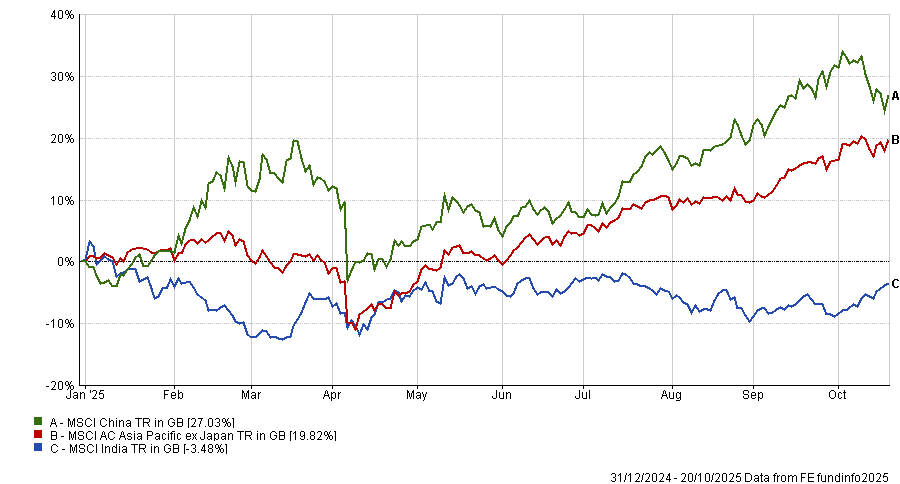

The MSCI India is down 3.5% over the year to date, while the MSCI AC Asia Pacific ex Japan index has rallied 19.8%.

Performance of indices YTD

Source: FE Analytics. Total return in sterling.

Meanwhile, China has been staging a comeback, with the MSCI China up by 27% over the year to date, as the country so far has suffered less than expected from the trade war with the US.

Pidcock sold out of China entirely in 2022 but maintains a 14.8% allocation to India, a core market in Asia that he has no plans on selling out of despite of the poorer run.

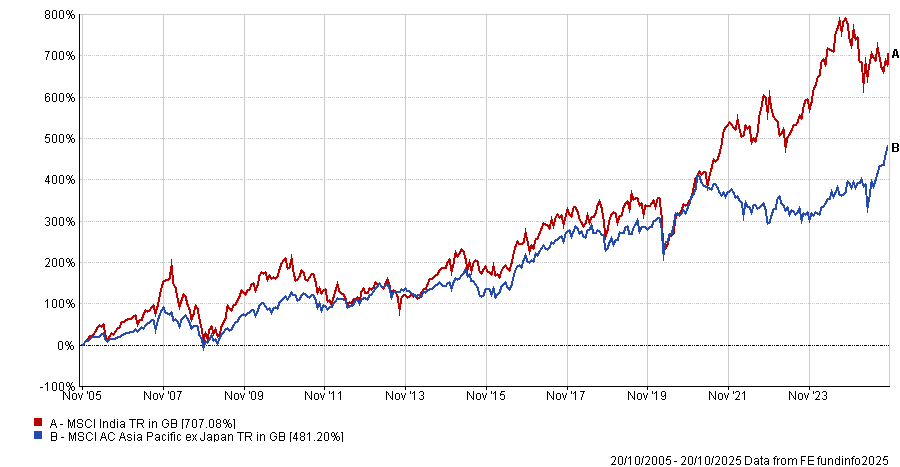

India has historically been one of the “better performing” Asian markets, he said. Indeed, Indian equities have outperformed the MSCI AC Pacific ex Japan index over the past five, 10 and 20 years, according to data from FE Analytics.

Performance of markets over the past 20yrs

Source: FE Analytics. Total return in sterling.

There are reasons to believe it can continue to deliver in the future, Pidcock continued.

The Indian economy is growing much faster than the average Asian peer, with GDP predicted to grow at 6.6% per annum compared to an average of 4.5% for Asia Pacific, according to data from the International Monetary Fund.

This growth “should be correlated with better stock market returns”, meaning the region has potential for further performance, even after this year's downturn.

The region is also full of high-quality, resilient companies that Pidcock argued could stand the test of time. His process searches for “robust” and recession-resistant businesses and examples can be found in India, such as the conglomerate LTC Limited, which features in his top 10.

“We’ll likely never sell out of India like we did China,” he said.

By contrast, investing in China still makes Pidcock’s teams “uncomfortable”, partially because stocks are held back by macro-factors such as politics.

“When buying stocks, we think a lot about the political system of the country we are investing in. If we don’t like it, we won’t own it,” he said.

