With volatility returning to markets, some fund selectors are adding exposure to long/short or trend-following strategies to diversify portfolios and protect against equity drawdowns.

Earlier this week, we published a guide on the pros and cons of long/short portfolios, with things to consider when buying one.

Below, experts explain which funds they are currently using, and what makes them stand out.

Man Absolute Value

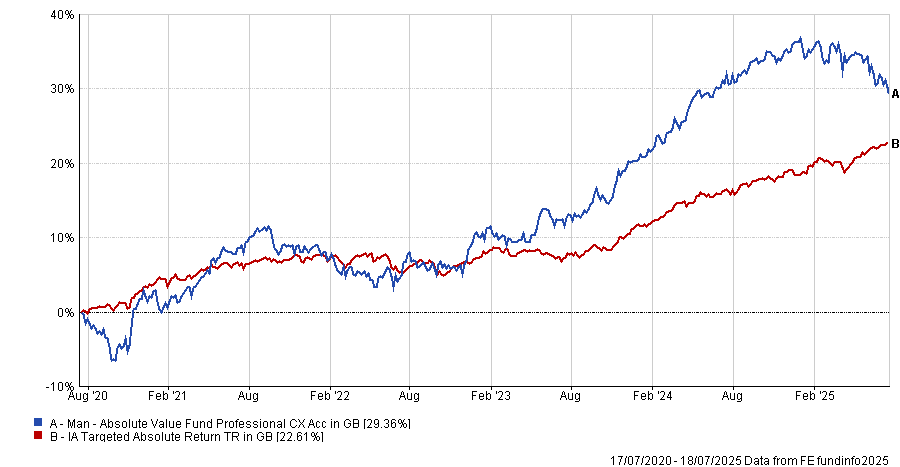

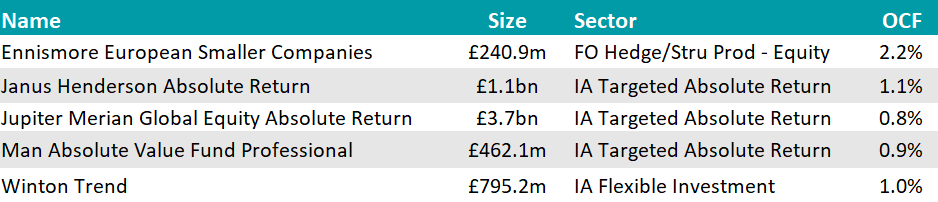

Joe Richardson, discretionary investment manager at Dennehy Wealth, recently added Man Absolute Value as part of a newly created “low volatility block” within his portfolios adding a “strong long-term performer” to his strategy.

Performance of fund against index and sector over 1yr

Source: FE Analytics

The fund has a FE fundinfo Crown rating of five and is led by FE fundinfo Alpha Manager Jack Barrat, who has been in charge since 2017.

Long/short is “a tricky space”, said Richardson, where “it takes a skilful manager with a repeatable process for these types of funds to really do well over time.”

That said, his allocation remains modest. “We avoid having multiple funds in this sector, as it can add unnecessary complexity to portfolios. Importantly, our primary defence with our process remains our stop-loss strategy rather than relying too much on long/short funds for defence.”

