Multi-asset portfolios are often picked for diversification, yet over the past five years most have moved in lockstep with the US market, offering little relief from its concentration risks, as Trustnet revealed last week.

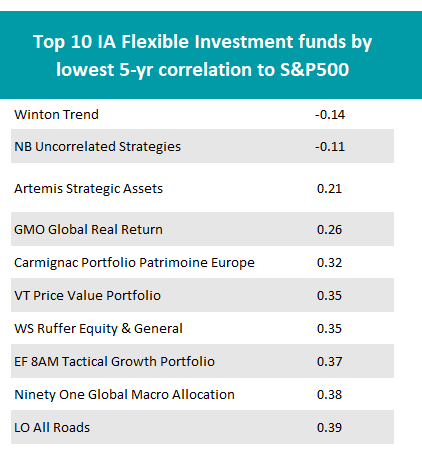

Even so, the 169-strong IA Flexible Investment sector contains notable outliers: 48 strategies (just over 28%) have a five-year correlation to the S&P 500 below 0.7, a level generally viewed as low, meaning these funds have tended to rise and fall on a different rhythm than the US.

Below we highlight the strategies whose low five-year correlation to the S&P 500 might make them an interesting option for investors who are looking to diversify away from the technology mega-caps that dominate the US market.

Source: FE Analytics

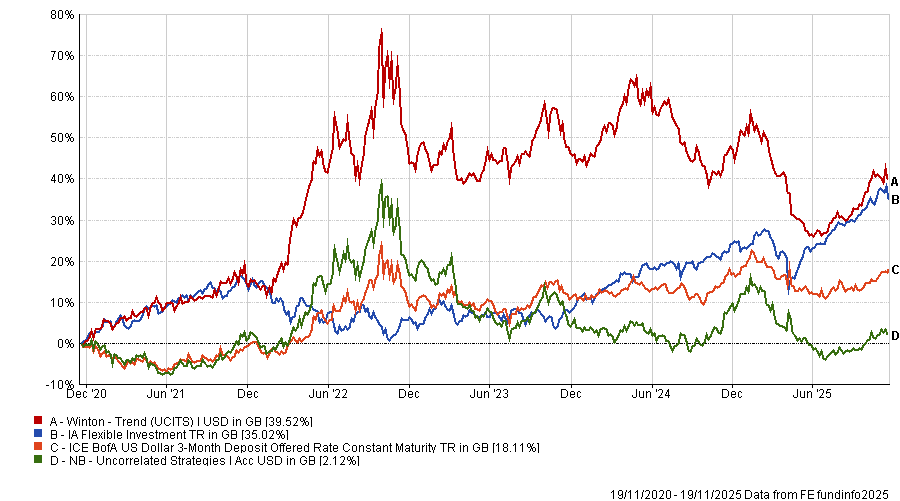

Starting with Winton Trend and NB Uncorrelated Strategies, which are the only two funds with a negative correlation of -0.14 and -0.11, respectively.

The former is a $1.3bn long/short fund, which employs a rules-based investment strategy designed to profit from medium-term price trends in stock market indices, government bonds, interest rates, currencies and commodities.

In 2022, the year when bonds and equities spooked investors by falling in tandem, Winton Trend was up 18% as the MSCI World index was down nearly 20%. The fund was highlighted on Trustnet as one to watch earlier this year.

NB Uncorrelated Strategies is a multi-manager, multi-strategy fund which, according to FE Invest analysts, provides “an attractive exposure to a range of diversifying alternative strategies”.

“The portfolio’s underlying sub-strategies are often complex and sophisticated, and investors in the fund benefit from Neuberger Berman’s strong expertise in manager selection within the alternatives space”, they said.

“Its focus on uncorrelated opportunities can provide strong alpha and effective diversification within a traditional equity and bond portfolio, which has several benefits amid market volatility.”

Its 2022 performance was “especially impressive”, with gains in eight out of 12 months, however those who bought it at its 2022 peak are now registering losses of more than 25%, as the chart below shows.

