Environmental, social & governance (ESG) investing is quickly gaining new followers and inflows, but the style is beset with contradictions and inconsistencies, meaning different things to different people.

Considering that it has to satisfy the three broad criteria, there will always be instances where the weightings could be skewed depending on a definition or rating agency used.

Moreover, issues of sustainable and ethical investing very much depend on the sensibilities of the individual, rather than a quantitative, derivable metric.

With this in mind, the team at Schroders has outlined how it approaches this style of investing and the sustainability credentials of the Schroder ISF Global Sustainable Growth fund.

“It’s a highly concentrated global equities portfolio, trying to invest in sustainable companies in all senses of the word,” said Katherine Davidson, portfolio manager of the fund.

Concerns of “greenwashing” in the industry are widespread and Davidson outlined how sustainability is assessed to help decipher which companies are “genuine”.

One of the asset manager’s key components of its approach is in the engagement with companies and ensuring they are improving outcomes for stakeholders and the wider society.

“Only companies that treat these stakeholders fairly and take a long-term approach to running their businesses will be able to succeed in the long run,” she said.

These long-term compounders are more likely to have better operational performance, according to Davidson.

“Stakeholder relationships are underpinning the long-term growth and return trajectory,” she said. “The market consistently underestimates the durability of that.”

Last year was an interesting test case for ESG investing in the sense that it didn’t fall victim to the turmoil in markets that many expected, the fund manager noted.

“There were concerns that maybe it was a bull market phenomenon and investors wouldn’t care so much when there was a sell-off,” said Davidson.

However, the evidence was supportive of huge momentum in this area amidst increased awareness of how companies interacted with their stakeholders, specifically their employees during the pandemic.

Indeed, data showed inflows of $200bn into ESG, which was the only part of active equity to show positive flows over 2020.

A common criticism of using third-party rating agencies for the ESG framework is the tendency to rely on historic data, which is not a component of the Schroders proprietary approach.

“These third-party approaches are backwards and static,” she said. “They tend to reward policies and disclosures rather than a genuine commitment to sustainability.

“Furthermore, the correlation between the different score providers are really low, which essentially means any stock can be top-quartile if you pick the right agency.”

The difficulties in assessing sustainability

Source: LHS Charts, March ACWI December 2020. RHS Chart, Schroders March 2018

The disparities in these ratings highlight how challenging it is to reach a consensus on these topics.

Similarly, assessing moral and ethical behaviour ultimately comes down to personal preferences and individual values, which requires a much more qualitative approach.

“In our approach, we wanted to embrace the uncertainty and put together a qualitative approach that would draw out the best of what we do in fundamental investing,” said Davidson.

Over three years, the $1.3bn Schroder ISF Global Sustainable Growth fund has made a total return of 60.38 per cent, compared to a 35.41 per cent gain for the average fund in the FO Equity – Ethical sector and 35.07 per cent for the MSCI AC World Index.

Performance of fund vs sector & benchmark over 3yrs

Source: FE Analytics

The five FE fundinfo Crown Rated fund has an ongoing charges figure (OCF) of 1.65 per cent.

“The outperformance has been driven overwhelmingly by stock selection,” she said. “It’s consistently been about finding those long-term compounders.”

Another important theme for the Schroders team is energy transition, which has been building for some time but has reached a key inflection point, according to Mark Lacey, manager of the Schroder ISF Global Energy Transition fund.

“This is the biggest structural shift in terms of investment, but also in the energy system that we’ve had for the last 70 years,” he said. “It’s fundamentally changing the way we produce and consume energy.”

While energy transition has been a theme for some time, the difference now is the global buy-in to such policies with all major nations committing to clear targets and providing huge sources of capital towards this, he said.

“In terms of investment rates around the world, it is 5x the rate of investment in fossil fuels that we’ve seen in the last 10 years,” said Lacey. “And of course, investment rates drive equity performance.”

Indeed, US president Joe Biden’s $2trn clean energy initiative, the €750bn EU Recovery Fund and efforts from the rest of the world equate to $100trn of investment between now and 2050, according to Schroders.

Another crucial difference between previous movements and now is the viability of the technological forces driving the transition.

“If you go back to 2010, wind and solar technologies did not work without subsidies,” he said. “The subsidies were removed in 2012 and a lot of the companies had to bring their costs down to make this viable.”

Across solar, offshore wind, and – increasingly – lithium-ion batteries, Lacey said prices are at an inflection point, which is combined with a very unique tailwind of government policy, cost profile and consumer take-up.

“It’s incredibly rare that you have all these drivers working together in a sector and currently the market cap of these companies is a fraction of future levels,” he said.

Lacey said this multi-decade investment theme is currently not represented in indices like the MSCI ACWI, which currently only has a small weighting towards hydrogen storage and electrical equipment.

“Pockets of exuberance have left some sectors looking very expensive, with regard to hydrogen and energy storage,” he added. “Therefore, it’s all about finding the areas of good value.”

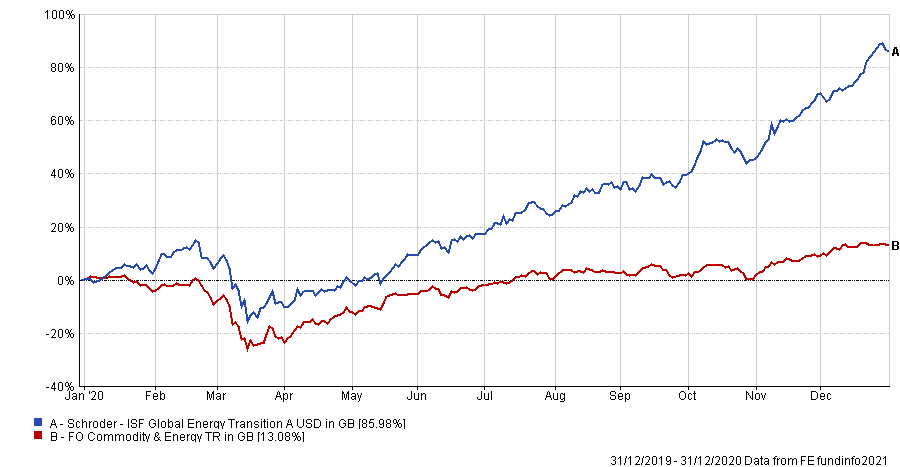

Performance of fund vs sector in 2020

Source: FE Analytics

Last year, the $1.1bn Schroder ISF Global Energy Transition fund made a total return of 85.98 per cent against a return of 13.08 per cent for the FO Commodity & Energy sector. It has an OCF of 1.86 per cent.