Watching out for inflection points in small-cap businesses can pay off for investors when they re-rate, according to American Century Investments’ Trevor Gurwich, who says large upward re-ratings have helped fuel performance this year.

Gurwich, co-manager of the top quartile $464m Nomura American Century Global Small Cap Equity fund, looks for the top one or two per cent of the 10,000-strong global small-cap universe to populate his portfolio of around 140 stocks.

To make it into the portfolio, a business has to meet the four pillars of what he calls the ‘ISGV’ outlook, namely: an inflection point, a sustainable improvement, a ‘gap’, and a valuation risk-reward.

Explaining the meaning of the ‘gap’, Gurwich said: “In other words, we look at the business and ask can we get to a higher revenue and earnings rate than what the market is expecting? Do we have an earnings gap?”

When it comes to a valuation risk-reward, he asks himself: “Are we being paid to take the risk on this business at this particular point in time?”

This is how the fund came to invest in the well-known footwear brand Crocs earlier this year.

“What ended up happening with Crocs is that during the virus, basically the market extrapolated that they’d have to close down all the retail stores and the malls would be closed,” Gurwich explained.

“But the stock dropped over 70 per cent, which is when we started actually buying the name.”

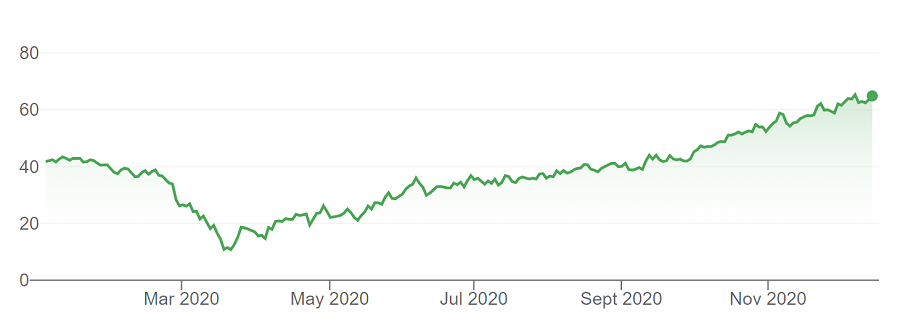

“We were looking at the stock initially in the early, early $40s, and the stock dropped all the way down to about $10 a share when we started accumulating a position.”

The share price of Crocs has rallied over five-fold since the fund took a position and has now swelled to become its second largest holding.

Share price performance of Crocs YTD

Source: Google Finance

Gurwich said the market drastically underestimated the earnings ability of Crocs, which has benefited hugely from the crisis, and he still believes its growth path remains strong.

“If you look at Crocs in terms of the forecast and revenue growth, 2020 is forecast to grow about 6 per cent and 2021 is going to accelerate to about 14 per cent topline growth,” he explained.

“It is somewhat a beneficiary of the coronavirus in the sense that no more people are staying at home, more people want to walk around their house comfortable and don’t want to wear fuddy-duddy slippers.”

He has reduced the position somewhat but continues to own it now despite its massive rally.

The investment philosophy of the fund boils down to the belief that earnings drive stock prices, and that financial markets are very inefficient in identifying inflection points in small-cap businesses.

Gurwich explained: “If we find a business that is inflecting and we invest in it, we’re benefiting from both that earnings re-rating – from [an] improved service or product or geographical expansion or change [in] management team or M&A opportunity – but also, benefiting from that P/E [price-to-earnings] re-rating opportunity.

“We have multi-factor models that basically scour the whole global universe and look at companies by region, companies by sector, their relative growth rates, their relative acceleration rates, their relative earnings revision rates, etc.”

After this, the manager then asks: “What has really changed over the last 24 hours, week, month, and how is this different from before?’ And, more importantly, ‘how does this company now interact in the global universe differently to how it had interacted in the past?’”

When it comes to investing in UK small caps, whilst there are some great companies, Gurwich admitted that the UK is quite an efficient market that is well-covered by local institutions.

The global small-cap manager said: “It might be a little tougher than some of the other smaller markets around the world to get early on ideas, but there are always inflections happening.”

He referenced JD Sports as an example where the approach has paid off. JD Sports dropped from around 850p to roughly 300p during the crisis and was a company where the market underestimated its earnings potential.

Gurwich said: “We looked at the business, and we asked, ‘Is this a good business? Do they have a good balance sheet? How are they going to manage their leases? What’s the management team?’”

He came to the conclusion that the business will ultimately make it – either with some help from the market or their suppliers – and that it would be a winner on the in the retail space because they offer a high-quality product that and people are going to continue buying.

JD sports has since rallied back to over 800p this year.

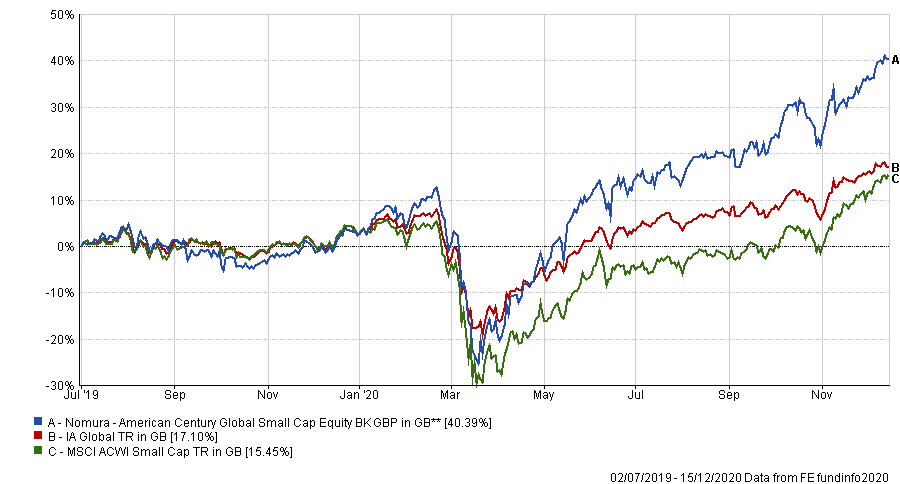

Performance of fund vs sector & benchmark since launch

Source: FE Analytics

The Nomura American Century Global Small Cap Equity fund, which Gurwich manages alongside Federico Laffan, has returned 40.39 per cent versus 15.45 per cent from the MSCI World Small Cap index since its launch in July 2019 and a 17.1 per cent return for the IA Global peer group. It has an ongoing charges figure (OCF) of 0.67 per cent.

It mirrors the strategy of the US-domiciled $576m American Century International Opportunities fund, which has delivered 9.97 per cent average annualised total returns for the past 10 years, compared with 7.2 per cent from the MSCI AC World ex-U.S. Small Cap Growth index.