ASI Global Smaller Companies, Schroder Global Recovery and First Sentier Global Listed Infrastructure are some of the ‘risk-on’ funds that FundCalibre’s Darius McDermott thinks investors should consider holding next year.

While FundCalibre managing director McDermott (pictured) said it is “almost foolish” to forecast 2021 after the unprecedented events of 2020, he does believe that it could be a more positive year for investors.

He said: “I’m broadly positive going into 2021. We have more than one vaccine in the offing, Brexit will be completed one way or another and we have a US president who is likely to be less unsettling.

“Yes, we have mountains of debt, a global recession and we’re bound to have hiccups along the way… but some of the uncertainty has been removed, we know what needs to be done to enable a recovery and both governments and central banks around the world are being supportive.

“To me this means 2021 should be good for risk-on assets – in both equity and bond markets.”

Below, McDermott reveals the five asset allocation calls he is making for 2021 and 15 funds offering exposure to them.

Emerging, not developed

McDermott expects the US dollar to remain weaker for some time, which will benefit Asia and broader emerging markets.

“Asia, in particular, has generally handled the pandemic well and has just struck a new inter-regional trade agreement. Calmer relations between the US and China will also help,” he added.

For investors seeking exposure to emerging markets because of these trends, he suggested Guinness Emerging Markets Equity Income and Fidelity Asia Pacific Opportunities.

Performance of funds over 2020

Source: FE Analytics

McDermott still expects developed markets to generate a positive return in 2021 – although not one as high as investors have seen in recent years. The only exception to this outlook is the UK, which could rally hard if a positive Brexit outcome is eventually reached.

In this case, investors might want funds that are geared to the UK economy – typically those with a small- and mid-cap tilt – rather than those focused on the more international-facing FTSE 100. FundCalibre likes AXA Framlington UK Mid Cap in this space.

Small, not large

Recent years have seen large-cap stocks make higher returns than their smaller peers, which tend to be risker investments. According to FE Analytics, the MSCI ACWI Large Cap index has risen 33.99 per cent over past three years compared with a gain of 24.41 per cent for the MSCI ACWI Small Cap.

Large-caps have also outperformed over 2020 so far, as the coronavirus crisis pushed investors in a rather narrow selection of stocks.

“Larger companies have been outperforming of late, helped in no small amount by the big tech names, which have been responsible for some 70 per cent of stock market gains this year in some countries,” McDermott said.

“Smaller companies, which have paid the price of investor uncertainty in 2020, have relatively attractive valuations and should do well going into a recovery.”

Indeed, some evidence of this can already be seen. Positive news around several coronavirus vaccines sparked a rally led by smaller companies; the MSCI ACWI Small Cap is up 14.13 per cent over three months, while the MSCI ACWI Large Cap has made just 5.82 per cent.

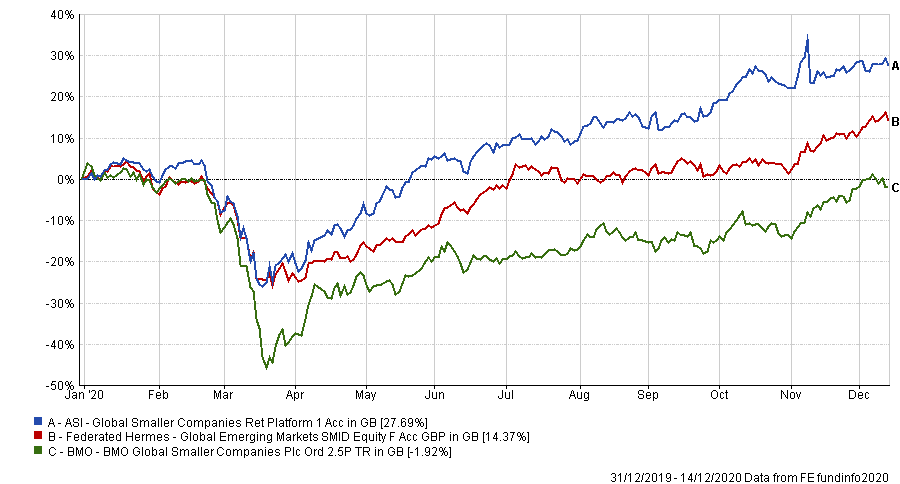

Performance of funds over 2020

Source: FE Analytics

FundCalibre thinks investors looking to add exposure to smaller companies could consider the likes of ASI Global Smaller Companies, Federated Hermes Global Emerging Markets SMID Equity and BMO Global Smaller Companies.

Growth and value

One of the stand-out investment trends of the past decade has been the significant outperformance of growth stocks (or companies that investors think will grow faster than the market) over the value style (or buying unloved stocks that are trading at a low price relative to their fundamentals).

While the MSCI ACWI Growth index has made a 261.14 per cent total return over 10 years, the MSCI ACWI Value index has gained just 111.76 per cent. This trend continued in most of 2020, although November’s vaccine rally caused value to surge past growth (albeit over a very short time frame).