Authoritarian regimes do not give businesses the freedom to operate in the ways they want, which limits the ability to find good opportunities in the region.

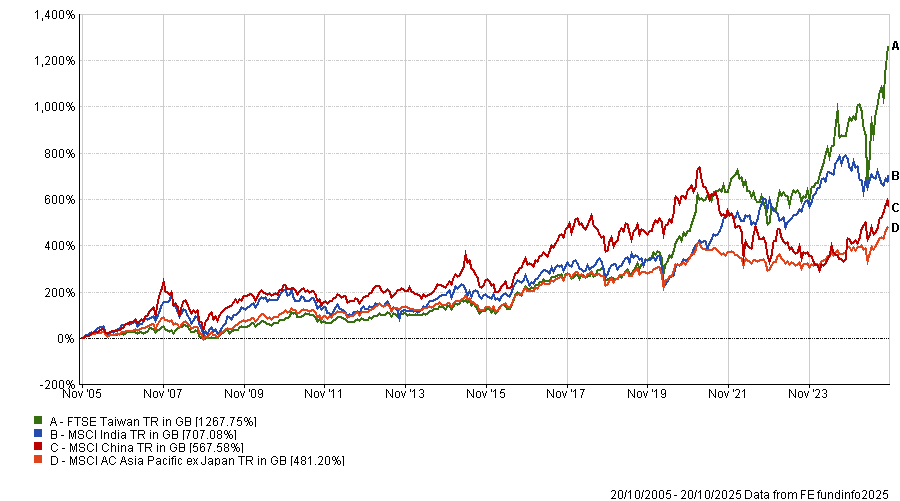

He pointed to China’s long-term performance as an example. While it has outperformed the MSCI AC Pacific ex Japan index over the past two decades, it has underperformed other markets such as India and Taiwan, as seen in the chart below.

Performance of indices over past 20yrs

Source: FE Analytics. Total return in sterling.

On top of this, Pidcock argued that China and the West “will continue to decouple”, particularly if tensions with the US continue to build. This political friction could limit returns over the long term and so avoiding the region makes a lot of sense, he argued.

“I’m just not comfortable investing in a country that I expect to have worse relationships with a country like the US, where most of our clients reside.”

Additionally, he argued that despite China representing 30.4% of the MSCI AC Asia Pacific ex Japan index, investors can get all the exposure they need from Asia without it.

Asian markets are full of “exciting opportunities” to invest in leading tech stocks like TSMC or Samsung, mining companies such as Northern Star Resources and even more domestically driven names. On a sector level, investors can get exposure to a broad variety of unique companies through investing in countries such as Taiwan, Australia or Indonesia without having to touch China, Pidcock argued.

“From a risk-reward perspective, we can get all the diversification we need out of just five markets.”

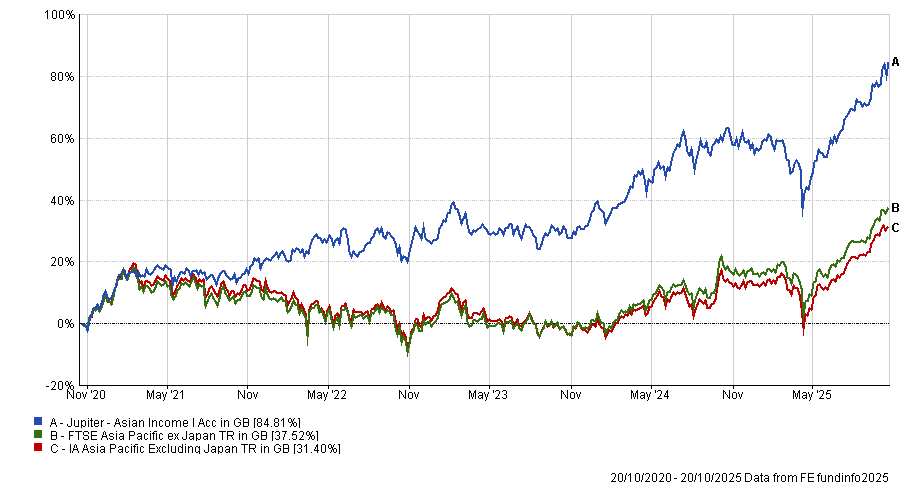

This approach has paid off for Pidcock over the medium term. Jupiter Asian Income has achieved top-quartile returns in the IA Asia Pacific ex Japan sector over the past three and five years.

The decision to sell out of China led to top-quartile performances in 2022 and 2023, when the MSCI China posted a double-digit loss.

Performance of fund vs the sector and benchmark over past five years

Source: FE Analytics. Total return in sterling.