Markets reacted positively after Joe Biden was declared winner of the US presidential election and news that the Pfizer/BioNTech vaccine had made a significant breakthrough – giving hope that the world could return to a semblance of normality at some point next year.

And while the US election result is still to be finalised – with incumbent Donald Trump yet to concede – European stock markets have rallied on a so-called ‘Biden bounce’. Biden is more of a multilateralist than Trump and is likely to enjoy a more cordial relationship with the EU with both sides committed to a green agenda, something likely to figure prominently in the post-Covid world.

Furthermore, the prospect of a Covid vaccine boosted European cyclical stocks which have been badly hit during this pandemic.

With that in mind, Trustnet asked two market experts which European funds they think could benefit from these events and complement an investor’s portfolio.

Andy Merricks, independent fund strategist

XTrackers Germany Mittelstand & MidCap ETF

First up is, Andy Merricks – manager of the EF 8am Focussed fund – who has chosen passive strategy, the XTrackers Germany Mittelstand & MidCap ETF.

The fund tracks the Solactive Mittelstand & MidCap Deutschland index, which aims to provide exposure to German companies with a primary listing on the blue-chip trading platform Xetra.

“Germany will be at the heart of the recovery in Europe and some of its mid-cap companies stand to benefit both domestically and through exporting opportunities, particularly into China and emerging markets,” he said.

“Again, Biden being more likely to be Europe-friendly can only enhance the possibilities of this niche sector outperforming, plus there’s nice mix of sectors to include our favoured ones of industrials, technology and healthcare.”

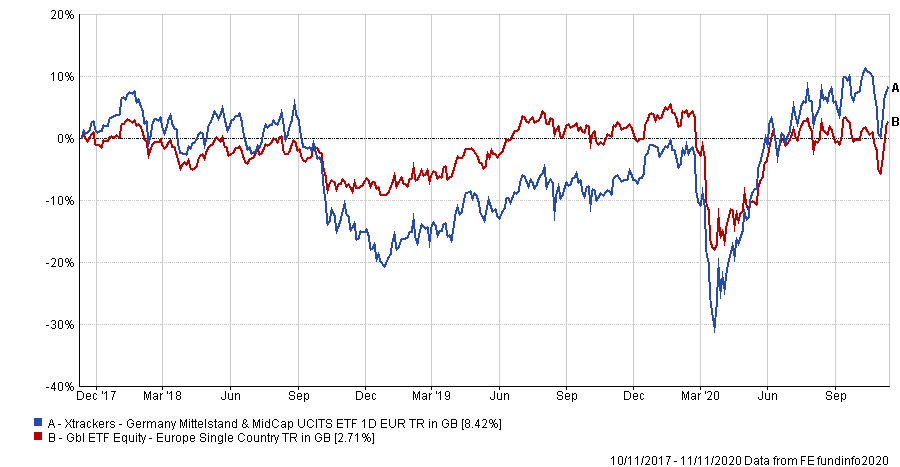

Performance of fund vs sector over 3yrs

Source: FE Analytics

The index fund has made a total return of 8.42 per cent over three years, against a return of 2.71 per cent for the Global ETF Equity – Europe Single Country average sector peer. It has an ongoing charges figure (OCF) of 0.40 per cent.

Marlborough European Multi-Cap

His second choice is the £212.3m Marlborough European Multi-Cap fund which has been run by FE fundinfo Alpha Manager David Walton since 2013.

“The Marlborough European Multi-Cap is an old favourite of mine which could be poised for a comeback,” said Merricks.

“They are not restricted to just one part of the European market and – after a period in which anything other than the biggest companies have struggled – those small- and mid-cap companies that make it through to the other side of the recession will be in a stronger position generally, due to some of their opposition disappearing and valuations potentially being a lot more attractive than some of their large-cap counterparts.

“The fact that this fund can invest in mega-caps as well though makes it a sensible pick as we emerge blinking from what 2020 has thrown at us.”

