Across the three main Investment Association sterling fixed-income sectors, 30 funds have posted a yield above cash while delivering best-in-class performance, according to Trustnet research.

Cash has been an appealing place for investors to put their money due to the high interest rates, but with an easing monetary policy, this high return may start to decline.

While the best easy-access savings accounts currently offer investors a 4.5% annual equivalent rate (AER), according to Moneyfactscompare (down from 4.75% earlier this month), many bond funds are offering competitive yields while providing opportunities for capital appreciation.

Below, Trustnet examines the sterling bond funds that are beating cash returns, providing both income and a top-quartile return over the past five years in their respective sectors.

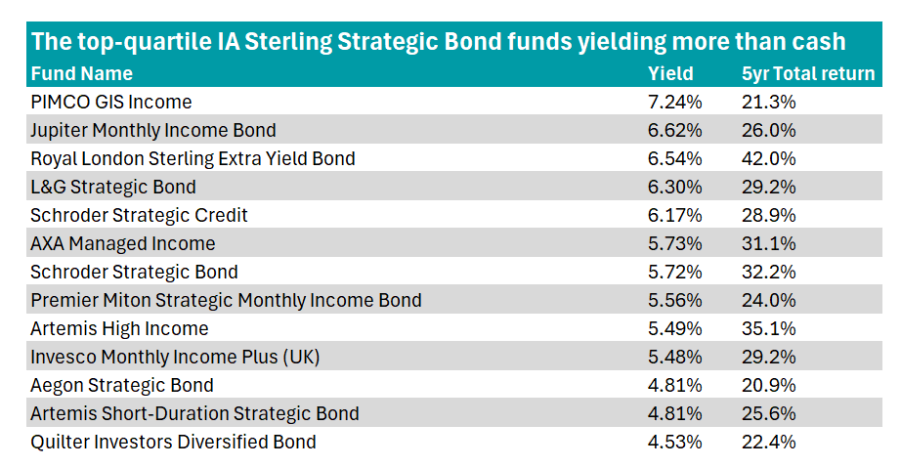

IA Sterling Strategic Bond

In the IA Sterling Strategic Bond sector, investors had 13 choices available to them, with PIMCO GIS Income topping the table with its 7.2% yield and 21.3% total return.

Source: FE Analytics. Data accurate to the end of October. Chart sorted by yield.

Led by FE fundinfo Alpha Manager Daniel Ivascyn and his team, the fund represents the group’s best ideas, as analysts at Rayner Spencer Mills Research (RSMR) said, and “should be able to outperform in a variety of market conditions”.

For investors who want an income fund with greater potential for capital returns, Royal London Sterling Extra Yield Bond may be a compelling choice. Its 42% total return is the top performance in the peer group and the fund's 6.5% yield also places it within the top quartile for income.

Managers Eric Holt and Rachid Semaoune currently emphasise bonds lower down the credit-rating spectrum, with just 4% of the fund invested in bonds rated A or higher.

Sector-wise, the fund is most exposed to financial services and industrials, with a preference for short-dated (0-5 year) bonds.

Schroder and Artemis had both two funds each on the list: Schroder Strategic Bond and Schroder Strategic Credit, and Artemis High Income and Artemis Short-Duration Strategic Bond.

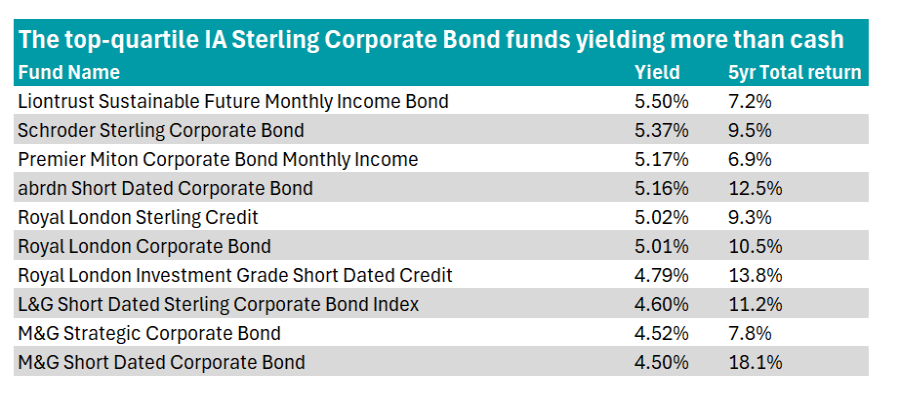

IA Sterling Corporate Bond

Liontrust Sustainable Future Monthly Income Bond Fund leads in the IA Sterling Corporate Bond sector with a yield of 5.5% and a total return of 7.2% over the past five years.

Source: FE Analytics. Data accurate to the end of October.

The strategy invests in companies that are considered to benefit society and the environmentbut ensuring all additions to the portfolio are good investment opportunities first and foremost.Analysts at Titan Square Mile described it as a “corporate bond fund with a conscience”, with as much emphasis being placed on sustainability as credit and valuation.

Over the past 10 and three years, the fund has continued to post top-quartile returns.

Three funds from the Royal London team also had top returns and high yields - the Royal London Sterling Credit fund, the Royal London Corporate Bond fund and the Royal London Investment Grade Short Dated Credit fund.

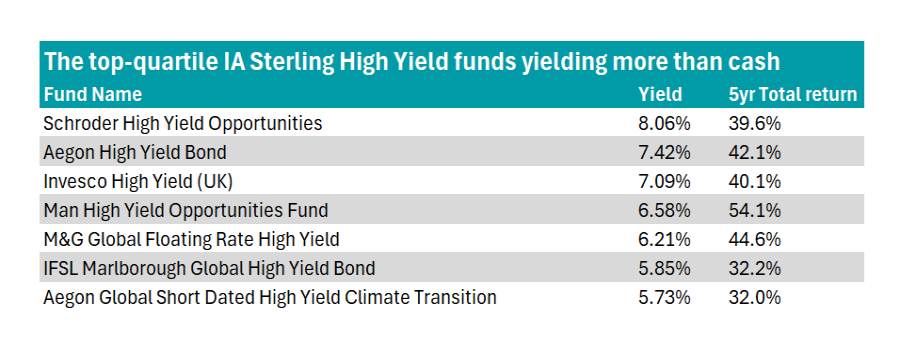

IA Sterling High Yield

Finally, in the higher-risk category, Schroder High Yield Opportunities offers an 8.1% income with a 39.6% total return (the fifth-best performance in the peer group over five years).

Source: FE Analytics. Data accurate to the end of October.

Manager Daniel Pearson aims to provide an income and capital growth of 4.5% to 6.5% per annum. Although it is primarily a high-yield strategy, it also invests in some higher-rated bonds, with US treasuries appearing in its top 10 holdings.

Analysts at RSMR praised the funds' proprietary research, which helps managers develop a better understanding of business models, avoid value traps and reduce risk. This is demonstrated by the five-year volatility of 4.9%, which is in the second quartile for funds in the IA Sterling High Yield sector.

Offering a higher total return, FE fundinfo Alpha Manager Michael Scott’s Man High Yield Opportunities fund delivered a return of 54.1%, the best in the entire sector, paired with a 6.6% yield.

Scott was also highlighted as one of the most consistent managers in choppy markets, with top-quartile returns on both his current mandate and his previous Schroder High Yield Opportunities fund.