Artemis' Adrian Frost and his co-managers Andy Marsh and Nick Shenton will take over the running of the £884m Murray Income Trust following a review by the board.

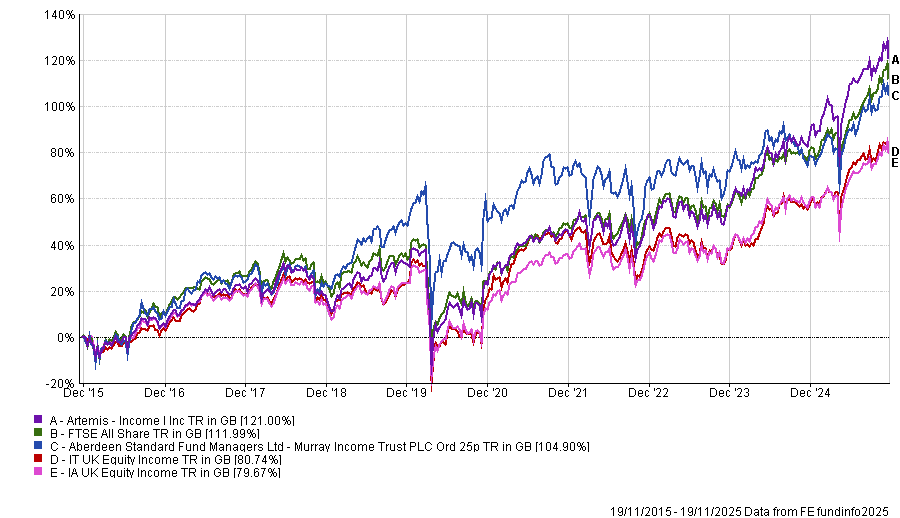

Formerly managed by Aberdeen’s Charles Luke, the trust has been a bottom-quartile performer in the IT UK Equity Income sector over the past three and five years, although its 10-year track record is some 24 percentage points above the sector average. It has failed to beat the FTSE All Share index over this time, however.

By contrast, the new investment team manage the open-ended £5.1bn Artemis Income fund, which has been a top-quartile performer in the IA UK Equity Income sector over one, three, five and 10 years.

Performance of fund and trust vs respective sectors and the FTSE All Share over 10yrs

Source: FE Analytics

It follows a strategic review announced in July, when the board said it would examine a range of options with the aim of boosting shareholder value, while continuing to deliver an attractive yield.

In a statement, the new managers said: “Murray Income Trust’s focus on delivering returns from both income and capital growth fits very well with our process, which identifies businesses that can compound cashflow over the long term, both individually and in aggregate as a diversified portfolio.”

It is the second trust Artemis has taken charge of this year. In March the firm took charge of the Invesco Perpetual UK Smaller Companies trust, which has since been renamed the Artemis UK Future Leaders trust, with Mark Niznik and William Tamworth at the helm.

James Carthew, head of investment company research at QuotedData, said: “Murray Income shareholders will probably welcome the choice of Artemis as its new manager.”

He said Frost - who holds FE fundinfo Alpha Manager status - and this team have a good reputation, adding that it was “odd” that they had not previously run money in an investment trust structure.

“The shares are down slightly this morning, perhaps there were some investors who were hoping for a cash exit. However, I don’t feel that the changes proposed are radical enough to warrant this,” he said. “The pragmatic Artemis approach of being style and benchmark agnostic should help steady the ship.”