Janus Henderson Absolute Return

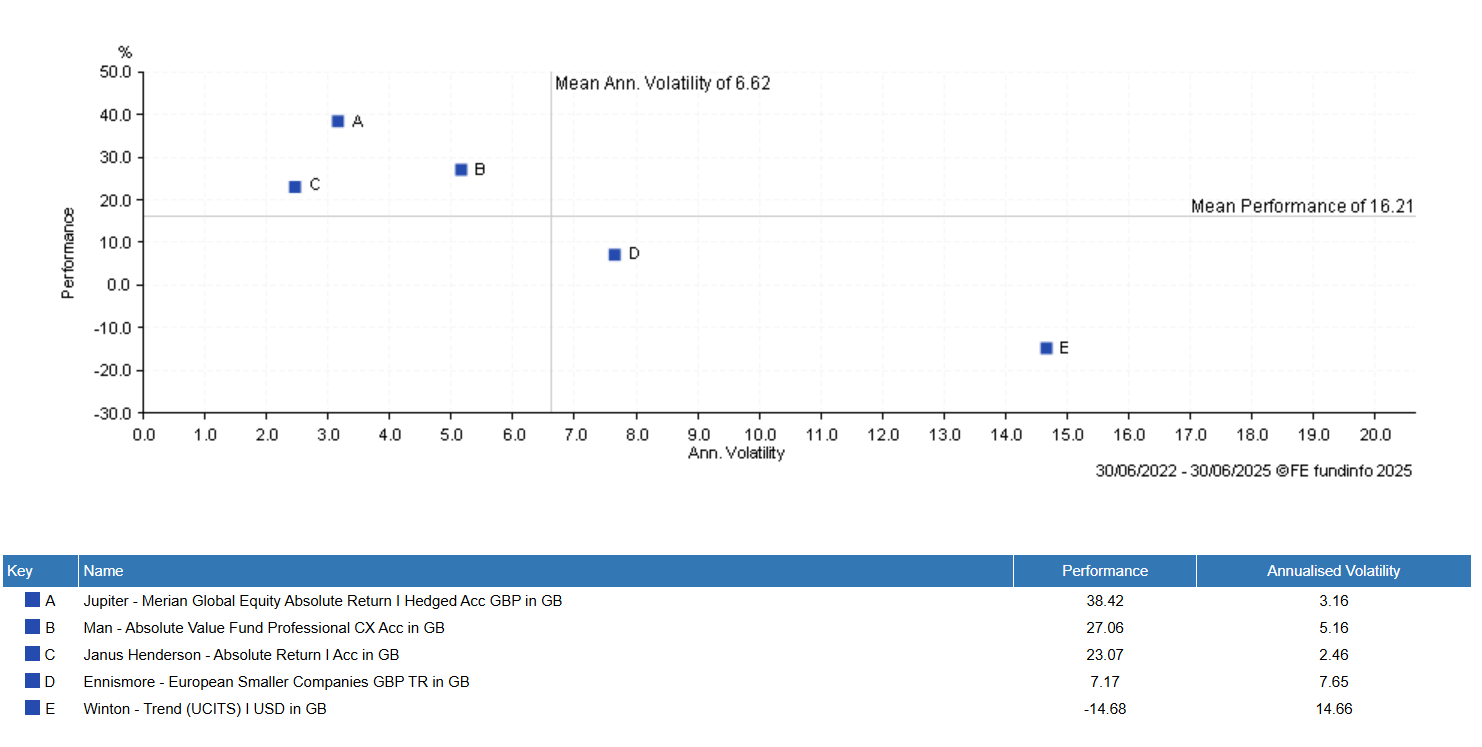

After reviewing several options, Chris Metcalfe, chief investment officer at iBoss, chose to bring the Janus Henderson Absolute Return fund into his portfolios in August last year.

The strategy is run by a duo of Alpha Managers: Ben Wallace and Luke Newman.

“The reason we chose the Janus Henderson fund in particular is really the risk-return profile,” he said. Its lower risk and higher returns make it appear in the top-left quadrant of the scatter chart below.

Scatter chart over 3 yrs

Source: FE Analytics

Metcalfe also cited the experience of the team. “Those guys have been around for about 16 years,” he said. “And within that period, you’ve had the global financial crisis, the eurozone crisis, Covid, Brexit... a lot of stuff.”

Tenure is a key element for Metcalfe when choosing funds, as the CIO recently told Trustnet in his guide to pick fund managers. “The longer the period to assess, the better – especially in the absolute return space,” he said.

The structure of Janus Henderson Absolute Return also helped it stand out in a “messy” sector. “With a simple long/short fund, you know the outcome is going to be: which longs worked; which shorts worked; and the dates bought and sold.”

This need for simplicity was reflected by Metcalfe’s move away from Jupiter Merian Global Equity Absolute Return five years ago.