“If November taught us anything it’s that investors shouldn’t write off value strategies completely. The rotation caused by the first vaccine news has reminded us why it’s unwise to be ‘all-in’ one style,” McDermott said.

“While we believe growth will still do well in a low interest rate environment, having some value in a portfolio could reap rewards too.”

Performance of funds over 2020

Source: FE Analytics

Funds that take a value approach and are highly regarded by FundCalibre’s analysts include TM CRUX UK Special Situations, Invesco Asian and Schroder Global Recovery.

Corporate bonds, not government bonds

Years of low rates and quantitative easing have pushed yields on government bonds in the developed world to very low levels and left investors with little capital upside.

“Inflation could be on the horizon - perhaps in 2022 – which could also make a bad situation worse,” McDermott added.

“I prefer investment grade and high yield bonds, which offer better yields and again should do better in a recovery environment. Emerging markets bonds also have more room to manoeuvre, as interest rates are higher.”

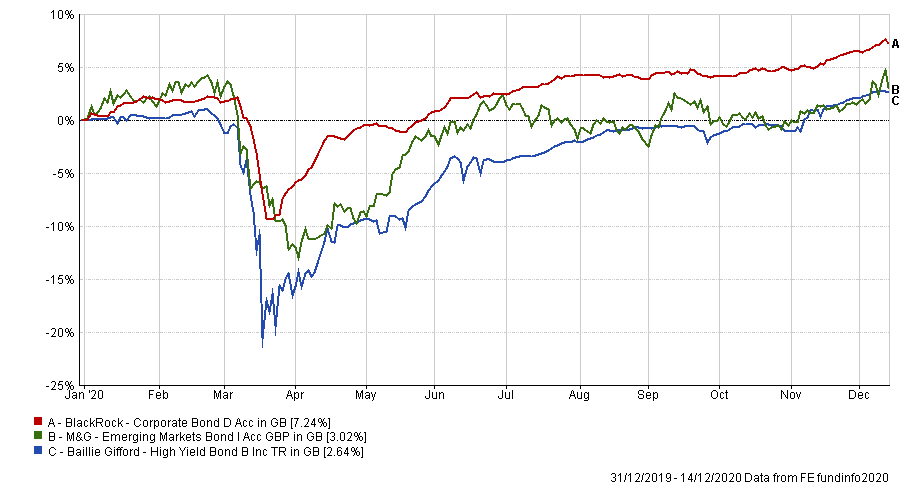

Performance of funds over 2020

Source: FE Analytics

Among his preferred funds covering these areas are Baillie Gifford High Yield Bond, BlackRock Corporate Bond and M&G Emerging Markets Bond.

Commodities and infrastructure, not tech

While tech stocks have led the market rally for much of the recent past, some have questioned how long this can continue and tech underperformed in November as market leadership shifted.

McDermott doesn’t think investors should drop tech but does believe other areas of the market could look more attractive as the global economy starts to recover from the coronavirus crisis.

“The big tech companies will continue to do well as they have momentum behind them in the form of structural change. But I don’t expect the same dominance as was shown in 2020,” he explained.

“Instead, commodities and infrastructure look interesting. Both should benefit from economic recovery. While oil has potentially already had its bounce, metals will be key, especially as the push for electrification and renewable energy gathers pace.

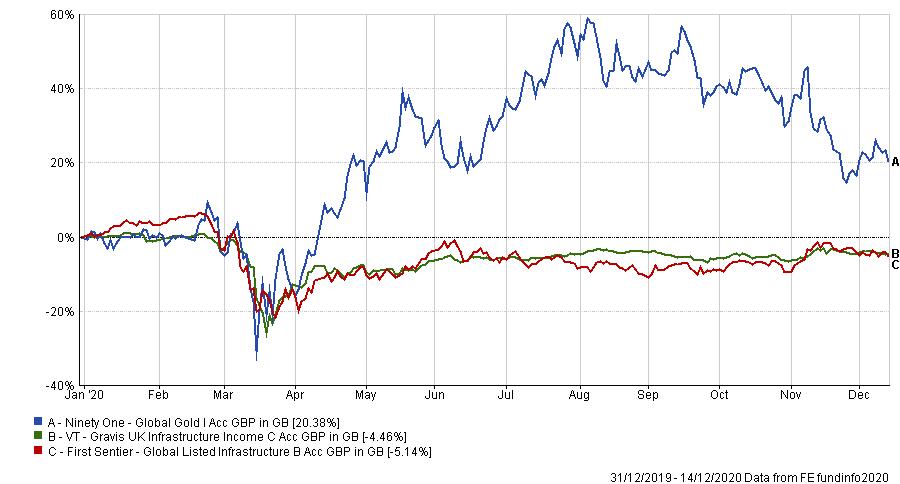

Performance of funds over 2020

Source: FE Analytics

As for funds offering exposure to these themes, McDermott likes Ninety One Global Gold, First Sentier Global Listed Infrastructure and VT Gravis UK Infrastructure Income.