The opening eight months of the year saw environmental, social & governance (ESG) funds outpace their conventional rivals by as much as 20 percentage points, according to research by Trustnet.

While the coronavirus crisis has sparked turmoil in financial markets, with stocks plunging as the pandemic took hold only to rally strongly on the back of massive stimulus packages, one trend that has been clear has been the outperformance of ESG.

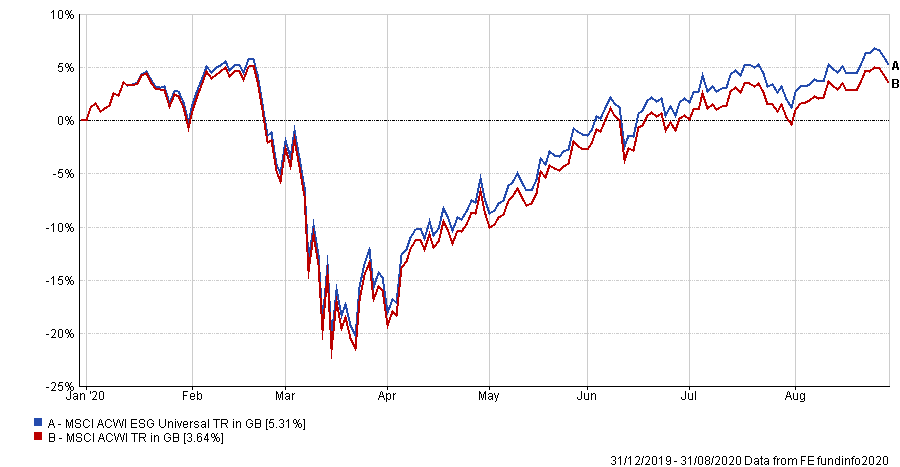

FE Analytics shows the MSCI ACWI ESG Universal index, which is made up of global stocks that have a “robust” EGS profile and a positive trend in improving that profile, made a total return of 5.31 per cent between the start of 2020 and the end of August.

The wider MSCI AC World index, on the other hand, was up just 3.64 per cent.

Performance of indices over 2020

Source: FE Analytics

Many investors believe that ESG is another growing trend that has been accelerated by the coronavirus crisis, along with the likes of e-commerce, working from home and automation.

Andrew Howard, global head of sustainable investment at Schroders, said: “If they ever did, financial markets no longer exist in isolation from social or environmental challenges. Companies’ fortunes are intrinsically tied to their ability to navigate changes in the societies on which they rely.

“We have long argued that companies don’t operate in a vacuum. Their success reflects their ability to adapt to challenges and trends in the societies to which they belong. That is more true now than ever; social and environmental challenges, and investment drivers, are increasingly overlapping.

“As a result, environmental and social problems are increasingly clear financial risks, moving up corporate agendas to drive long-term strategy and growth plans. As investors, our ability to examine companies and separate winners from losers has improved as corporate sustainability reporting has become mainstream.”

