Today’s market could be the best opportunity in decades for investors to pick up value stocks, according to River and Mercantile’s Hugh Sergeant, who says 10 signals are showing that the style could finally start to outperform.

Value stocks have lagged behind the growth style for an extended period of time, as the ultra-loose monetary policy that followed the global financial crisis of 2008 made growth more attractive to investors. For much of the past decade, the bull run has been led by growth stocks with value struggling to make ground.

This situation has continued in 2020’s coronavirus crisis as fresh monetary easing buoyed the growth style. In addition, many of the ‘coronavirus winners’ such as tech stocks are firmly in the growth bucket, while value sectors like materials and oil & gas suffered from plunging demand.

Performance of value vs growth over 10yrs

Source: FE Analytics

But Sergeant, manager of River and Mercantile’s range of UK and global recovery funds, thinks value stocks might surge once the economy starts to recover from the sharp and deep recession caused by the coronavirus lockdown.

“Value will be back. Value nearly always does well in an economic recovery period, especially if that recovery happens at a time when value is relatively attractively priced, which it most definitely is today,” he argued.

“Indeed if you were a person from Mars, and all you had was a deep set of data on factor returns and economic and profit cycles over the last 100 years since proper equity markets began, then if you set yourself 10 key tests on whether now was the time to invest in value, recovery and multi-cap stocks then the answer to all those key tests would be very supportive.”

Those “10 key tests” mentioned by Sergeant are:

1. Are we at the cyclical low point for the relative value of value stocks?2. Are we at the cyclical low point for the relative value of recovery stocks?

3. Have smaller companies underperformed and are lowly valued?

4. Are absolute valuations for value stocks compelling?

5. Is the global economy cyclically depressed?

6. Are corporate profits depressed?

7. Is global economic policy stimulative?

8. Are value stocks unloved?

9. Are value practitioners withdrawing their investments?

10. Is there a catalyst – possible change of economic narrative (reflation)?

The manager added that, in his opinion, the answer to each one of these 10 questions is “yes”. “I believe that now is, at least according to the data, the best time to invest in value, recovery and multi-cap that I have seen in my career,” he said.

However, Sergeant noted that value is continuing to tail growth because so many investors are worried that a second wave of coronavirus and further lockdowns could stifle the nascent economic recovery. This has kept investors focused on growth stocks, for now.

“No-one really believes in the recovery yet thanks to huge fears of the second wave. Monetary policy has, in the short term, boosted what has already worked. The short-term fundamentals of the winners of the last 10 years have looked much better than those of the laggards,” he said.

“Passive and ETF money is also facing in one direction because many value players have been forced out. Everyone is giving up on value and the marginal player has remained a seller. But at some time, the elastic band does become too stretched and the fundamentals of value stocks starts to beat very depressed expectations.”

Barring another mass lockdown, the global economy is expected to start recovering from the coronavirus crisis over the next few quarters. At the same time, the massive amounts of massive monetary and fiscal stimulus will continue to have positive impact, which Sergeant believes will prompt bond yields to bottom out and will cause the current deflationary environment to turn reflationary.

This is important, as value stocks have historically outperformed in the early stages of an economic recovery and in inflationary environments.

“Growth and quality stocks’ relative fundamentals will peak as more cyclical value stocks start to see profits recover. Brought-forward digital spending will struggle to preserve the momentum embedded in many growth and quality stock share prices. And finally, liquidity and passive investing may change direction as momentum shifts from deflation to reflation beneficiaries,” Sergeant finished.

“Meanwhile asset pricing, such as negative bond yields, has deeply embedded deflation expectations, at a time when economies are recovering, and record levels of monetary and fiscal stimulus have been committed by central banks and governments.

“The post coronavirus crisis period of austerity has been replaced by a far more reflationary mix of policies – surely it is therefore a possibility that the narrative changes direction, from deflation to reflation.”

Of course, the debate over when – and if – value will start to outperform growth has been running for several years. Some have argued that the drivers of the growth bull market, such as interest rates at record lows and the global economy’s reliance on tech, look likely to remain in place for some time to come.

But there are signs that value, which tends to outperform in short but significant bursts, could be on the brink of returning to favour.

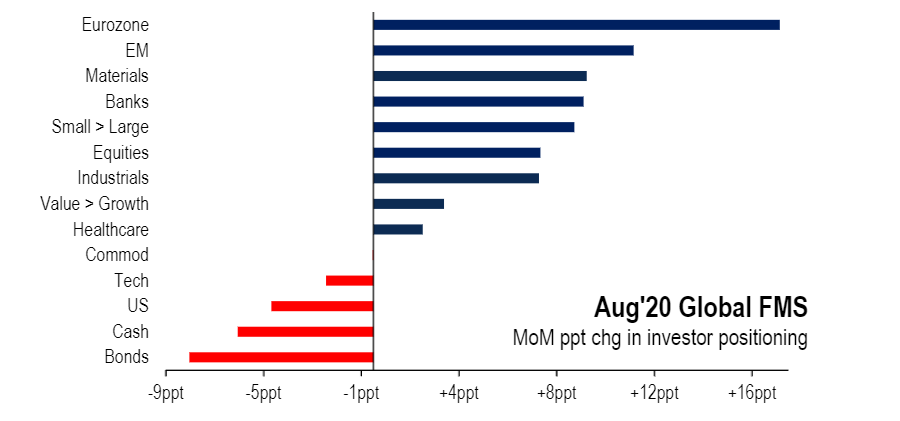

Source: BofA Global Fund Manager Survey - Aug 2020

The August edition of the closely watched Bank of America Global Fund Manager Survey suggests the “start of rotation to inflation”. This month has “green shoots” for inflation asst such as value stocks as well as banks, materials and European equities, as shown in the chart above.

Lars Kreckel, global equity strategist at Legal & General Investment Management, recently argued that value stocks could be facing a “now or never moment” after being “terrible relative performers” since 2006.

He suggested that macro backdrop for value is likely to look more favourable in the coming months than it has in many years as the global economy starts to recover.

“An arguably even more important and more durable factor is that we are likely to soon enter the part of the economic cycle that has typically delivered the best risk-adjusted returns for value: early cycle. Mapping equity returns to the stages of economic cycles suggests that value has delivered its best risk-adjusted returns during the first part of expansions,” Kreckel said.

“A word of caution, though. If the market and economy have much further to fall, then it’s too early for value and the lack of outperformance during the recovery makes sense because it was only a bear-market rally. And even if the cyclical outlook for value improves, we expect the structural headwinds of a low-growth, low-inflation and low-bond yield environment over the medium term to remain.

“As a result, we see potential opportunities in value stocks as more tactical than structural.”