Five years ago, markets jumped when pharmaceutical giants announced the first effective vaccines to combat Coronavirus.

The subsequent rally in stock markets prompted hopes that the global economy was on the path to recovering following the ramifications of nationwide lockdowns that dominated 2020.

However, no one could have predicted the volatile five years that followed, with conflicts in Ukraine, Israel and other regions, rampant inflation and geopolitical tensions making for a very rocky landscape for fund managers to navigate.

It has not all been bad news for investors, with some sectors and funds managing to sail through choppy waters to post impressive returns.

Below is a table showing the top 10 best-returning sectors over the past five years.

Source: FE Analytics

At the top of the table, funds in the IA Commodity/Natural Resources sector gained an average of 87% over the past five years.

Commodities tend to perform well in inflationary environments, as their prices will often rise with inflation – this has especially been the case since 2021, when inflation spiked globally due to pandemic-related stimulus, supply chains were disrupted and geopolitical tensions began mounting.

In addition, oil and natural gas prices rose in 2022 following Russia’s invasion of Ukraine, which benefited funds in the sector heavily exposed to energy commodities.

There have also been structural shifts due to the global energy transition, with mounting demand for metals like copper, nickel and lithium, which has bolstered the mining sector.

More recently, the sector has also benefited from a surge in gold prices, which is seen by investors as a safe haven asset and crucial hedge against monetary devaluation – particularly during periods of central bank easing and currency volatility.

Meanwhile, in second place, it is arguably unsurprising to see IA Technology & Technology Innovation, given the outperformance of the Magnificent Seven – which continue to demonstrate strong earnings growth – and the momentum behind artificial intelligence (AI), with AI-focused funds and exchange-traded funds (ETFs) surging in popularity.

The pandemic also accelerated the digital transformation as businesses moved to cloud-based infrastructure and e-commerce and remote work tools became essential.

Alongside AI, the sector covers other rapidly growing themes, such as cybersecurity, robotics and semiconductors.

Funds in the sector returned an average of 83.5% over the past half-decade.

It is worth mentioning IA North America in tandem with the IA Technology & Technology Innovation, given the sector’s high concentration in US tech stocks. IA North America funds returned a slightly lower average of 75.3%.

Sandwiched between these two sectors is IA India/Indian Subcontinent, with funds in the sector gaining an average of 77.7% over the assessed time period.

India has been one of the fastest-growing major economies globally, driven by demographic tailwinds – with a young and growing population – alongside a rising middle class with increasing disposable income paired with urbanisation and digitalisation which are boosting consumption and productivity.

For investors seeking emerging market exposure, India is seen as a strategic alternative to China. Indeed, funds in the IA China/Greater China sector significantly underperformed India-focused counterparts, losing 13.6% on average.

Also worth mentioning is that funds in the IA UK Equity Income sector managed a higher return average than IA Global Equity Income by around seven percentage points.

In contrast, the worst performing sectors were largely bonds, with IA UK Index-Linked Gilts, IA UK Gilts, IA EUR Government Bond and IA Global Government Bond all losing at least 10% on average over the past five years.

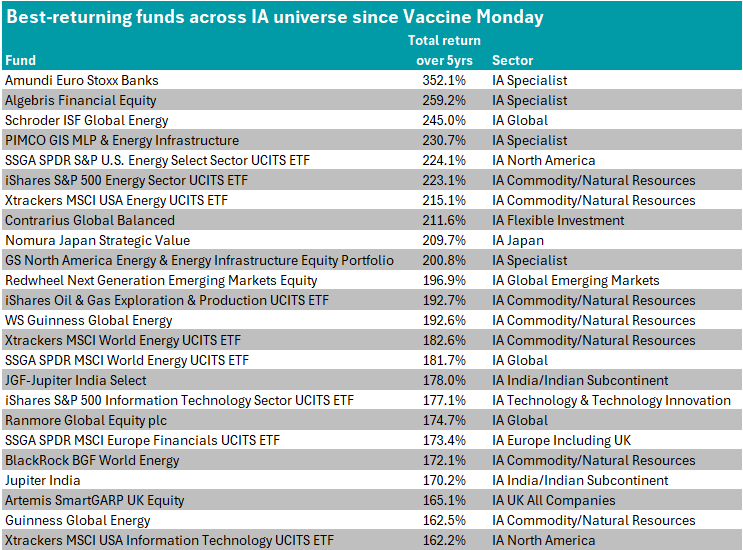

But which were the best performing funds overall?

The top two funds with the strongest returns across the IA universe do not belong to any of the aforementioned sectors.

Amundi Euro Stoxx Banks UCITS ETF and Algebris Financial Equity are both in the IA Specialist sector, meaning they have an investment universe or strategy too niche or diverse to be accommodated by standard IA sectors. Since November 2020, they have gained 351.1% and 259.2% respectively.

Source: FE Analytics

The Amundi exchange-traded fund tracks the EURO STOXX Banks index, which includes top-performing banks like Banco Santander, Societe Generale and BNP Paribas. Eurozone banks were well-positioned to benefit from post-Covid recovery and fiscal stimulus across Europe which supported loan growth, consumer activity and corporate investment.

Meanwhile, the €1.1bn Algebris Financial Equity fund, managed by Mark Conrad since 1 November 2020, also benefited from exposure to financials such as Santander, Barclays and NatWest Group. It aims to achieve capital appreciation in the medium to long term, primarily by taking long positions in companies in the global financial services sector and, to a lesser extent, the real-estate sector.

Of the actively managed funds, the $324.4m Schroder ISF Global Energy delivered the second-best returns, gaining 245% over the assessed period. It aims to provide capital growth in excess of the MSCI World Energy index over a three-to-five-year period by investing in the energy sector.

It was also one of the top-returning funds over three years since vaccine Monday, gaining 228% over that time.

Seven funds in the top 25 are in the IA Commodity/Natural Resources sector, with the small WS Guinness Global Energy being the top-returning actively managed fund in the sector, gaining 192.6% over the assessed period.

With just £46m in assets under management, the fund primarily invests in companies engaged in the production, exploration or discovery of energy derived from fossil fuels and the research, development and production of alternative energy sources.

As such, the top holdings are dominated by oil and gas majors, such as ExxonMobil, Chevron and BP.

Finally, despite the IA Technology & Technology Innovation sector’s overall strong performance, only iShares S&P 500 Information Technology Sector UCITS ETF made the top 25 for best returns across the IA universe.