Performance of funds against index and sector over 5yrs

Source: FE Analytics

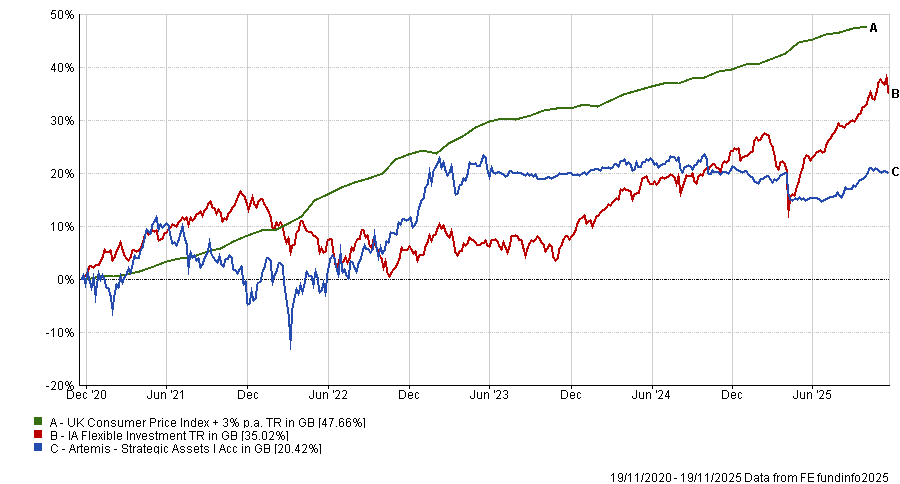

The lowest positive correlation with the S&P 500 was that of Artemis Strategic Assets (0.21), a £153m fund run by David Hollis which aims to return 3% per annum above inflation over a minimum five-year period. However, investors should note that its performance has dwindled since 2023, as shown in the chart below.

Performance of funds against index and sector over 5yrs

Source: FE Analytics

Still in the top 10, the small (£71m) VT Price Value Portfolio has been on a rally, with a year-to-date return of more than 50%, with the fund showing remarkable consistency. It was the fifth-best strategy in the sector over 10 years, sixth-best over five years, second over three years and first over 12 months.

Recently, its returns have been propped up by the very high allocation to commodities, in particular mining companies (27%), energy companies (17%) and gold bullion (11%).

GMO Global Real Return also stood out for its recent performance.

Source: FE Analytics

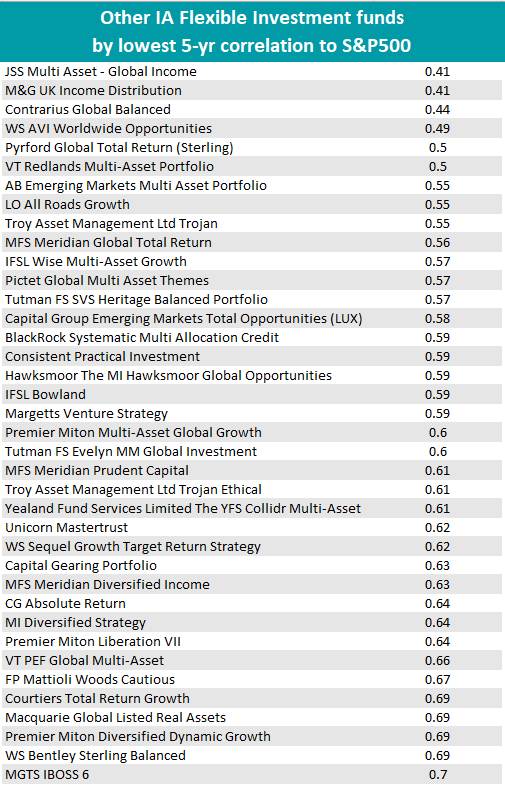

Outside of the top 10, two funds maintained a top-quartile performance against their peers over all standard timeframes: the $141m Contrarius Global Balanced Investor (correlation: 0.44) and the £130m Unicorn Mastertrust (0.62).

The former is an actively managed fund with the option of reducing its exposure to global equities through stock market hedging (the hedge position was at 14.9% as of 31 October), aiming to earn a higher total rate of return than an absolute return.

Tesla, Warner Bros, Paramount and Fox Corporation are among its top-10 positions.

Meanwhile, managed by Peter Walls, the Unicorn Mastertrust is a fund-of-funds portfolio focusing on investment trusts. Its top positions include Oakley Capital Investments (4%), Invesco Asia Dragon (3.8%) and AVI Japan Opportunity (3.5%).

Funds with strong track records also included AB Emerging Markets Multi Asset Portfolio (correlation: 0.55), MI Hawksmoor Global Opportunities (0.59), Wise Multi-Asset Growth (0.57) and M&G UK Income Distribution (0.41).

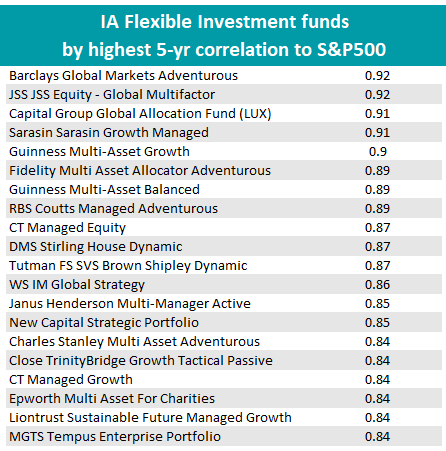

Finally, the table below highlights the funds with the highest correlation levels to the US market.

Source: FE Analytics