Investors ditched funds run by Aberdeen, Janus Henderson and BlackRock (through its iShares range) last year, but there were some fixed income strategies that took in cash, data from FE Analytics has shown.

Trustnet used the platform’s Market Movements tool, which looks at unit trusts and open-ended investment companies (OEICs; exchange-traded funds and SICAVs are excluded).

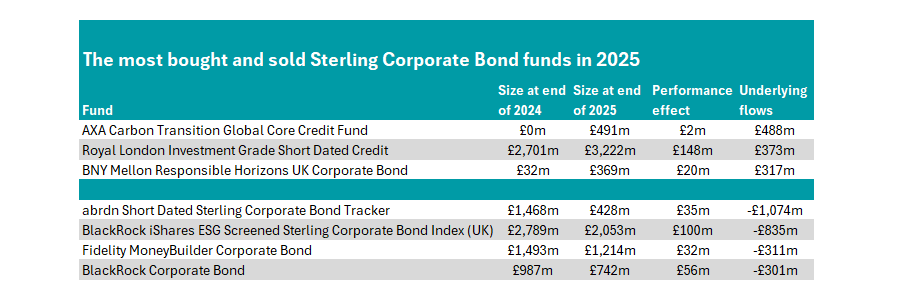

There were some big swings across the four main UK bond sectors. The most sold fund in absolute terms was the abrdn Short Dated Sterling Corporate Bond Tracker, which dropped from assets under management of £1.5bn to £428m. Although the fund made £35m last year, its underlying flows showed a net exodus of around £1.1bn.

From a performance perspective, the fund was a bottom-quartile performer in the IA Sterling Corporate Bond over the course of 2025, although its medium-term performance remains strong, sitting in the top quartile of the peer group over five years.

Another passive option, the iShares ESG Screened Sterling Corporate Bond Index (UK) fund was the second-most sold, with a net £835m removed.

Source: FE Analytics

These were followed by two active strategies: Fidelity Moneybuilder Corporate Bond and BlackRock Corporate Bond. Despite strong net sales of more than £300m last year, both have their backers.

The former is ranked by analysts at Hargreaves Lansdown, who said managers Kris Atkinson and Shamil Gohil have a “relatively conservative approach”, aiming to achieve decent income and stability in difficult times.

“This means it could appeal to investors looking for income, and offer some diversification to a portfolio invested mostly in the stock market,” they said.

While it is “unlikely to be the highest-yielding corporate bond fund”, over the long term it “has the potential to offer a good balance between delivering a good income, achieving some growth, and not taking excessive risk”.

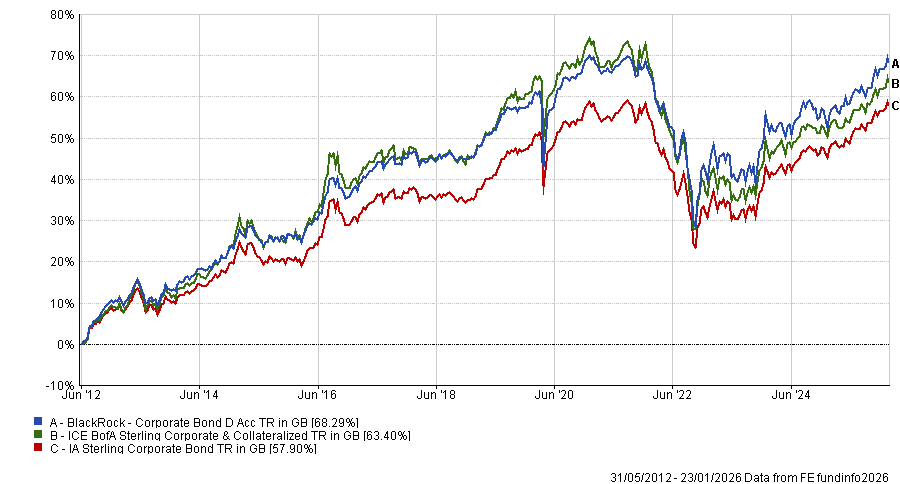

BlackRock Corporate Bond is highlighted by experts at RSMR, who said manager Ben Edwards has “delivered robust returns ahead of the peer group whilst taking less risk” since he took charge in 2012, as the below chart shows.