The $4.9bn Jupiter fund stands out for its five FE Crowns and Alpha Manager Amadeo Alentorn. However, Metcalfe’s team “just can’t get comfortable enough with the mechanics of it”.

“There are an awful lot of moving parts,” he said. “We were struggling to explain why the fund wasn’t working. We listened to the managers, had updates and were trying to understand: Why is what you’re doing now not working, when it was working before?”

iBoss held it for five years exactly, from May 2014 to May 2019.

Ennismore European Smaller Companies and Winton Trend

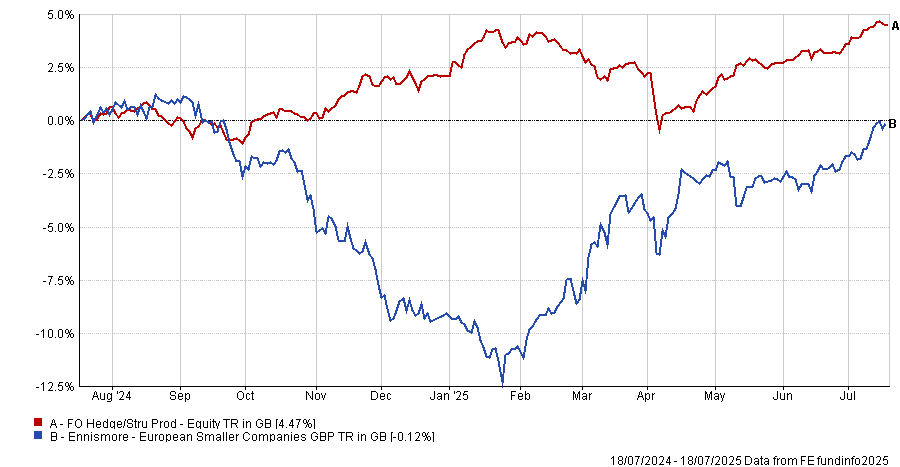

Andrius Makin, senior portfolio manager at Killik, invests in Ennismore European Smaller Companies, although his team has scaled back exposure due to recent market strength in Europe more recently.

Performance of fund against index and sector over 1yr

Source: FE Analytics

The fund’s short book tends to be about half the size of the long book, which has been a “real drag” on performance as European markets have been “on an absolute tear year to date”.

“We like to position the portfolio to be diversified and we’re absolutely fine with certain funds costing performance, but we just have upper limits on how much of a drag that can be,” he said.

“So we’ve taken it down from around 2.5% to about 1.5%. If that continues, we’d probably do the same again.”

While trimming long/short equity exposure, Makin has kept faith in similar, trend-following strategies, particularly the $1.1bn Winton Trend.

He described it as a “very systematic, very computer-driven” momentum strategy that can go long or short currencies, equity markets and commodities.

“The last time we saw it working really well was in the 2022 inflation sell-off, where everything – fixed income and equities – was going down at the same time,” he recalled. “It had a really stellar year: it was up 18%, while the MSCI World was down nearly 20%.”

Because trend funds have commodity and currency, they are more of an all-weather approach, said Makin.

AQR Equity Market Neutral and Delphi Long/Short

Finally, Credo Dynamic managers Rupert Silver and Ben Newton have recently cut their exposure to real estate investment trusts (REITs) to add to a set of long/short and market-neutral strategies run by AQR, including Equity Market Neutral, Alternative Trends and Delphi Long/Short, as they recently told Trustnet.

“AQR Equity Market Neutral uses 500 characteristics to screen positions – a kind of algorithm-led, AI-style approach. It’s very different from what we could do in-house, so we’re happy to allocate to a manager with strong intellectual property and a solid (albeit short) track record,” they said.

“[Meanwhile] Delphi Long/Short is long value and quality, and short overstretched areas of the market. That’s about diversifying the portfolio – we still hold tech and equities that would benefit in a boom, but if there’s a rotation or frothy behaviour, this helps protect against that.”

Source: FE Analytics