When it comes to the three elements of ESG – environmental, social and governance – investors should focus on the G first, because once that is in order the E and the S will naturally follow.

This is the ‘roadmap to ESG investment’ which Ketan Patel, co-manager of the £119.5m EdenTree Amity UK and £129m EdenTree UK Equity Growth funds, said can be applied to any company, industry or sector.

EdenTree Amity UK fund, which launched in 1988, invests in UK companies that make a positive contribution to society and the environment through sustainable and socially responsible practices.

Patel (pictured) refers to himself “as a responsible and sustainable” fund manager.

“People say ‘Well, what do you mean? How can you be sustainable and not responsible?’ The way we think about it you can obviously be sustainable but it’s not always responsible,” he added.

“We argue that if you’re a responsible person, or company, that’s the G, or governance part. If you get the governance correct then the company will benefit the shareholders, and we think that [then] the S and the E will take care of itself.

“Because ultimately if you then get the S right people’s investments are aligned and it then ensures that the environment [E], in its broadest sense are looked after, not just now but for future generations.”

The governance element of ESG has largely been seen as a ‘good business practice’ factor, following the idea that a company which is run well will make better returns.

But Patel explained that what having good governance actually means is having the core foundations of a company well set up, including independent board voting and diversity. If this is in place, then the company will then lend itself to more socially sustainable practices.

Investment in ESG strategies has been on the rise in recent years with the Investment Association (IA) reporting consistently rising inflows into responsible investments. The latest available monthly data shows a net retail inflow of £669m into responsible funds in June.

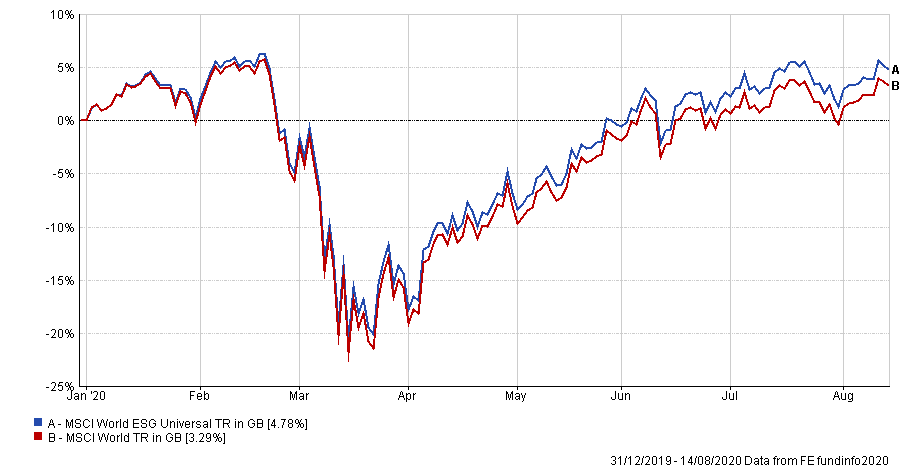

Performance of global ESG stocks vs conventional stocks in 2020

Source: FE Analytics

Last year was very much the year of environmental, with global protests raising awareness around climate change issues, dubbed the ‘Greta Effect’ after teenage activist Greta Thunberg.

But 2020 has been the year of the social factor, as the coronavirus pandemic created a turning point for investor’s priorities with the focus now being shone on companies’ wider social responsibilities.

“The E of ESG has always been right in your face, which is fantastic, but what the pandemic has done is put the S right at the forefront. The whole notion of social justice and social inequality and how corporations behave,” Patel said.

“And there’ve been some really bad examples out there but also some really good examples and companies that have got it right, [such as] allowing people to work from home with tech support.”

Having worked in the sustainable investment space for almost two decades, this swell of interest and investment into ESG and sustainability has been a long time coming for Patel.

“The momentum behind ESG now is greater than it has ever been,” he said. “Finally, after 20, 30 years it’s happening. It’s taken a pandemic in the space of six months for it to happen.”

One thing Patel hopes will gain momentum from this increased focus and demand for ESG investment is making managers re-evaluate whether they should actually be invested in traditional sectors such as airlines or oil & gas.

“I think it will be interesting for fund managers to realise that some sectors do not need to be invested in anymore,” he said.

“You know a few years ago people wouldn’t have thought about screening out airlines and gas but there’s so much changing in those sectors.”

Patel added that this divestment away from certain sectors isn’t only down to a drive in ESG investment, but also the types of investors entering the market.

He said: “Finally they’ve realised that there is a generation of investors that are waiting. They don’t want to invest in BT and Shell and tobacco stocks, which is very much how people invested in the 1980s. And the new generation coming through are not just interested in the product, but the whole supply line everything and whether it’s the clothes you wear or how you eat or how you holiday. Even how you buy a house.

“And a lot of fund providers have actually realised ‘wow, there is a massive opportunity’ so they’re thinking how they can commercialise and monetise it.”

During the coronavirus crisis, Patel has looked for companies that are not just going to get through the pandemic but excel afterwards.

One area that he has increased his focus on is in engineering, because firms here are already well set up to thrive once the pandemic is over.

Some of these engineering companies in the EdenTree Amity UK fund include Porvair and Vixtrix. Patel calls both companies “high quality” and he has held them in the fund for some time now, recently increasing his allocation.

He said: “So we think that there’s a dozen, if not more, high-quality companies that are around the world, in both portfolios but particularly Amity UK. We have a very, very nice portfolio of companies.

“I think riding out the pandemic is important, but we want to invest in companies which can ride out the pandemic and then fly after.”

Performance of fund versus sector and index over 5yrs

Source: FE Analytics

Over the past five years, Patel’s EdenTree Amity UK fund has made a total return of 10.77 per cent, underperforming the FTSE All Share index and the IA UK All Companies sector.

But over 2020 so far, it loss of 14.48 per cent is better than the 17.3 per cent fall in the FTSE All Share and the 16.6 per cent drop from the its average peer.

The fund has an ongoing charges figure (OCF) of 0.79 per cent.