Performance of fund vs sector and benchmark since manager start

Source: FE Analytics

“This has been achieved by the disciplined approach of managing both interest rate risk and credit risk. The unconstrained nature of the fund (in terms of not being dictated by the benchmark) has allowed the manager to focus on selecting not only the right company but the right bond issue to achieve the best risk versus reward profile,” they said.

Only three funds took in more than £250m last year, with AXA Carbon Transition Global Core Credit Fund top of the pile at £488m. Launched in November, it has already attracted some £488m by the end of the year – a figure that has risen again so far in 2026.

Royal London Investment Grade Short Dated Credit (£373m) and BNY Mellon Responsible Horizons UK Corporate Bond (£317m) were the other two names from the sector.

Strategic bonds

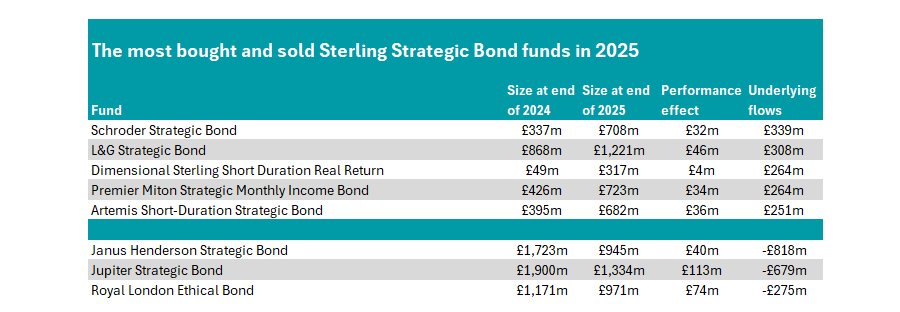

The most sold fund in the IA Sterling Strategic Bond sector was Janus Henderson Strategic Bond, which suffered outflows of £818m.

Despite being heavily sold, the former retained the backing of analysts at Titan Square Mile, who said the fund remains in “good hands” with Jenna Barnard and Nicholas Ware, following the retirement of John Pattullo at the end of March.

“Barnard worked alongside Mr Pattullo for over 20 years, developing the investment process with her strong asset allocation and credit selection skills,” they said.

“The thoughtful process and flexible mandate mean that the fund should be well-positioned to benefit in various economic scenarios, with the managers aiming to take advantage of wherever they see the best opportunities in bond markets.”

Jupiter Strategic Bond was the second-most sold, with investors removing a net £679m despite backing from the experts. Analysts at RSMR said it “remains a strong offering in the sector”, although performance can be in line with the sector average “when the manager takes a more cautious approach in managing the credit exposure in the fund”.

Source: FE Analytics

However, in the IA Sterling Strategic Bond sector, there were more big winners than losers. Overall, five funds topped £250m in net inflows, while three suffered net outflows above this figure.

Schroder Strategic Bond and L&G Strategic Bond were the two funds to take in more than £300m, with Dimensional Sterling Short Duration Real Return, Premier Miton Strategic Monthly Income Bond and Artemis Short-Duration Strategic Bond all receiving net inflows of more than £250m.

Analysts at FE Investments were particularly keen on the Premier Miton fund, highlighting the asset manager as “a well-established investment house”.

FE fundinfo Alpha Managers Lloyd Harris and Simon Prior have worked together since 2013, starting at Merian Investors before bringing the strategy over to Premier Miton.

“Both managers enjoy strong long-term industry track records. They are also joined at Premier Miton by experienced trading colleagues, who were critical to the success of their high-turnover approach at their former employer,” the analysts said.

Although the fund has not made the same total returns as its highest-risk peers, “the process is highly flexible and allows the managers to adjust their views tactically to protect investor capital while ensuring consistent income generation”.

Other bond sectors

In the IA Sterling High Yield sector, Aegon High Yield Bond took in net inflows of £400m, while M&G Global High Yield Bond suffered net outflows of £460m.

Meanwhile, in the IA Gilts sector, iShares UK Gilts All Stocks Index and Allianz Gilt Yield were hit by the most outflows at £800m and £287m respectively.

There were two funds that benefited, with iShares Over 15 Years Gilts Index (£891m) and L&G All Stocks Gilt Index Trust (£506m) taking in the most new cash.

Analysts at Hargreaves Lansdown said the L&G fund is their “favoured gilt tracker fund” as the team is “one of the most experienced”.

There were no funds in the IA Index-Linked Gilts sector with £250m or more of net inflows or outflows.