Performance of fund vs sector over 3yrs

Source: FE Analytics

With a total return over three years of 20.77 per cent, the Marlborough European Multi-Cap fund has outperformed the IA Europe Excluding UK sector average which made 9.59 per cent. It has an OCF of 0.83 per cent.

Janus Henderson European Selected Opportunities

Merricks’ final pick is the £1.8bn Janus Henderson European Selected Opportunities fund, overseen by John Bennett.

“If you think that value investing is back then John Bennet of the Janus Henderson European Selected Opportunities fund could be your manager of choice,” said Merricks.

After a difficult year for value investing, news of the vaccine was a boost for some of the hardest-hit stocks, with some arguing that these were early signs of a rotation from growth to value.

“The fund is stuffed full of big pharmaceuticals and other European heavyweight companies,” said Merricks. “If value is really going to make more than a fleeting appearance on the back of the ‘new order’ between the US and Europe, this fund will benefit from it.”

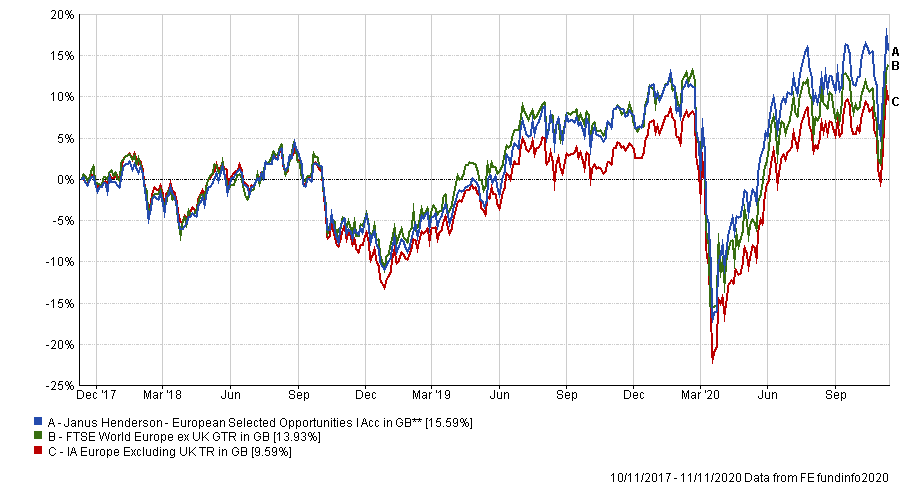

Performance of fund vs sector & benchmark over 3yrs

Source: FE Analytics

The Janus Henderson European Selected Opportunities fund has returned 15.59 per cent over three years, while the FTSE World Europe ex UK index made 13.93 per cent. It has an OCF of 0.84 per cent.

Daniel Pereira, Square Mile Investment Consulting and Research

Daniel Pereira, investment research analyst at Square Mile Investment Consulting and Research, warned that caution is needed when making fund selection decisions solely on the outcome of binary events, such as the US elections or news of a vaccine.

“One can make assumptions about the market’s reaction, but in reality these are often very difficult to predict and far better explained in hindsight,” he said.

The analyst explained that Biden holds strong views on climate change and investing in clean energy, whilst also being vocal on raising corporation tax, and taxes on high earning individuals.

Comgest Growth Europe ex UK

Pereira’s first choice is the £161.9m Comgest Growth Europe ex UK fund run by FE fundinfo Alpha Managers Alistair Wittet, Arnaud Cosserat and Franz Weis.

“The fund excludes companies in controversial areas and its investment process naturally leads the team to avoiding a lot of the more cyclically sensitive areas,” Pereira said. “These areas may perform poorly under a Biden administration.

“The managers are bottom-up stockpickers and look for factors that can grow a company’s earnings, regardless of broad macroeconomic headwinds, such as increases in taxes.”