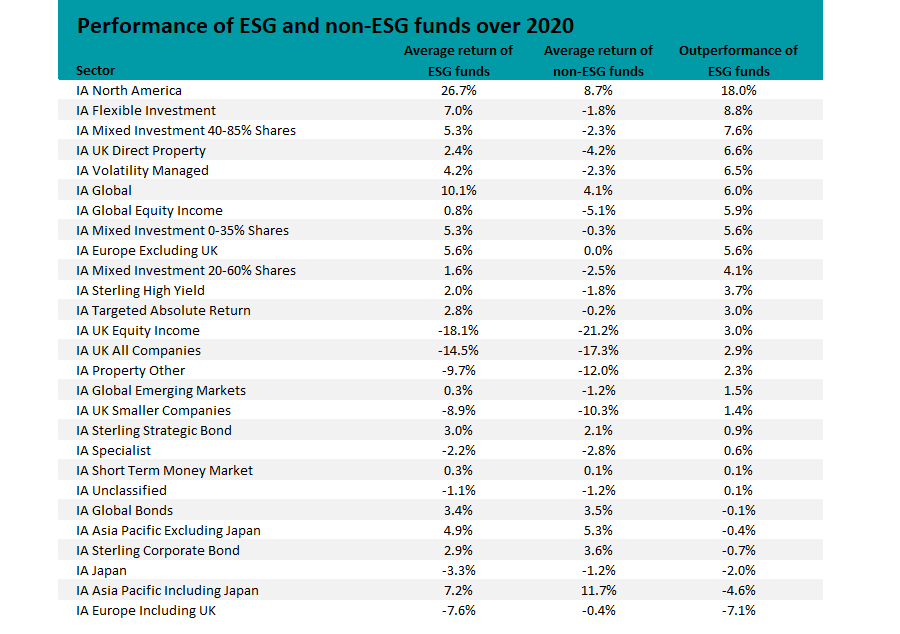

A closer look at the performance of ESG funds versus their conventional peers reveals much stronger outperformance than we saw at the index level.

The table below shows the return of the average ESG fund and average conventional fund in each of the Investment Association sectors, ranked by the level of outperformance. Some sectors are missing, but that is because they are not home to any ESG strategies.

Source: FE Analytics

As can be seen, the gap between ESG and non-ESG funds is strongest in the IA North America sector, where it is close to 20 percentage points. However, this is down to the performance of one fund. Brown Advisory US Sustainable Growth has made 26.73 per cent over 2020 so far, putting it in the top quartile of the peer group.

That said, there are 15 US equity funds that have made higher total returns, led by Baillie Gifford American – which is up 83.32 per cent this year. Two other funds are up by more than 50 per cent: Morg Stnly US Growth (79.52 per cent) and Morg Stnly US Advantage (54.18 per cent).

The most interesting sector to look at is IA Global, as this peer group is home to the most ESG strategies.

Recent research by global funds network Calastone suggested that inflows into global funds are being driven by ESG. Over the last year, one-third of the money going into global funds has ended up in those focused on ESG investing, on the back of strong performance and “a huge marketing push” by the fund management industry.

Over the first eight months of 2020, the average ESG fund in the IA Global sector made a 10.10 per cent total return. Their conventional peers averaged a total return of 4.09 per cent.

The best performing member of the sector is Baillie Gifford Long Term Global Growth Investment, which does not take an ESG approach and is up by 70.45 per cent in 2020.

However, in second and third place are stablemates Baillie Gifford Positive Change (up 54 per cent) and Baillie Gifford Global Stewardship (up 49.5 per cent), which both have put ESG at the heart of the processes.

Other ESG funds in the top quartile of the IA Global sector include Guinness Sustainable Energy, Kames Global Sustainable Equity, Morgan Stanley Global Sustain, Pictet Clean Energy, Liontrust Sustainable Future Global Growth, Janus Henderson Global Sustainable Equity, Rathbone Global Sustainability and Montanaro Better World.

Of the 50 ESG funds in the peer group, 20 have made first-quartile returns over 2020 so far while another 15 are in the second quartile. Just six are bottom-quartile.

Closer to home, the 19 ESG funds in the IA UK All Companies sector have outperformed their conventional rivals this year with an average loss of 14.45 per cent. Non-ESG funds in this peer group have dropped by an average of 17.30 per cent.

Outperforming ESG funds here include Royal London Sustainable Leaders Trust (down 1.82 per cent), Ninety One UK Sustainable Equity (down 4.91 per cent) and Liontrust Sustainable Future UK Growth (9.10 per cent).

There’s a similar level of outperformance from the ESG funds in the IA UK Equity Income sector, although their losses have been higher because of the widespread dividend cuts in the UK market.

Not every sector has witnessed the outperformance of ESG strategies this year, however, with IA Europe Including UK, IA Japan and IA Sterling Corporate Bond being among those where an investor would have been better-off in the average non-ESG fund.

But many expect the trends that the coronavirus crisis has brought into the spotlight will remain in place after the outbreak is over, with ESG investing being among them.

Schroders’ Howard argued that a number of social and environmental pressures will “reach boiling points” in the next decade. These include the effect of climate change on the global economy, technological advances reshaping the role of workers and the impact of social unrest on political and economic stability.

“Any of these trends alone will have a major impact on economies and industries. Together they represent a cocktail that could reshape stock markets and redefine the investment industry,” he finished.

“Understanding those trends and aligning investments to them will be vital. We believe that sustainable investment is becoming a requirement, not a choice.”