UK smaller companies have been growing at a similar pace to the tech-heavy US Nasdaq index but flows away from the asset class has meant returns have badly lagged.

As a result, Chris McVey, manager of the FP Octopus UK Multi Cap Income fund, said that over the next few years, AIM stocks and main-market listed smaller companies should be able to deliver strong double-digit gains, providing they can stem the tide of outflows.

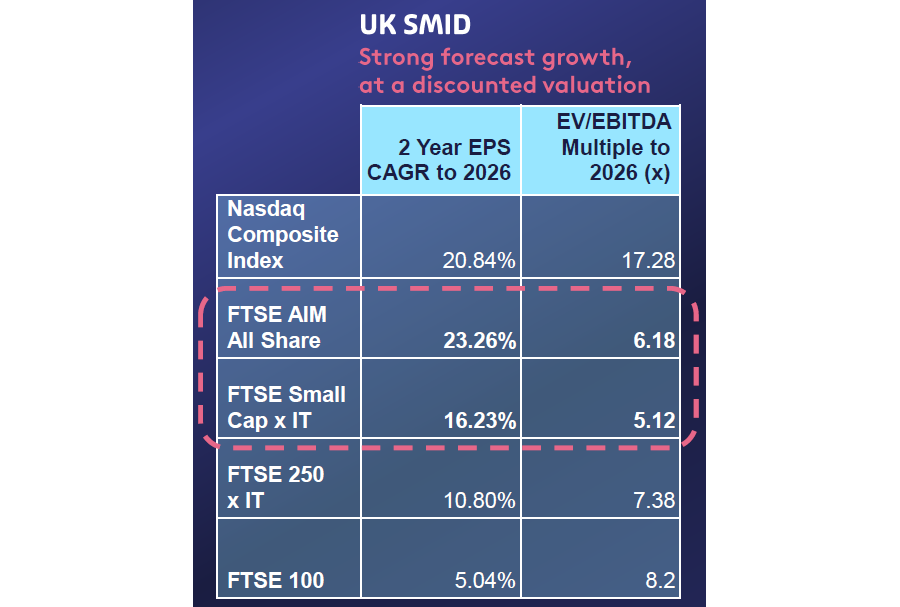

The chart below shows the underlying growth rates in earnings per share by index, against the enterprise value (EV) and earnings before interest, tax, depreciation and amortisation (EBITDA) multiples.

Source: Octopus Investments

Companies quoted on AIM lead the way with two-year cyclically-adjusted earnings growth of 23.3%. This is higher than the Nasdaq. FTSE Small Cap stocks (excluding investment trusts) are producing growth of around 16.2%.

“Even if you don't see any progression in valuation multiples, you should theoretically get between 15% and 20% per annum by investing in UK small-caps right now,” said McVey.

“If you get some semblance of re-basing of valuation, they’ll deliver significantly higher returns than that.”

The main issue, however, is “capturing people’s imaginations” and stopping the outflows. On this, McVey said government support around pension funds (forcing them to invest in domestic minnows) would be beneficial.

He noted there are many schemes being considered by the government to attract money back to the UK but admitted he did not know which, if any, would work.

Regardless, investors buying now are starting at a good price, with AIM stocks trading at 6x EV/EBITDA and small-caps on 5x. As such, McVey said he sees “limited downside from a valuation multiple perspective right now”.

“These are basically the lowest they’ve ever been. I can't see any reason for this level of valuation downside from a multiple perspective,” he said.

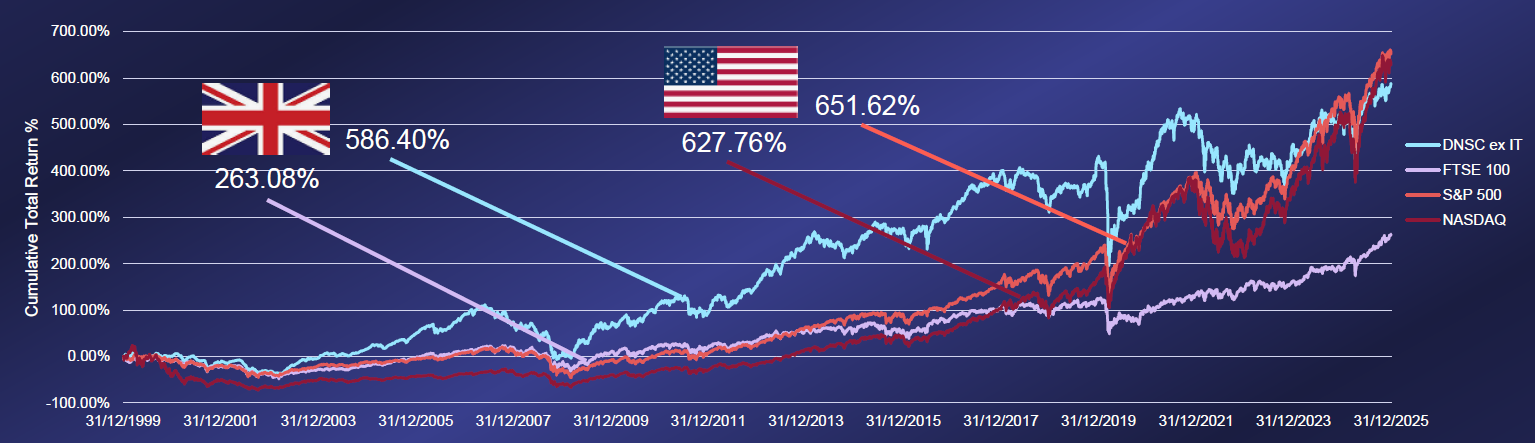

This is combined with strong historic long-term performance. Small-caps have broadly kept pace with the dominant US large-caps since the turn of the century, with relatively poor performance only starting in recent years.

Source: Octopus Investments

While he cannot guarantee the timeframe (McVey admitted he would have said the same thing at the start of 2025 and 2024), the FP Octopus UK Multi Cap Income manager stated that in three or four years’ time investors will be “kicking themselves for not buying at these levels”.

Alexandra Jackson, manager of the Rathbone UK Opportunities fund, agreed that UK small- and mid-caps (SMIDs) are undervalued but noted there are some external factors that could turn things around.

Firstly, SMIDs are very negatively correlated to interest rates, so falling rates should reverse the trend of recent years.

“They're also very positively correlated to sterling strength, so if your view on the dollar is informed by what you think Donald Trump is doing, then maybe think of currencies that take advantage of that. A stronger pound tends to be good for this part of the market,” she added.

Lastly, she pointed to corporate actions such as mergers and acquisitions and share buybacks, which should boost share prices.

However, having to choose between small and mid-caps, she would choose the latter, noting that it was an easy choice. While the earnings per share are lower, smaller companies tend to be more vulnerable to economic shocks or unfriendly conditions.

Higher debt costs or higher labour costs through things like higher wages or increasing energy bills tend to have an outsized impact on companies with lower revenues.

“So I want to be in that sweet spot, where the growth can really move the dial, but also with a little bit of protection,” she said.

“We have less than 6% of the fund at the moment in true small-caps. A lot of that is because the small-caps that we've owned have become mid-caps, but in the typical life cycle of this fund, you would then expect us to kind of recycle larger-cap capital into smaller companies. We just haven't found enough ‘tomorrow's winners’.”