Interest in ESG (environmental, social & governance) investing has been building for several years now, but 2020 has proven to be a turning point in both inflows and returns.

According to the latest edition of the Calastone Fund Flow Index (CFFI), ESG funds saw their best month of inflows in November for five years, with £820m of new investment.

And on the returns side, Trustnet found that in 2020 ESG funds have outperformed the average non-ESG fund in 20 out of 26 sectors.

These high returns and inflows have been questioned, however, as a large portion of ESG funds have high growth allocations, a style that has dominated markets for years and thrived during the Covid-19 pandemic.

Looking at the IA Global sector and funds with an ESG mandate had a higher correlation to the MSCI ACWI Growth index (0.84 per cent) over the past three years, compared to the MSCI ACWI Value index (0.80 per cent), according to FE Analytics data.

Indeed, value and cyclical areas of the market – such as oil & gas or financials – typically don’t feature prominently in ESG portfolios.

This section of the market has struggled in an environment of ultra-low interest rates and loose monetary policy, which has supported growth stocks over the past few years.

But recent positive Covid-19 vaccine news has catalysed into a significant value rally in markets as hopes of a return to more normalised conditions have risen.

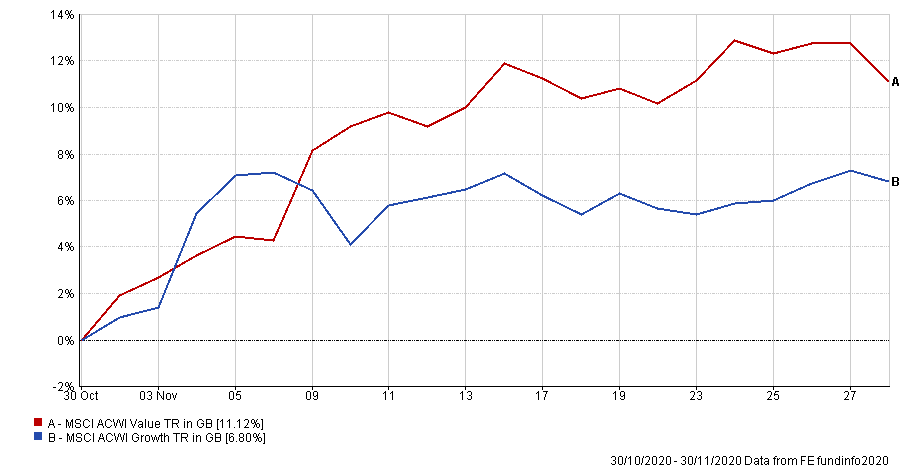

Performance of MSCI ACWI Growth index versus MSCI ACWI Value index in November

Source: FE Analytics

But if this value rally was to continue what would it mean for ESG returns ahead of 2021? Could the strong value rally upset ESG funds’ outperformance?

“This is a very real and likely scenario in the short term,” warned Adrian Lowcock, head of personal investing at investment platform Willis Owen.

Value has underperformed growth for some time – and sold off earlier in the year as Covid-19 struck – with Lowcock noting that even with the November rally, value stocks are still a long way off pre-pandemic levels.

But a value rally could take place once the economy begins to normalise, he said, “and people return to a life closer to a pre-pandemic world”. In such a rally, Lowcock said that valuations of some tech stocks favoured by ESG managers that have “gotten ahead of themselves” could sell off.

“So far, they have held up – even if the rally in value has overtaken them recently,” he said. “As the recovery takes hold the focus will shift to fiscal stimulus and economic growth, which is supportive of financials and oil stocks, etc.”

But Lowcock said the impact of a value rally on the performance of ESG strategies would be more short-term, since the underlying drivers of ESG performance are much more long-term.

Like Lowcock, Charles Stanley Direct’s Rob Morgan said the major long-term structural trends in ESG won’t be changed by Covid-19, arguing that any value rally would be much more selective.

Morgan (pictured) said what will matter more is the “sort of value rally we see”, as not every growth stock will be ‘derailed’ by a value recovery.

For example, tech stocks – one of the major growth areas – are still likely to do well as people’s online habits and remote working remain unchanged.

“Therefore, it may be a case of a selective value rally, and one that favours areas that the socially responsible funds have some exposure to rather than the very cheap areas such as oil and gas and big banks,” he said.

But even if there was a widespread value rally, Morgan said the impact on performance would vary from fund to fund.

“There are a few value-orientated funds such as Edentree Amity International that would stand to benefit,” he said. “Meanwhile, the managers of Liontrust Sustainable Future UK Growth, having had a growth bias for some time, have started to rotate into cheaper areas on valuation grounds.

“The funds more focused on long-term solutions providers addressing environmental or social issues would tend to have a significant tech and healthcare bias – i.e. two of the main growth sectors – and you would expect to see these among the laggards in a value rally versus broader funds.”

Louie French, senior research analyst at Tilney, said the amount a value rally could challenge ESG returns “really does depend on the underlying investment approaches and policies, and how fund managers seek to diversify their portfolio risks”.

He said: “For example, some funds will use a best in class ESG approach in an attempt to limit tracking error versus an index, whilst other funds might have negative screens that exclude banks, but they will invest in insurance companies and investment management firms instead.”

While some of the best ESG performers have had biases towards growth stocks that doesn’t mean there aren’t suitable value investment options, according to Declan McAndrew, head of investment research at Foster Denovo.

McAndrew said there are “plenty of value stocks” in areas of ESG risk mitigation and potentially going into some of the sustainable areas as well.

“There’s always going to be pockets of value, if you like, that are pure value investing,” he added. “If you think about UK and, to a lesser extent Europe, they’ve lagged behind the US. But within that there are healthcare providers, industrials that are going about [sustainability] the right way, and even some smatterings of financials.”

But if investors are worried about the impact of a value rally in their ESG holdings the simple alternative is to invest in funds which don’t have a style bias, said GDIM investment manager Tom Sparke.

“There is a definite dominant style evident in many ESG investments and quality-growth is very prevalent,” Sparke said. “These managers, who obviously will exclude oil and many financials, will inevitably struggle to keep up if these elements rally in the short-term.

“However, there are many funds that can give exposure to the most potent ESG themes that do not have these biases.

“For instance, a clean energy fund can hold the high-tech areas of the sector, but also the more traditionally defensive sectors such as utilities.”

Another example is semiconductor companies, which Sparke said are not strictly value “but have a very high cyclicality to them and should do well when value rallies too”.

“Additionally, secular growth themes of web services, cloud-based technology and other flexible working stocks are not disappearing and these will continue to do well even as value recovers,” he finished.