Much ink has been spilt on the supposed burst of the growth ‘bubble’. Still nursing multi-year sub-par returns, many ‘value investors’ have now come out from the shadows.

Apparently, the vaccine, reopening of economies, massive quantitative easing measures and stimulus spending have conjured the perfect tonic! That has jolted the so-called ‘value stocks’ into life. ‘Growth stocks’ or the ‘long duration equities’, if there is such a thing, came crashing down as inflationary fears set in.

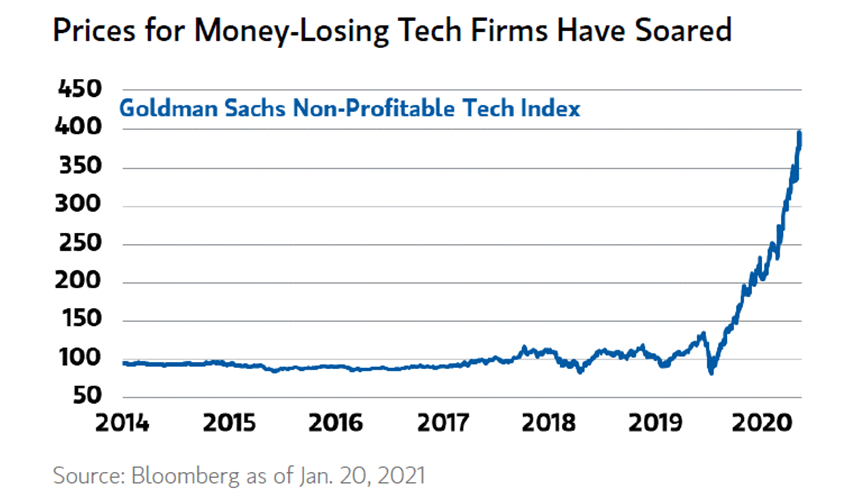

In some ways, these investors do have a point. The chart below should send chills down the spine of any investor (speculator?) who holds such speculative, loss-making, non-profitable technological equities which had galloped ahead in the last six months or so at unprecedented levels. How many of these companies are actually going to be the next Amazon or Facebook?!

Hiding in plain sight?

Yet what the ‘value investors’ miss is that this has not been a ‘rising tide lifts all boats’ scenario. Like many high-quality growth companies, Amazon has actually underperformed the market by nearly 22 per cent over these past six months. Critics will no doubt point out to Amazon’s stellar run in the earlier stages of the pandemic.

Yet to put it into context, Amazon’s share price outperformed the market by just over 23 per cent over the past year. Over that same timeframe, Amazon’s top line grew in excess of 37 per cent whilst operating cashflow surged ahead over 71 per cent.

According to data taken from Bloomberg - in spite of the never-ending rhetoric on the supposed over-valuation of growth stocks - Amazon, one of the darlings of the stock market and instantly recognisable names on the planet, on a price to cashflow basis is actually trading at a 24 per cent discount compared to its 10-year average. So much so for the tech bubble 2.0!

Valuations are not the only thing market speculators seem to misunderstand. By focusing on economic factors, they don’t see the wood for the trees. Taking Amazon again, the firm’s road to a $1.5trn market cap has not been forged by quantitative easing or multiple expansion as many ‘experts’ would have you believe. Rather the path has been set by an explosion of cashflow growth. In just a decade the company grew its operating cashflows from $3.5bn in 2010 to over $66bn in 2020.

This might appear ground-breaking to some but ironed out over time, Amazon’s cashflows and share prices have both largely tracked each other, having each compounded at an annualised rate of approximately 34 per cent over the past decade.

Contrast this with the more traditional value plays.

After seeing the energy sector gallop ahead by a whopping 37 per cent year to date, you’d be forgiven for concluding that a solution to climate change has been found! Alas this is not the case, and the energy sector, like so many in the traditional value arena - remains structurally challenged. Cigar butt investments, or rather trades, can be profitable, but they do not persist.

Over time the only thing which truly matters is the company’s fundamental performance. As legendary investor Peter Lynch stated: “If you spend 13 minutes a year on economics, you’ve wasted 10 minutes.”

Market participants are currently wasting a lot of time and effort on noise and are being very short-sighted, this is creating great opportunities.

Amazon is only one such example; we believe that Microsoft, Facebook, Roper Technologies and Veeva amongst others are all high-quality companies which are currently all trading at a discount to their intrinsic value.

Malcolm Schembri is manager of the Garraway Global Equity fund. The views above are his own and should not be taken as investment advice.