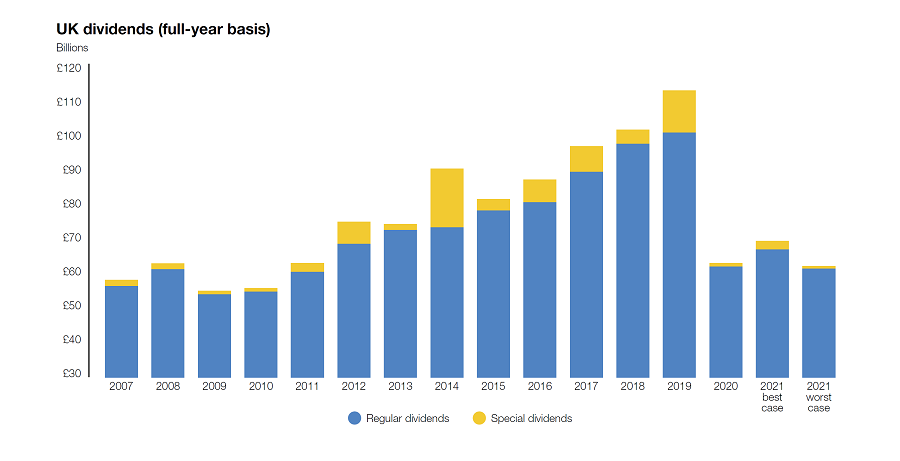

Dividends from UK companies fell by 44 per cent last year to £61.9bn – the lowest level since 2011 – as the Covid-19 pandemic saw companies cancel or cut payouts, according to the latest UK Dividend Monitor from Link Group.

According to the administrator, cuts related to the coronavirus crisis (excluding special dividends) totalled £39.5bn last year.

Headline dividends including specials fell from £110.6bn in 2019, a record year, as two-thirds of companies cut or cancelled dividends between Q2 and Q4 last year. On an underlying basis – excluding specials – payouts fell by 38.1 per cent to £61.1bn.

A better-than-expected Q4 – boosted by reinstated payouts – helped 2020 beat Link Group’s ‘best case’ estimates “by a whisker” as headline dividends reached £10.3bn.

The biggest impact last year came from the financial sector, which accounted for two-fifths of the Covid-19 cuts between April and December, as £16.6bn in dividends were cut or cancelled, with the majority attributed to the financial sector.

Aside from banks, companies dependent on discretionary consumer spending made the biggest percentage cuts, which fell by £5.5bn as lockdown conditions hit retailers and the airline, leisure and travel sectors.

Source: Link Group

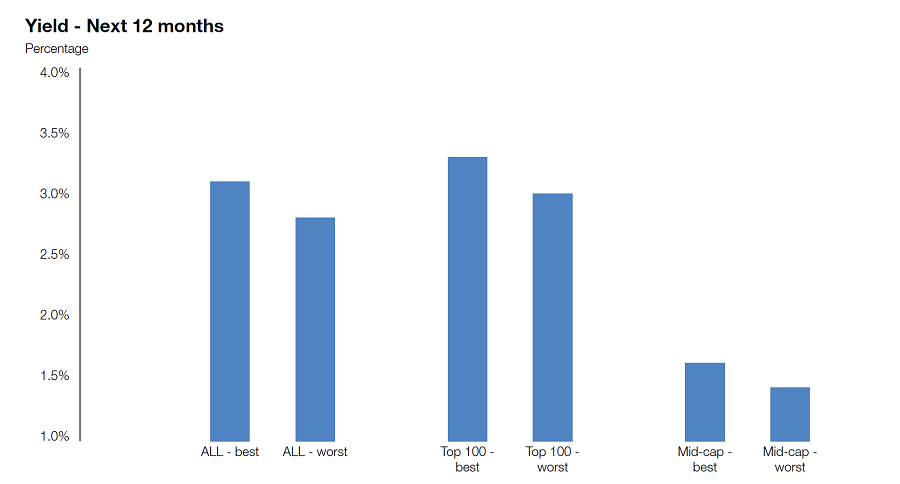

Looking ahead to 2021, Link Group claimed higher share prices and a lower forecast for dividends mean a compression of the prospective yield on equities.

As such, based on its best-case scenario for 2021, UK equities will yield 3.1 per cent or 2.8 per cent if its worst-case materialises.

Susan Ring, chief executive for corporate markets at Link Group, said while there was a “slightly better end to 2020 may be a cause for relief”, it was a dreadful result for UK investors.

She said: “UK payouts have been more severely impacted than in most comparable countries because of their heavy concentration in the hands of just a few very large companies, mainly in the oil, mining and banking industries – all sectors that have had to cut dividends steeply.”

Ring continued: “There are reasons for optimism, but the resurgent pandemic has pushed back the reopening of the economy even further, especially in the UK.

“We still believe the worst is past, but a new lockdown means our expectations for 2021 are significantly more subdued.

“The social and economic scars of Covid-19 will be deep. We think it is highly unlikely dividends can regain their previous highs until 2025 at the earliest, and potentially even a year or two after that.”

David Smith, fund manager of £263.2m Henderson High Income Trust, said 2020 had been an “incredibly tough year” for UK income investors, albeit with a glimpse of optimism in Q4 as some previously suspended dividends were reinstated.

He said: “It’s likely that more companies will continue to return to the dividend register in 2021 but at low levels as companies remain cautious until there is a clearer path for cash flows to recover and balance sheets to be repaired.

“While I would expect some growth in dividends this year, it is likely to be at least 2022 before we start seeing more significant dividend growth.

“Having said that, there will be pockets of strong dividend growth within the market this year for the selective investor.”

Nevertheless, Smith said a dividend yield of 3.1 per cent for the UK market is still attractive and is likely to be more sustainable going forward with the opportunity to grow.