Stocks that were expensive before the March sell-off have become even more so in the rally that has been seen in the months since, prompting IBOSS Asset Management to tilt away from the best performing region this year in favour of more attractive valuations elsewhere.

Chris Rush (pictured), senior investment analyst, said the firm aimed to seek out areas of the market where there is greater value on offer when making allocation decisions in the IBOSS managed portfolios and open-ended multi-asset range.

“What we try and do when we’re putting portfolios together… we’re trying to kind of tilt the portfolios away from the areas that look expensive relative to history and towards the areas that look like there could be some value there,” said Rush.

“And that’s not just value in the traditional sense, but also in the sense that in most scenarios – obviously coronavirus is different – if you are positioning yourself away from the most expensive areas, then you’ve got some more upside. Also, you’ve got potentially less downside.”

Indeed, the coronavirus period has been very different to past market environments in that everything sold off together, said Rush.

However, the analyst said such a broad-based sell-off meant the stocks that were expensive before the pandemic started remained expensive after it began.

“What has happened since then… is that this has perhaps been exacerbated even further, whereby the areas of the markets that looked expensive bounced back faster and the markets that look relatively cheap have bounced back less,” he explained.

Rush highlighted the strong performance of US stocks over the past five years and its representation in global benchmarks such as the MSCI World index, something that will have benefited passive investors. It’s been a similar story in terms of sector allocation.

Performance of indices over 5yrs

Source: FE Analytics

“Looking at a sector-weighted sample, it’s been all about how much you’ve had in the US and how much technology for the last for the last five years,” he said. “And if we go to year-to-date returns, basically nothing has changed.

“So, essentially, you’ve been rewarded – year-to-date at least – for basically having more of a benchmark position. Or if you’re an active manager having an overweight in US and technology stocks and that’s something that many investors have obviously gotten used to.”

However, while US stocks – and US tech stocks in particular – have been rallied strongly since the sell-off earlier this year, it means that they have just become more expensive to own.

“All the things that have worked in the past five years continue to look expensive to where we are today,” said Rush. “And that differential between the most expensive stocks and the least expensive stocks has gotten wider than it’s been for quite some time.”

While expensive growth stocks have continued to get more expensive, the gap with cheaper value stocks has widened since the start of the year. Rush noted that the returns from the growth and value styles this year were in line with the prior five-year period.

However, this does mean that there are many areas for investors to find opportunities.

As such, the asset manager has moved to an underweight position in US equities and is now overweight UK and emerging market stocks.

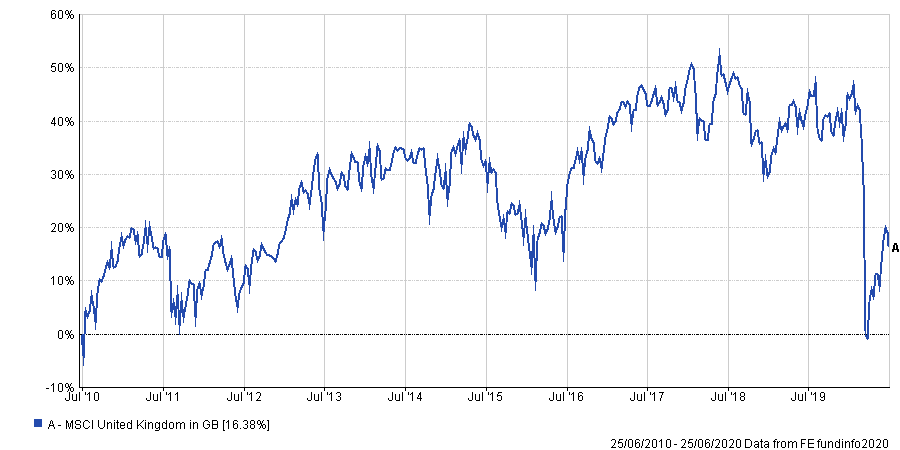

“If you look at the MSCI United Kingdom index including the bounce-back that we’ve had more recently, in price terms, we’re trading back at levels but last seen in 2016 or February 2016,” he explained. “And that isn’t the case anywhere else that valuations look as cheap as they do in the UK.”