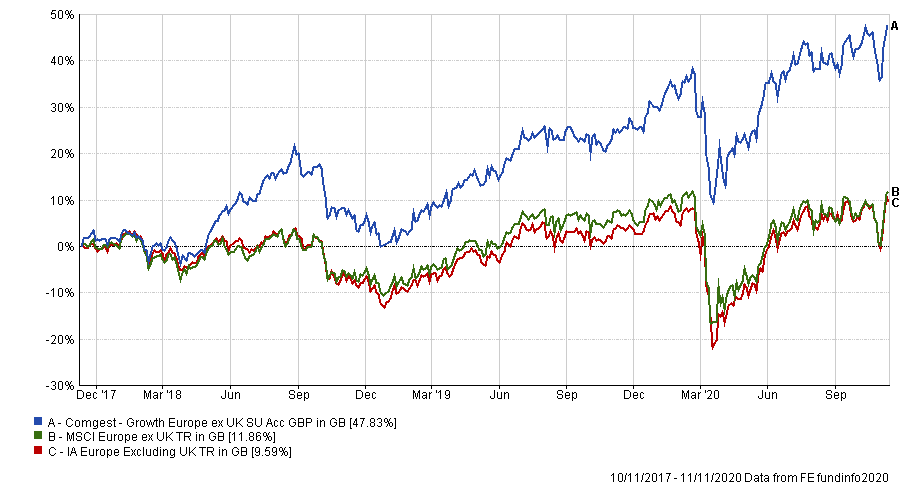

Performance of fund vs sector & benchmark over 3yrs

Source: FE Analytics

The Comgest Growth Europe ex UK fund has returned 47.83 per cent over three years versus the MSCI Europe ex UK benchmark’s 11.86 per cent. It has an OCF of 0.94 per cent.

BlackRock Continental European Income

His final pick is the £1.5bn BlackRock Continental European Income fund, managed by Andreas Zoellinger.

“We believe the manager has a robust investment approach to pick stocks that are able to deliverer long-term income growth,” said Pereira. “The supporting resources at the firm are large and set this fund apart from many of its competitors.

“If the market does reward value or even cyclicality sensitive areas, this fund is likely to fair better than many of its overt growth-oriented peers.”

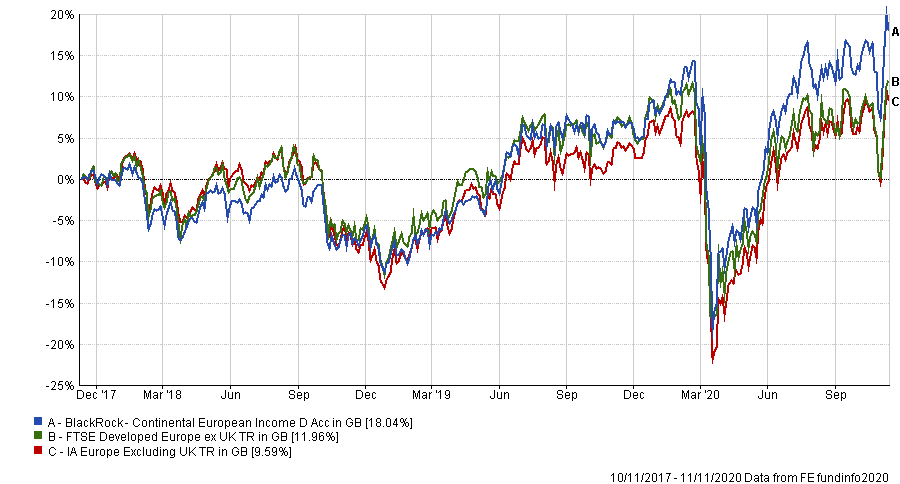

Performance of fund vs sector & benchmark over 3yrs

Source: FE Analytics

Over three years, the fund has returned 18.04 per cent versus 11.96 per cent for the FTSE Developed Europe ex UK index. It has an OCF of 0.92 per cent.