Investors who stuck with James Clunie’s underperforming Jupiter Absolute Return fund might be worried that the manager has been taken off the portfolio just as things were looking up, but questions need to be asked when an absolute return fund posts such heavy losses for so long.

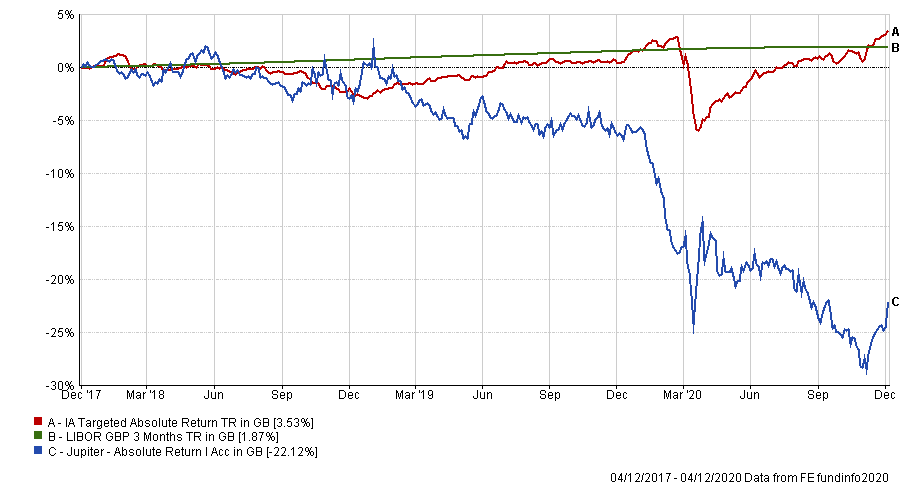

Recent years have seen Jupiter Absolute Return hand disappointing results to investors. FE Analytics shows it plummeted 22.12 per cent over the last three years, while its average peer in the IA Targeted Absolute Return sector is up 3.53 per cent.

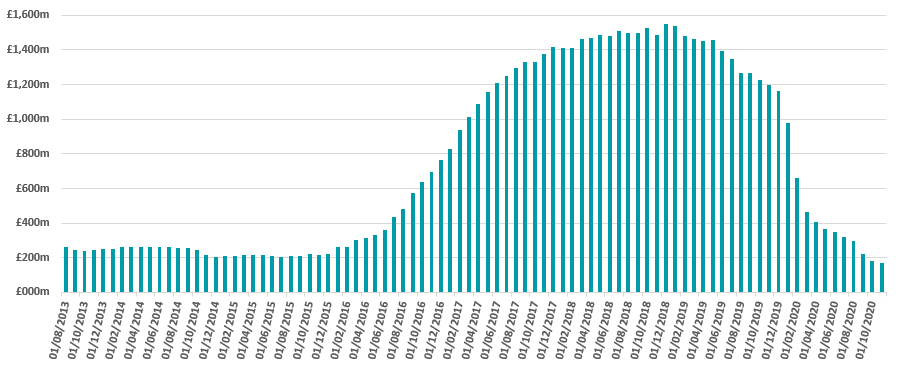

Meanwhile, the combination of losses and outflows means that it has fallen from more than £1.5bn in size in the summer of 2018 to just £165m today.

Last week, Jupiter announced that management of the Jupiter Absolute Return fund will be handed to Talib Sheikh’s multi-asset team at the start of 2021, because of this period of sustained underperformance and heavy outflows. In light of this change, Clunie (pictured) will leave the company.

Jupiter added: “Whilst we intend to retain the core proposition of the global, outcome-orientated approach of the fund, we will take this opportunity to review aspects of the investment process and proposition. The fund will continue to be managed to its investment objective by the new team.”

Performance of fund vs sector and benchmark over 3yrs

Source: FE Analytics

The reasons for the fund’s underperformance are not difficult to decipher.

Clunie had been open about the fact that his long book (or stocks he was backing in the hope they will go up) is full of cyclical companies whose fortunes are tied to the wider economy, with significant positions in the industrials, basic materials and financials sectors.

These value stocks have struggled in recent years as the ultra-loose monetary policy environment favoured ‘growth’ stocks in areas such as technology.

At the same time, Clunie was short (or betting on price falls) in companies such as Tesla, Netflix and Nvidia. Not only were these stocks riding a high before 2020, but they continued to surge during this year’s coronavirus pandemic – causing Jupiter Absolute Return to suffer.

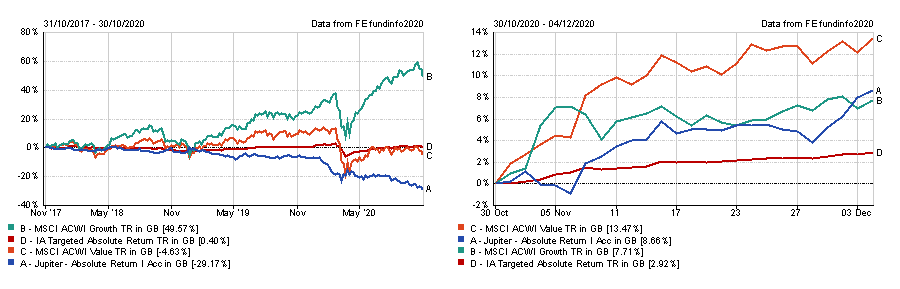

The first chart below shows how weak the fund’s performance was over the past two years, when the value style continued to lag behind growth stocks.

