The US market is a polarising place for investors at present. On the one hand, the rise of artificial intelligence (AI) and the dominance of its tech titans over the past decade and a half mean many will be reticent to sell.

Yet it was the worst-performing major market in 2025 as president Donald Trump caused chaos with his ‘Liberation Day’ trade tariffs and threats to allied (and non-allied) nations. This has since kicked up a gear in 2026 with the US seizing control of Venezuela and threatening to invade Greenland – something that the president has since walked back.

Last year seemed to mark a turning point. Below, Trustnet looks at the funds that investors bought and sold during the turbulent year. To do this we used the FE Analytics’ Market Movements tool, which looks at unit trusts and open-ended investment companies (Oeics). Flows for exchange-traded funds and SICAVs are not included in this data.

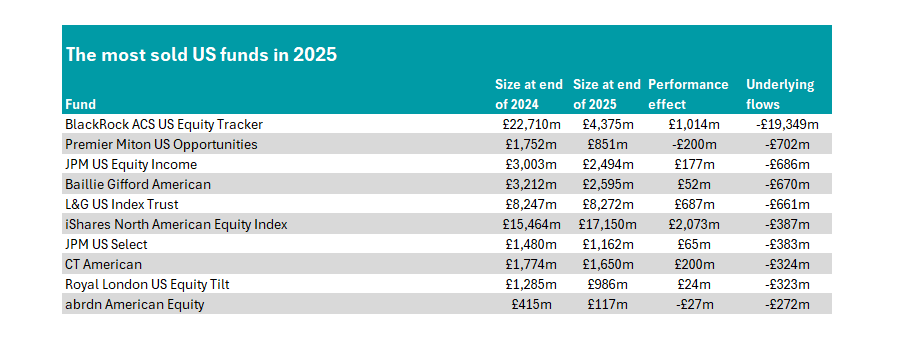

Starting with the most sold US funds of last year, BlackRock ACS US Equity Tracker was at the top of the list, with some £19.4bn removed. However, most of the assets remain under the group’s management, with the outflows triggered by investors moving from the ACS pension fund range to other mandates.

In total, 10 funds in the IA North America sector suffered net outflows of more than £250m in 2025.

Source: FE Analytics

In second place, investors removed £702m from Premier Miton US Opportunities, which had a disappointing year – the fund lost investors 11.7% in 2025. As a result, having previously had assets under management of £1.7bn, it now runs around half this.

The fund does not include any of the ‘Magnificent Seven’ names among its top 10 holdings and invests across the market-cap spectrum. While this has been a drag on performance, it remains a favourite of FE Investments, where analysts said managers Hugh Grieves and Alex Knox “have considerable expertise in all-cap investing”.

“The fund is a solid option as an active US equity fund, providing exposure to the full spectrum of the US equity market, with differentiated positioning and a bias to companies with revenues generated domestically in the US,” they noted.

JPM US Equity Income and Baillie Gifford American were also heavily sold last year, with net outflows of more than £650m. They were followed by passive options L&G US Index Trust and iShares North American Equity Index.

While out of favour with investors, both remain backed by best-buy lists. The JP Morgan fund is rated by AJ Bell and Barclays, with the latter noting that it is a “reliable equity income product managed by an experienced portfolio management team”.

“Medium- to long-term performance has been strong, though we are aware that it has underperformed recently when the likes of technology stocks (which typically don’t pay dividends, and therefore aren’t widely held within this fund) have performed well,” they said.

“However, if you’re looking for a US fund to add to your investment portfolio, we still believe this should deliver good returns over the longer term.”

Baillie Gifford American is trusted by experts at Hargreaves Lansdown, who said it is a “great way to invest in businesses with strong growth prospects in the world's largest stock market”.

“We think this fund could work well in a portfolio with little exposure to the US, invested for long-term growth. Its focus on large companies means it could also sit well alongside a US equity fund focused on medium-sized or higher-risk smaller sized companies, or a US fund with a value bias.”

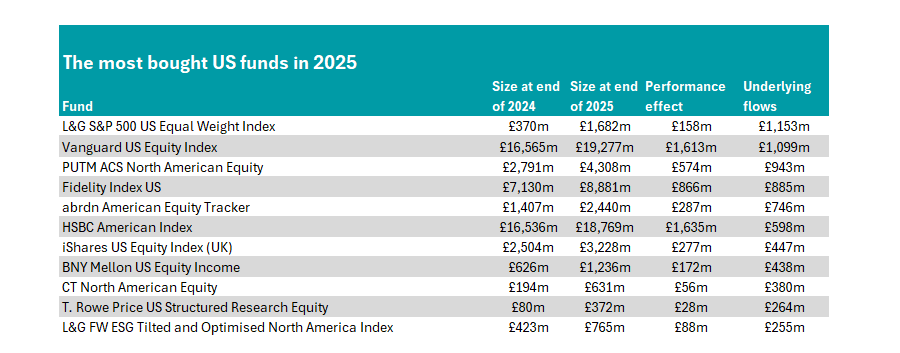

However, there were 10 funds that attracted more than £250m in net new flows in 2025. Passives proved popular once again, accounting for the top six most-bought funds.

Source: FE Analytics

But it was not a traditional tracker that investors most turned to. L&G S&P 500 US Equal Weight Index was the most bought fund, with net inflows of some £1.1bn.

Equally weighted passive funds have been growing in popularity in recent years as investors have looked to move away from the overly concentrated traditional trackers.

It is only a partial movement, however, as the remaining five passive funds are all traditional US trackers, including Vanguard US Equity Index, the only other fund to rake in more than £1bn in net new money last year.

Among active funds, the most bought last year was BNY Mellon US Equity Income, which took in £438m in net new money.

A favourite of analysts at Hargreaves Lansdown, they said: “The fund aims to maximise total returns by growing both the income it pays to investors and the capital value. We think this is a good way of investing in larger companies based in the US that the manager believes are trading below their true value.

“That makes it different from many other US funds that focus on companies with high-growth expectations and we think the two styles could work well together in a portfolio.”

It was joined by CT North American Equity and T. Rowe Price US Structured Research Equity as the only active funds with net inflows above £250m last year.