Investors are being paid more than ever before to take a punt on companies outside of the US tech giants, according to Peter Davies, manager of the £472m Lansdowne (Lux) Developed Markets fund, but few have made any changes to their portfolio so far this decade.

“Most people I talk to haven’t changed their portfolio since the 2010s but will freely accept that the environment we are in during the 2020s is totally different,” he said. “It seems fundamentally unlikely that the same portfolio will keep working given how radically different the world is.”

While others have sat on their hands, he has built a portfolio that is very different to its peers, with just 16% in the US (and no major holdings to the ‘Magnificent Seven’) and some 73% in UK and European businesses.

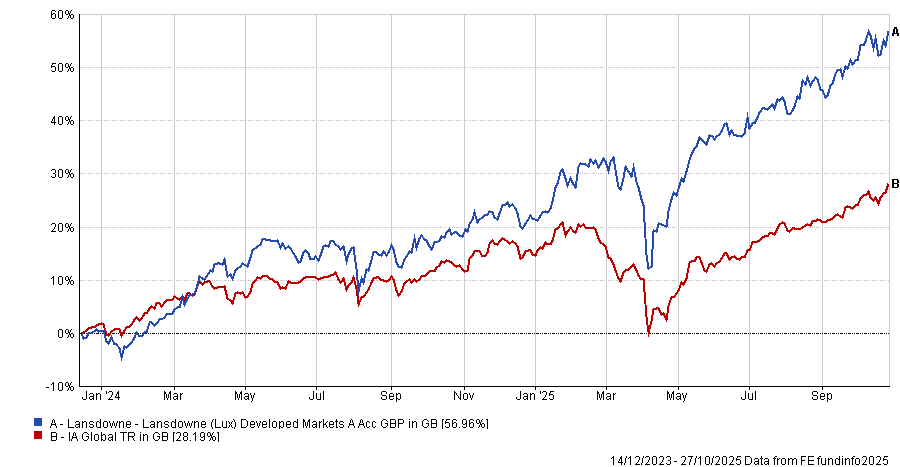

This has worked wonders for his portfolio, which forms part of the asset manager's much larger Lansdowne Developed Markets Strategy. Lansdowne (Lux) Developed Markets has got off to a storming start since its launch in 2023, making a 57% return, the 12th best in the IA Global peer group.

Performance of fund vs sector since launch

Source: FE Analytics

But the manager has not always been against the large US tech stocks, noting that in the early 2010s he was “building positions in Amazon, Google and the things that subsequently became the Magnificent Seven”.

However, he no longer holds these companies, noting that two things have “changed radically” since he saw them as priority holdings.

The first is that the companies have become more expensive, with Davies suggesting that 12 years ago they traded on price-to-earnings (P/E) multiples that were almost a third of what they are today.

The other is that they had a “very obvious growth path ahead of them with predictable returns”, something that is not the case in the current climate.

Although the artificial intelligence (AI) boom has boosted share prices, the US mega-caps face a “more capital-intensive and competitive future”, which is much riskier than the environment they have enjoyed for the past 10 years.

“The stuff that is a big part of the index looks to be a lot more complicated than it did 10 years ago,” he said. “Today, those are less attractive, I would say, and by contrast we see a plethora of opportunities, particularly in Europe.”

One benefit to investing outside the US is low valuations. Despite European stocks rallying so far in 2025 (up 29.4% versus the MSCI World’s 13.3% gain), he said they remain cheap compared with their American counterparts.

Normally, low valuations come with either a lack of growth or more risk entailed, but this is not the case, he argued, pointing to the building sector as an example.

“Things like building shares have demonstrated the ability to deal with massive rises in input costs without compromising their profitability. So they are clearly much better companies [than given credit for],” he said.

Meanwhile, the number of properties needing to be built should be higher in the next decade than in the past decade, whether it be through residential and commercial spending or even government spending. “We need to build more stuff,” said Davies.

“Europe has at least as much structural need for houses as the US does but cyclically is starting from a more depressed point. A sector like that is very cheap but, critically, that cheapness comes with both growth and less risk than you would normally take.”

Davies, who manages the Lansdowne (Lux) Developed Markets fund alongside Jonathon Regis and Nigel Hikmet, is particularly heartened by the fact that Europe’s revival has come at a time when there has been a cost-of-living crisis and war on the continent.

“What happened during the Ukraine crisis was rising energy prices and rising interest rates. What’s interesting to me is it [his portfolio] is working despite a worst-case scenario from a macro perspective,” he said. “That bodes well.”

However, he noted that investors should not think that the fund is set up to “systemically avoid the US” or to be value-biased.

Indeed, while his businesses may be listed in Europe, the manager noted that his exposure “is less pronounced economically than it is market-wise”. In other words, a lot of the companies he owns are exposed to the US economy, rather than the domestic one.

“I feel you can get the same exposure to the same economic variables more cheaply on average in Europe than in the US,” he said. “It’s a question of how much you get paid for deviating from the index, and we think you get paid a lot more today than we have ever seen in the past – and certainly a lot more compared with 12 years ago.”