European equity markets have not always been an investor’s top choice, with the strength and massive growth of the US market tempting many.

However, over past year, the region has enjoyed increased attention as investors look for stable markets outside of the US.

But with volatility still lurking and broad market gains far from guaranteed, investors may be better served by funds where manager skill – not market momentum – has been the driving force.

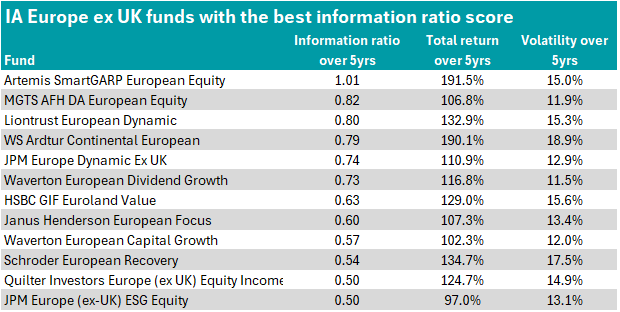

In a continuation of an ongoing series, Trustnet identified funds in the IA Europe ex UK sector with the highest information ratio score over the past five years.

This score calculates the extent to which a fund’s performance derives from natural market fluctuations versus manager skill by dividing the portfolio’s active return by the tracking error, with a score of 0.5 or higher indicating a better risk-adjusted performance.

To allow for comparison between funds across the sector, we selected one of the most common indices – MSCI Europe ex UK – against which to calculate scores.

We found that 36 funds scored 0.5 or higher but, when honing in on actively managed funds, this number fell to 12.

Source: FE Analytics

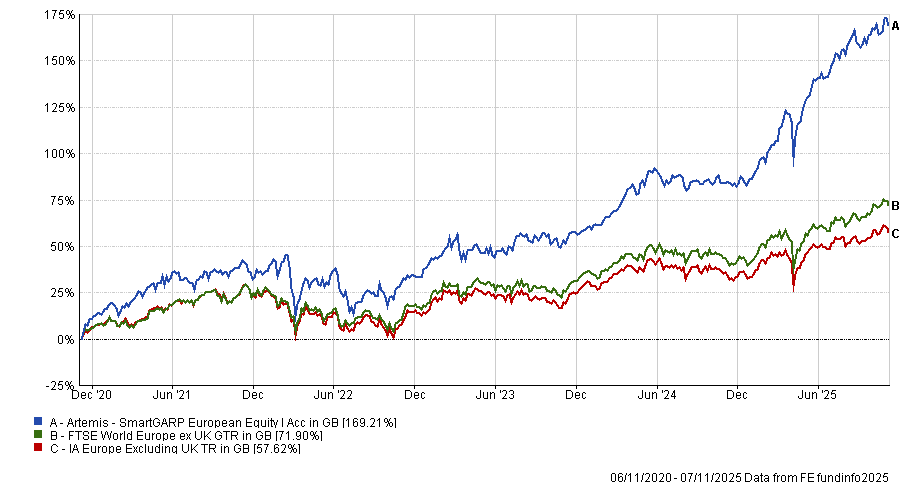

Top of the table is the £1.3bn Artemis SmartGARP European Equity, with an information ratio score of 1.

The fund, which has an FE fundinfo Crown Rating of five out of five, has been managed by Philip Wolstencroft since launch and seeks to provide capital growth by investing in between 70 and 90 stocks attractively valued companies with the potential to grow. The top 10 companies – which include Societe Generale and Engie – represent around 30% of the fund and individual holdings are limited to 5% of net asset value.

Utilising Artemis’ SmartGARP quantitative analysis tool, the management team screens the financial characteristics of prospective investee companies, identifying those that are valued materially lower than their growth prospects merit.

RSMR analysts said the fund’s investment process is “clearly defined and rigorous and the quantitative approach is overlaid by the actions of the manager to ensure the quality of the underlying investments and the level of diversification within the fund”.

It has delivered top-quartile returns in the sector over one, three, five and 10 years, gaining 221.4% over the decade.

Performance of the fund vs sector and benchmark over 5yrs

Source: FE Analytics

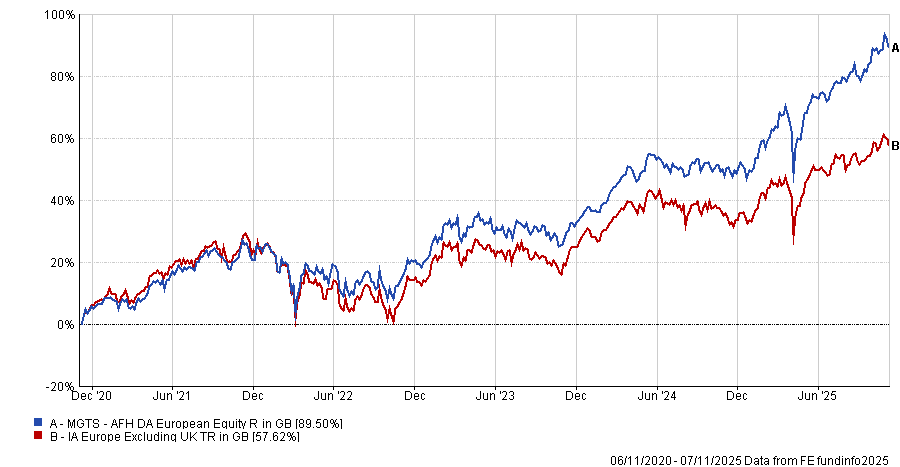

In second place is MGTS AFH DA European Equity, which managed an information ratio score of 0.8.

The £444.8m fund utilises a multi-manager approach, meaning the portfolio is split into sleeves run by different teams.

