Despite a difficult economic outlook, UK equities staged something of a comeback in 2025, benefiting from worldwide geopolitical uncertainty that pushed investors towards defensive assets.

Dan Coatsworth, head of markets at AJ Bell, said: “Investors have faced considerable uncertainty and many have looked away from the US for opportunities. They have focused on cheaper areas of the market, of which the UK is one.”

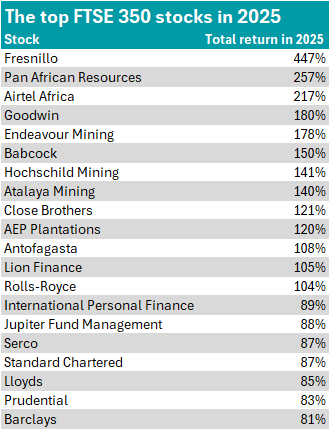

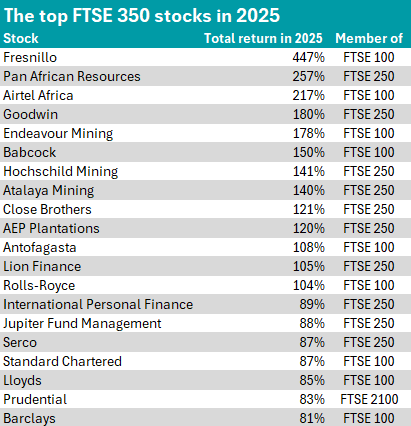

When looking at the best performers of the year, the top 20 best-performing FTSE 350 stocks in 2025 proved to be an even split between FTSE 100 and FTSE 250 companies at 10 stocks apiece.

Source: AJ Bell

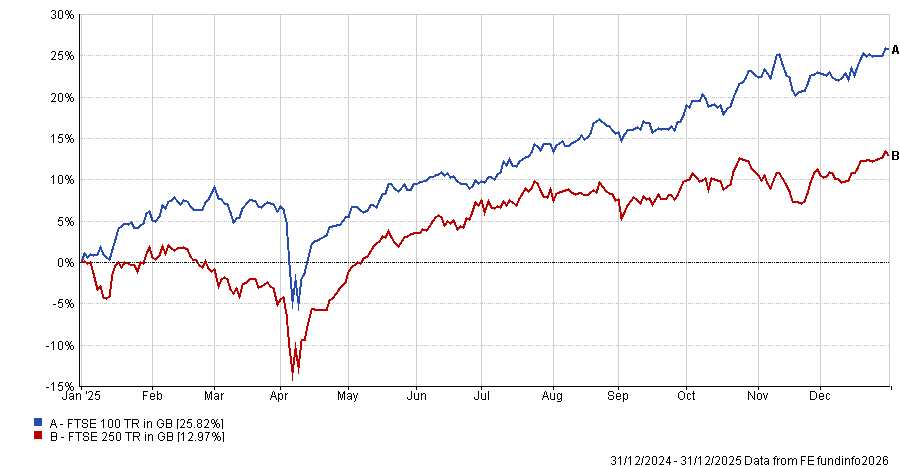

The FTSE 100, in particular, had a stellar year. It beat the US’ flagship S&P 500 index in 2025 as its diverse range of defensive industries enticed wary investors looking for a safe haven.

“Lots of people have criticised the UK for being an old economy market, full of boring companies in the banking and natural resources sector,” said Coatsworth.

“Yes, it lacks the excitement of go-go-growth stocks omnipresent in the US, but boring can also be beautiful when it comes to investing.”

Precious metals surged as investors hedged against inflation and geopolitical risk, lifting FTSE 100 miners like Fresnillo and Endeavour Mining to triple-digit gains. The former returned 447% over the year, the top return among all domestic FTSE 350 companies.

“A surge in the silver and gold price put a shine on Fresnillo’s shares as investors sought a way to get exposure to precious metals,” said Coatsworth. “The plethora of other miners in the FTSE 350 were up for the same reason.”

Fellow FTSE 100 mining company Endeavour Mining also managed an impressive 178% return last year.

However, with a forward-looking price-to-earnings (P/E) ratio of over 20x, Fresnillo looks relatively expensive going into 2026 compared with the majority of the UK market.

Indeed, analysts are split on the future returns for the stock. Among 10 researchers to rate the stock in the past three months, three have a ‘buy’ recommendation, five suggest holding and two recommend selling, according to research site Tipranks.

They have an average target price of £28.32, some 19% down on its current level, although the most bullish suggests a top price of £43, while the most bearish has a suggested price of £19.50.

Defence stocks also enjoyed a strong year, with US president Donald Trump’s pressure on fellow NATO countries to up defence spending prompting improvements in earnings prospects for contractors such as Babcock, which returned 150% in 2025.

Coatsworth added that the UK market remains a “rich hunting ground” for dividends and offers an array of companies managing slow but steady growth – traits which are “underappreciated engines for wealth creation”.

UK banks are a key example, as companies such as Lloyds, Barclays and Standard Chartered staged a comeback as stable interest rates and cost-cutting measures improved profitability. They returned 85%, 81% and 87% respectively in 2025.

The FTSE 100 is therefore riding high into 2026 and has set the stage for a strong start to the year, with the blue-chip index surpassing 10,000 for the first time on the first day of trading – marking a rise of more than 20% over the past year.

In contrast, while mid-caps accounted for the top five performing FTSE 350 stocks in 2024, 2025 proved to be a different story, with 18 of the 20 worst performing stocks in last year coming from the FTSE 250 index.

Source: AJ Bell

Coatsworth said some of these mid-cap stocks were “dragged down by problems of their own making”, while others fell victim to “shifting market dynamics”.

Advertising company WPP had the worst year of the bunch, losing 55% in 2025. Coatsworth said the company “issued more profit warnings than shareholders care to remember”, with the agency losing multiple clients, profits taking a hit and forecasts trimmed as new business proved harder to win.

Meanwhile, in 2025 British retailer WHSmith carved out its UK high street operations and shifted its operations to become a more focused travel player. However, Coatsworth said the company “fell flat on its face with an accounting scandal”, ultimately losing 43% in 2025.

UK-based food-on-the-go retailer Greggs also lost 37%. “Greggs’ investors got indigestion as the world started to ask if we have hit peak sausage roll,” said Coatsworth.

“Growth disappointed, people’s eating habits changed thanks to spiralling food costs and the rise of weight-loss drugs curbing appetites, and Greggs ended the year as the UK’s most shorted stock.”

Alcoholic beverage company Diageo and distribution and outsourcing company Bunzl were the only two FTSE 100 stocks to fall into the worst performing 20 of the FTSE 350, losing 34% and 35% respectively.

Performance of the indices in 2025

Source: FE Analytics