However, as can be seen in the second chart, value rallied in November on the back of positive coronavirus vaccine news and Joe Biden’s victory in the US presidential election – and the fund rallied with it.

Performance of fund vs value and growth indices

Source: FE Analytics

While one month is too short a time frame to determine if market leadership is really switching from growth to value, it seems valid to ask whether Clunie’s portfolio would have been one of those best positioned to capitalise on a change in this dynamic.

The manager himself thought so.

In an update to investors that was published before November’s rotation, he wrote: “While we cannot know for certain if the market regime is already changing, if it does move in favour of value stocks, we believe there is plenty of upside potential. Indeed, from where we stand today, we believe that expected returns for a strategy like ours have probably never been higher.”

Some fund pickers that spoke with Trustnet off the record were critical of Jupiter’s decision to change management of the fund just as the possibility of turnaround in performance appeared to be on the cards.

They argued that Jupiter Absolute Return’s portfolio looks like it would hold up well if all the stocks that have led the market in recent years – typically large-cap US tech stocks – hit a rough patch because of a cyclical rally.

One concern is that existing holders of the fund, who stuck with it despite its significant underperformance, could become forced sellers at the exact time when market conditions could be moving in its favour.

Change in Jupiter Absolute Return’s size under Clunie

Source: FinXL

However, others could see the reasoning for switching the fund’s management regardless of the hopes of a sustained cyclical rally.

Darius McDermott, managing director at Chelsea Financial Services, described Clunie as “a very bright, competent manager” but said the fund’s performance highlights the challenges of successfully shorting stocks, even for an experienced investor.

“As a manager, his premise is that he may lose you a little bit each year in bull markets – but when markets do sell off he will make that back. That is why investors held the fund, but he has continued to struggle in downward markets and that lack of protection has raised significant questions about whether the fund’s process and philosophy still work,” he added.

“The bottom line is if an absolute return fund is down almost 25 per cent over three years, questions are going to be asked and the answer hasn’t been enough, even if the turnaround in market leadership has given it a boost in recent days.”

Adrian Lowcock, head of personal investing at Willis Owen, agreed that Clunie is “an articulate and insightful manager” with strong views of the market. “The trouble is – and this is often the case for long/short managers – the market can disagree far longer than they can stay solvent,” he added.

Some have argued that Jupiter Absolute Return’s positioning makes it a good diversifier for investors who own popular strategies such as Scottish Mortgage, which has prospered off the back of the bull market in growth stocks.

However, Lowcock thinks absolute return funds should not be used in this manner. “The Jupiter fund was the polar opposite to Scottish Mortgage so it would act as a hedge but it is not necessarily a good idea to invest in both sides of the argument,” he explained.

“Absolute returns are usually better for protecting against wider market falls and provide some support to in such conditions. A better approach to benefit from rotation in markets is to get exposure to a value fund.”

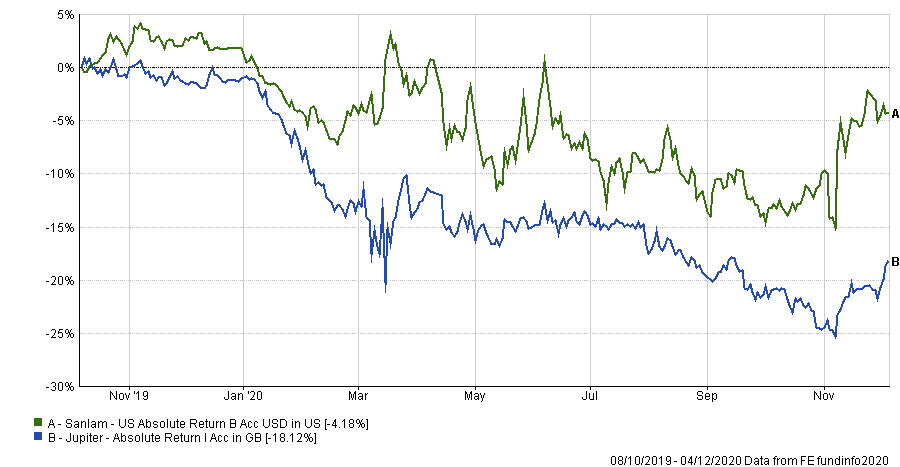

But for those investors who want a strategy with similar positioning to Jupiter Absolute Return, Premier Miton Investors multi-asset manager Simon Evan-Cook highlighted the Sanlam US Absolute Return fund.

The offshore fund only launched at the end of 2019 and has made a loss over that time, but it has beaten the Jupiter fund.

Performance of Sanlam US Absolute Return since launch, vs Jupiter Absolute Return

Source: FE Analytics

“We hold Sanlam US Absolute Return in our alternatives portfolio and have done of most of its short life. It’s run on a value basis, so it’s definitely faced some stiff headwinds in that time, but we think it’s held up well given that very trying backdrop. It also proved particularly useful at the peak of March’s pandemic sell-off. At the point when government bonds joined in with the equity sell-off, it was good to have a fund heading in the other direction,” Evan-Cook said.

“Its manager, Adour Sarkissian, is an old-school value-driven manager. It’s a long/short fund, with his long book made up of perfectly good but out-of-favour companies and his short book consisting of either growth stocks that been driven well above their fundamental value or with value traps that look cheap but that he believes still have further bad news ahead of them.

“We hold it as a useful foil to some of our more-growthy holdings, as it tends to perform well when growth funds struggle, as they have for the past month or so.”