AFH Wealth Management, as the fund’s investment adviser and overseer of the strategy, sets the European equities-focused approach and monitors performance, adjusting allocations and sub-managers when necessary.

By blending different strategies under different managers, the idea is to ensure diversification and smoother returns.

As of October 2025, the sub-managers of the fund are Wellington Management, Goldman Sachs Asset Management, MFS International and JPMorgan Asset Management – the latter of which joined the sub-manager team in May 2025.

It has delivered top-quartile returns in the sector over one and three years.

Performance of the fund vs sector over 5yrs

Source: FE Analytics

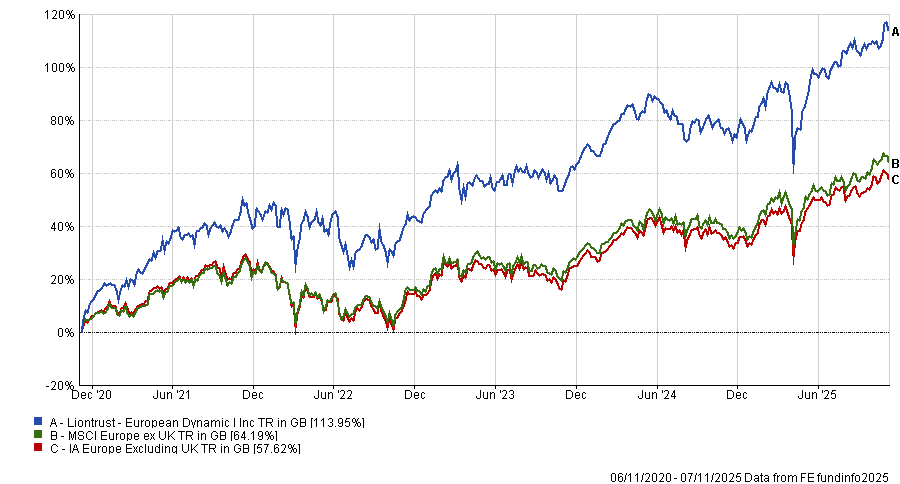

Rounding out the top three is the £2.2bn Liontrust European Dynamic – also with an information ratio score of 0.8, alongside a total five-year return of 132.9% and volatility of 15.3%.

Managed by James Inglis-Jones and Samantha Gleave, the fund looks to provide long-term capital growth through a concentrated portfolio of investments, holding 30 stocks and an active share typically above 90%. The majority of the fund is invested in industrials (28.8%) and financials (26.5%).

RSMR analysts said the investment process is “very distinct, well-documented and implemented in a consistent fashion by an experienced and highly competent team”, adding that the managers continually look to improve the investment process.

Performance of the fund vs sector and benchmark over 5yrs

Source: FE Analytics

Meanwhile, WS Ardtur Continental European – also with an information ratio score of 0.8 – delivered the second-highest five-year returns of the 190.1%. However, the £387.3m fund is the most volatile of the 12 at 18.9%.

Launched in 2011 and managed by Oliver Kelton since 2015, its top holdings include Shell, Deutsche Bank and Orange.

It has managed top-quartile returns in the sector over one, three and 10 years – gaining 248.6% over the decade.

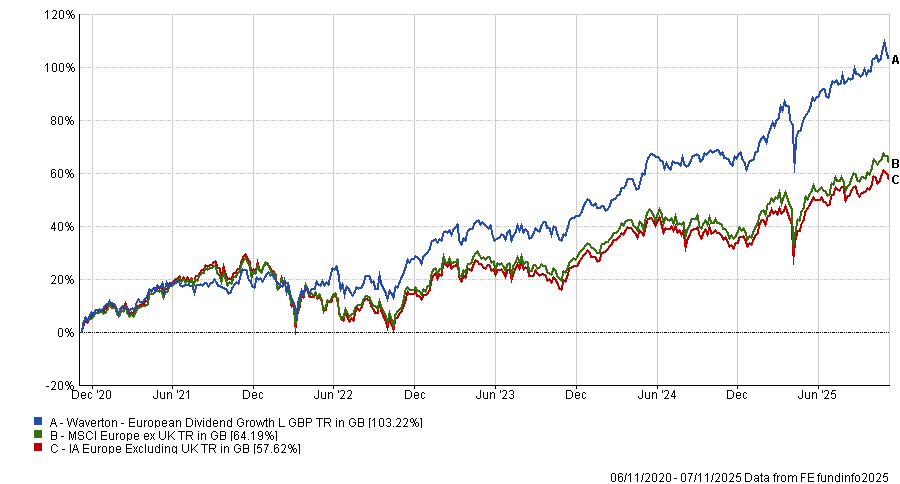

In contrast, the 168.2m Waverton European Dividend Growth has the lowest volatility of the 12 funds at 11.5%, alongside an information ratio score of 0.7.

The fund aims to deliver long-term income and capital growth by investing in a diversified portfolio of European stocks that the managers believe will deliver dividend growth over a rolling three-to-five-year period.

It has been managed by FE fundinfo Alpha Managers Charles Glasse and Chris Garsten since its launch in 2005.

Its top three holdings are engineering and technology company Technip Energies, Swiss multinational pharmaceutical corporation Novartis and Smurfit Westrock, a global sustainable paper and packaging business.

With a five-year return of 116.8%, it beat the Waverton European Capital Growth across the three assessed parameters. The Waverton dividend fund has also delivered top-quartile returns over three and 10 years.

Performance of the fund vs sector and benchmark over 5yrs

Source: FE Analytics

Rounding out the table of 12 actively managed funds with the highest information ratio scores are JPM Europe (ex-UK) ESG Equity, JPM Europe Dynamic Ex UK, HSBC GIF Euroland Value, Janus Henderson European Focus, Schroder European Recovery and Quilter Investors Europe (ex UK) Equity Income.