Price performance of index over 10yrs

Source: FE Analytics

Domestic stocks have continued to lag their international peers in recent years as Brexit headwinds have taken their toll on the UK economy. But they had picked up significantly following the election of Boris Johnson in December and before the coronavirus took hold.

And this is why the managers Rush and IBOSS' Chris Metcalfe have been adding to their UK exposure, favouring funds with experienced management teams and proven stockpicking ability to weather short-term headwinds.

UK funds in the portfolios include Artemis UK Select, Franklin UK Equity Income, JOHCM UK Dynamic, JOHCM UK Opportunities, Man GLG UK Income, Polar Capital UK Value Opportunities, SVM UK Growth and Unicorn Outstanding British Companies.

In emerging markets, the managers have seen a similar valuation gap – relative to developed markets – opening up. However, given the varied nature of emerging markets Rush and Metcalfe have opted for active strategies that can make specific allocation decisions (BlackRock Emerging Markets and Baillie Gifford Emerging Markets Growth) as well as broad-based exposure through a passive tracker fund (L&G Global Emerging Markets Index).

Something else that investors need to be aware of is the currency impact on UK investors’ portfolios.

Sterling investors in international assets have benefited from currency weakness in recent years, something which has again been highlighted in recent years.

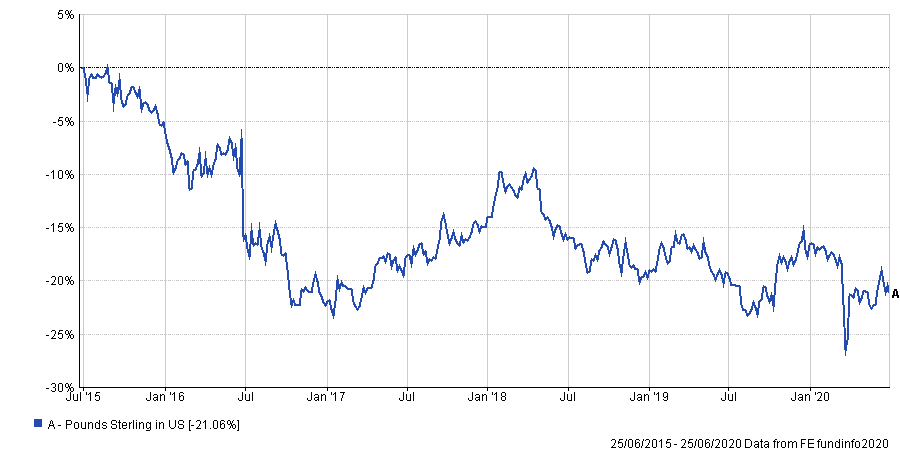

Performance of sterling in US dollar over 5yrs

Source: FE Analytics

“A weaker sterling in periods of market crisis helps sterling investors, as all of a sudden your international equities are worth more pounds than they were beforehand,” said the IBOSS analyst. “But as we’ve seen in the rally – and this is this is definitely a risk to investors going forward – is what has been a huge tailwind for the majority of the last five years can quickly become a headwind.”

He continued: “I think lots of investors have basically become comfortable with the idea that there is no risk to holding international assets from a currency perspective. So, they haven’t been hedging, because they’ve just been basically riding this wave of US dollar strength.”

Portfolio manager Metcalfe added: “We’ve written a lot about over the years – right back to Brexit, when it first really came to a head – but a lot of investors I’m not sure really appreciate just how many times the pound’s falls have coincided with market rallies.

“The big danger is that the equity markets sell off at the same time as the pound is rallying, but it’s just not happened in the last four years, but it could potentially happen one day.”

As such the pair have aimed to neutralise the impact of currency on their portfolios given the surge in the US dollar over time in much the same way as it has tilted its portfolio towards the more undervalued parts of the market.

“That’s not necessarily making a call one way or another, but just being aware that there’s a lot of investors piling into US equities, and many of these very popular [areas] – whether its growth, whether it’s North American equities or anything else – that have all benefited from very similar tailwinds over such a long period of time,” finished Rush.