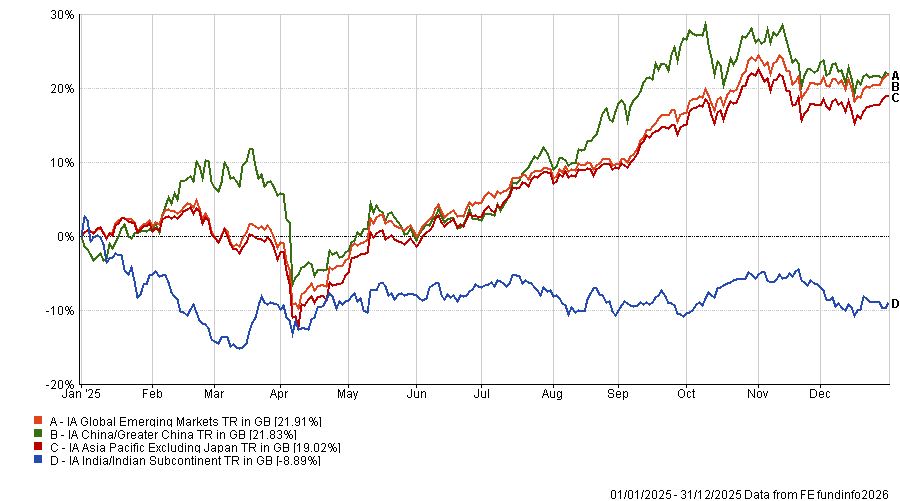

Indian equities have enjoyed a bullish run in recent years, thanks to sustained economic and earnings growth. However, 2025 proved to be an exception to the rule, with the IA India/Indian Subcontinent sector underperforming the rest of the Investment Association (IA) universe as global investors pivoted towards cheaper markets and funds linked to the artificial intelligence (AI) boom.

The sector lost 8.9% on average over the course of 2025. It was the only sector to lose money, with the next worst-performing IA sector being the IA USD Government Bond sector, which saw an average gain of 0.7%.

Performance of IA India/India Subcontinent vs other emerging market sectors in 2025

Source: FE Analytics

After delivering years of strong returns leading into 2025, fund managers and market experts speaking to Trustnet said that valuations had become elevated – higher than emerging market peers – while earnings growth slowed.

India’s premium had become harder to justify, prompting foreign investors to rotate into cheaper markets.

Rob Secker, portfolio specialist at T. Rowe Price, said: “With high expectations, it becomes much harder for companies to surprise on the upside – as investors had effectively priced in the perfect scenario.”

Despite this, Juliet Schooling Latter, research director at Chelsea Financial Services and FundCalibre, said India has been “an exceptional long-term investment” and still holds appeal due to its offering of high-quality companies.

“India is less exposed to the global economic cycle and its stock market often behaves differently from developed markets – this low correlation is actually a strength, making India a valuable source of diversification within a portfolio,” she said.

India also fell short because it offers less exposure to the AI surge – a defining megatrend that gathered pace in 2025 and is set to continue into 2026 – and is instead dominated by domestic cyclicals.

Archie Hart, emerging markets equity portfolio manager at Ninety One, said: “Foreign investors generally sold the [Indian] market and rotated into markets with a greater exposure to AI, such as China, Taiwan and Korea.”

But there are those who argue AI is a bubble – or, at the very least, that there are areas of exuberance which could catch investors out.

As such, Devan Kaloo, global head of equities at Aberdeen Investments, said India is “a natural hedge against fears around the bursting of a possible bubble in AI that has fuelled much of the rally in North Asian markets this year”.

But even beyond valuations and the AI trade, the country faced a separate set of headwinds which added another layer of uncertainty for global investors: geopolitical tension.

In particular, Jonathan Unwin, UK head of portfolio management at Mirabaud Wealth Management, noted that foreign investors have been “spooked” by the weaker rupee and the political risk associated with a country “openly courting trade with Russia and China”.

India’s ongoing trade relationships with Russia and China have proven to be a source of friction with the US, with president Donald Trump introducing – and so far sticking to – 50% tariffs on most Indian exports.

Mali Chivakul, emerging markets economist at J. Safra Sarasin Sustainable Asset Management, said: “We expect that it will still take some more time for the US and India to agree on lower tariffs, as India continues to rely on Russian oil imports.”

Kaloo countered that the US and India “share many common interests”, noting that India is underpinned by a rising middle class and one of the world’s largest consumption markets. As such, he expects relations between the two countries to improve.

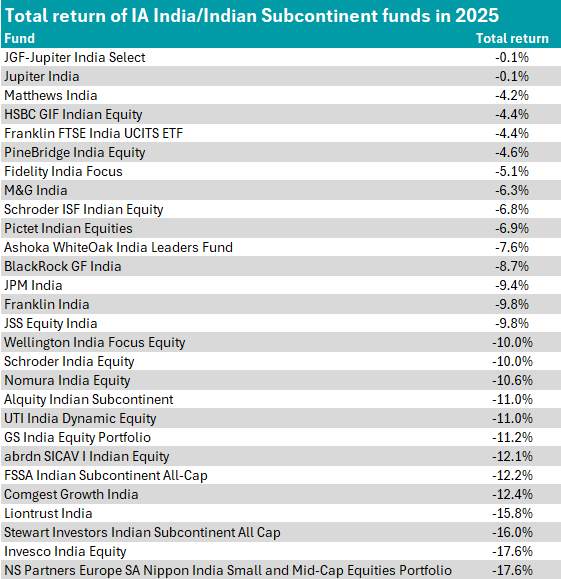

All of these forces ultimately filtered through to fund‑level performance, with all funds in the IA India/Indian Subcontinent sector ending the year in negative territory.

Source: FE Analytics

Despite the challenges of last year, the 2026 outlook from managers is far from downbeat, with most expecting some form of rebound.

They argue that the fundamental investment case for Indian equities remains strong – with high structural growth, favourable demographics, increased urbanisation and an expanding middle class consumption narrative.

“Valuations are now more attractive and there are signs that the gloss is coming off AI due to concerns over the scale of investment required and how that will be financed,” added Hart.

India is also attracting increasing interest as a manufacturing hub for a number of established growth areas, such as renewable energy, pharmaceuticals and defence, particularly as Western firms look to diversify supply chains away from China.

“It is also possible that investors put off by the increasing correlation between Chinese and US markets (especially with respect to mega-tech) may refocus on India as a diversified and conventional emerging market strategy in the context of a global portfolio,” said Unwin.

In addition, interest rates are falling and banks have significant liquidity.

“This should support stronger credit growth, creating the conditions for cyclical recovery,” said Secker. “The initial public offering market also remains active, which is another positive sign for confidence.”

Despite being long underweight India, Secker said he is becoming more interested in India as the backdrop improves.