Calling value investing “dead” is like saying the Earth is flat, according to Fidelity International’s Nitin Bajaj, who said it plays into the hands of experienced fund managers like him.

Bajaj, who runs the Fidelity Asian Smaller Companies fund, added that value investing is not about just buying stocks that are cheap, but buying those with a margin of safety, made up of three factors: valuation, the quality of the business and growth.

He said the first two of these pillars are the most important for investors who want to minimise risk.

“The reason we do this is that these are way more predictable than forecasting the future of the world,” he explained.

“It’s very hard to figure out the businesses which will be successful 10 to 15 years from now.

“As an example, if you went back to 2007, seven out of the top-10 companies in the world were oil companies. Today, we think they’re going extinct.

“That’s the difficulty with forecasting the future. And that’s why I think that the margin of safety based on valuation and on the quality of the cash flows of the business is way more dependable than the margin of safety based on growth.”

To sum up value investing in another way, Bajaj pointed to a quote from Warren Buffett: “Whether we’re talking about socks or stocks, I like buying quality merchandise when it is marked down.”

The manager said that where value investors often fall down is by not paying enough attention to the ‘quality’ part of that equation. He added that the biggest lesson from his 30-year career is that you need to own good businesses as “bad businesses don’t compound”.

“You need to be with the right people, because bad management will either destroy your capital or steal your capital,” Bajaj added.

“And you need to buy businesses at a good price because if you buy at the wrong price, compounding doesn’t work. And that’s what I try to do.”

As an example, he pointed to a recent acquisition in India called KEI, which makes electrical cables. It makes more than 20 per cent return on invested capital, is trading at 12x earnings and has grown its top line at around 15 per cent per annum over the last decade. Meanwhile, companies with a similar profile in more fashionable areas are trading at 35 to 50x earnings.

Even a ‘quality value’ strategy would have underperformed a pure growth approach over the last decade as the most expensive stocks have accelerated ahead of the market.

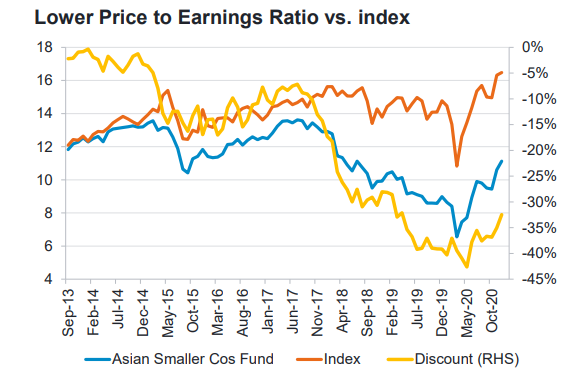

Source: Fidelity

But Bajaj warned that investors have taken that as a sign to extrapolate this trend from the handful of exceptional growth stocks across the rest of the market – and this is where problems arise.

“What happens in a manic market like we are in at the moment is you start pricing probabilities as certainties,” he continued. “The rule of thumb is eight-and-a-half to nine out of every 10 start-ups will fail. But we are in a world where every start-up is being priced as if it’s going to succeed and it never happens like that.

“Actually, they’re not real growth companies. A lot of ‘growth companies’ [in the] long term don’t grow earnings faster than value companies and there’s more than enough data in the world to prove that.

“The world is in a place where almost everyone agrees that these perceived growth companies are really richly priced and there’s not a good margin of safety there. But the momentum is so strong that it’s very hard for investors to get off a horse which is continuing to make so much money.”

And the manager said the benefit of a 30-year career is that he saw the same thing happen in 1992, 1999 and 2007, when it paid to stick to fundamentals.

“What we are seeing is just a repetition of human behaviour,” he continued. “We’ve seen this many times in the past and I’m sure we’ll see it in the future: every 15 to 20 years there’s a new generation of investors who feel that this time is different.

“So, is value investing dead? I don’t think so, but if you’re in the shipping business, I think it pays if your competition thinks the world is flat.”

Data from FE Analytics shows that Fidelity Asian Smaller Companies has made 122.54 per cent since Bajaj became manager in September 2013, compared with 104.89 per cent from the fund’s FO Equity Asia Pacific ex Japan sector and MSCI AC Asia Pacific ex Japan Small Cap benchmark.

Performance of fund vs sector and index under manager

Source: FE Analytics

The $903m fund has ongoing charges of 1.1 per cent.