The backdrop for UK assets is more nuanced than recent bearish news flow suggests, according to Fiona Ker, fund manager at Ruffer, who said the domestic market is “most exciting equity market stories” but also “one of the most misunderstood”.

Although the UK has faced challenges such as sticky inflation, higher taxes and “some accusations of government incompetence”, this has not deterred Ruffer.

Across the entire firm, around 13% of total assets is invested in UK stocks – despite the asset manager not housing a dedicated UK portfolio. This is the highest exposure to any single equity market in the company.

This is significantly ahead of the MSCI World, where UK companies make up just 3% of the index. At such a low weighting, Ker said global equity managers have been able to “ignore the market”, leaving it underappreciated.

Yet there are nuances and opportunities in the UK market, Ker said, for those willing to look. One such nuance is inflation. While higher than the Bank of England target rate, Ker said she expects it to come down.

“Clients say inflation cannot come down, that there is no reason for things to get any better, but I think that could be the big surprise of next year,” she said.

While inflation has remained “persistently high” at 3.5% this year, this has been due to some “specific idiosyncrasies” that are unlikely to last over the long term.

For example, higher-than-average food inflation, minimum wage increases and changes in rates have contributed to above-average inflation in 2025, she said. By the end of next year, when these short-term influences have been removed, data from the International Monetary Fund (IMF) suggests inflation should drop closer to 2%.

“I think if inflation starts to come down, it will be a lot easier for people to have faith in the economic backdrop,” Ker said.

On top of this, the UK consumer is in a “decent position”, with robust household balance sheets and household debt levels declining. Indeed, data from the IMF shows household debt as a percentage of GDP has fallen by 14% over the past five years.

Paired with the potential for further interest rate cuts from the Bank of England, declining rates and inflation could serve to reignite investors' confidence in assets with more domestic exposure, she said.

Yet a “revival of the consumer” is not in market expectations, meaning it will not take much to “surprise on the upside”, Ker said. “You don’t need to be massively bullish to get a good return out of UK equities next year, you need to be a bit optimistic.”

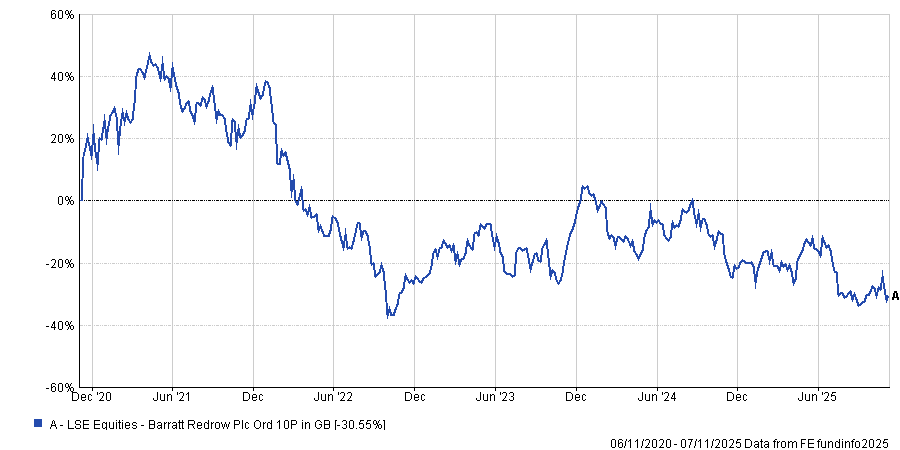

As a result, Ruffer has increased its exposure to some of the more domestically sensitive companies in the UK market, such as housebuilder Barratt Redrow.

While its share price fell by 30.5% in the past five years, this is an “attractive value opportunity” for investors.

Share price return of Barratt Redrow over 5yrs

Source: FE Analytics

On a price-to-book level, housebuilders are trading on levels close to those of the global financial crisis (GFC) but are far stronger businesses with better balance sheets and lower levels of debt than they were during this period, Ker said.

This is an “exciting base” to start with, particularly for investors who believe that the government will make good on its commitment to try and address the housing market shortage, she continued.

Additionally, these companies should benefit from falling interest rates, making borrowing more affordable and increasing the demand for mortgages.

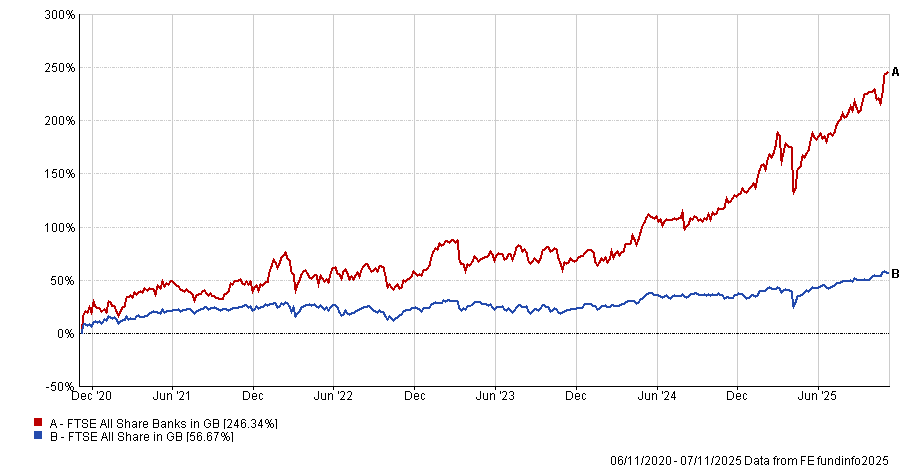

Another UK sector Ruffer has increased exposure to is banks. For a long time, they were considered an unattractive asset class as low interest rates made returns unappealing, while latterly as rates have risen, investors have yet to shake off that they were at the “epicentre of the problem in the GFC.”

However, the FTSE All Share Banks index has delivered a 246.3% return over the past five years, outperforming the wider FTSE All Share.

Performance of indices over 5yrs

Source: FE Analytics

The Ruffer team argued that UK banks still have further to run, even after their recent rally. They are also unlikely to experience the same crisis as in 2008 because they have become one of the biggest owners of government debt at a time when government borrowing has swelled. This has made them “much more valuable utilities of the state”, Ker said.

Coupled with much stronger fundamentals and a more volatile interest rate environment, banks are demonstrating that they have the potential for “sustainable growth over a longer period of time”.

“They remain an exciting opportunity,” Ker concluded.