A sharp increase in the number of new coronavirus cases in Europe and the US has given way to fears of a second wave and highlighted the importance of a vaccine if the global economy is to return to growth.

But while a vaccine may help boost the economy, it may not lift all types of stocks by the same amount, according to analysts at bank Goldman Sachs.

Although death rates have remained much lower than earlier in the year – reflecting more testing, a lower average age of infected and better treatments – it has prompted governments to pause plans to reopen economies.

“The rise in global confirmed case growth suggests that sustained virus control and economic recovery will remain challenging until a vaccine becomes widely available,” said the bank’s analysts.

Yet, the outlook for the vaccine seems promising, with the World Health Organisation tracking more than 169 Covid-19 vaccines in development, with 26 already in human trial phase.

“While highly uncertain, our economists expect that the FDA [Food and Drug Administration] will approve at least one vaccine this year and that large shares of the US and European populations will be vaccinated by the end of Q2-2021 and Q3-2021, respectively,” the bank noted.

According to the bank, a vaccine would boost US growth by 3 per cent and Europe by 2 per cent. However, the later a vaccine becomes available, they said, the smaller its growth impact, due to scarring effects and improving virus control through new testing and treatments.

And, once a vaccine is found, it could signal a change in market leadership, according to the bank.

“While there may be less potential for strong index-level returns from here, we think there is still potential for a material rotation below the market surface,” said its analysts.

“If the market is really pricing an early vaccine and a quick recovery, then we believe it is pricing it in the wrong slices of the market.

“Indeed, with an early vaccine, we would expect some reversal of the trades that worked well during the ‘coronacrisis’, but the companies that have done well year-to-date are still holding up well relative to the market.”

Value and cyclical stocks should outperform growth and defensive names, the bank claimed, with energy, consumer discretionary and financials likely to benefit over healthcare, consumer staples and technology stocks.

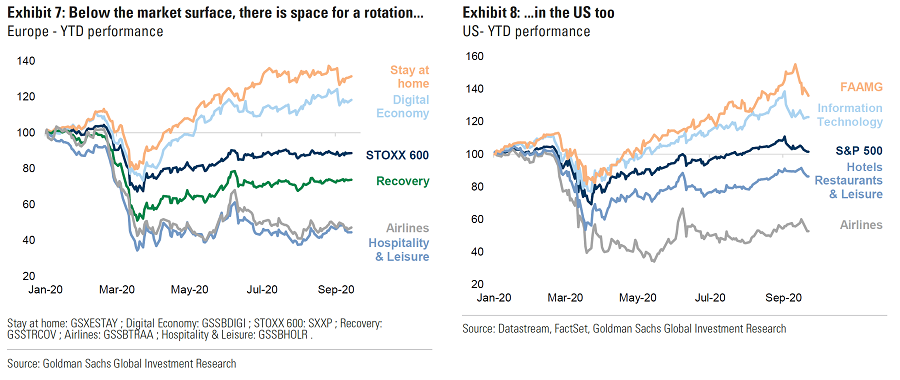

Both in Europe and the US, ‘digital economy’ and ‘stay at home’ stocks have continued to perform strongly, while heavily hit sectors such as airlines and hospitality & leisure have not recovered.

While investors might expect that a vaccine would be an absolute positive for the entire economy, the bank found that both ‘digital economy’ and ‘stay at home’ stocks were negatively correlated to the prospect of a vaccine.

“In other words, the latter could experience negative returns on positive vaccine news – on top of underperforming the rest of the market,” they said.

In the event of a vaccine, the bank found, value and cyclical stocks should outperform growth and defensive names: with energy, consumer discretionary and financials likely to benefit over healthcare, consumer staples and technology stocks.

“Indeed, a medical solution will accelerate the path to economic normalisation, which we believe will lift the earnings and prices of the most cyclical slices of the market,” they said.

“This potential improvement in economic growth should boost inflation and increase longer-term rates.”

In addition, the bank said, it would penalise growth stocks, which are longer-duration assets, with investors paying for strong future cash flows.

Value stocks, meanwhile, have the shortest duration and should outperform as the discount rate – the rate used to discount companies’ future cash flows – rises.

Nevertheless, because value and cyclical stocks have become much smaller parts of the index as growthier elements have soared, the overall impact on the market will likely be limited.

“In Europe, the technology sector has grown bigger than the oil sector and is the same size as the bank sector, and healthcare is almost one-fifth of the index,” they explained.

“Therefore, a rebound of the laggards will provide less of a boost to the headline index but more a rotation below the market surface.”

Yet, the bank was quick to note that while value and cyclical stocks could rebound sharply on positive vaccine news, it does not detract from the long-term structural drivers in markets.

“In the medium/long term we remain positive on the growth slices of the markets such as ‘digital economy’ or renewables,” the Goldman Sachs analysts concluded.

“Even though these baskets are trading on a premium, we think their growth is still supported by long-term structural changes. Moreover, their growth is particularly attractive given the scarcity of ‘growth companies’ nowadays.

They concluded: “We believe they will continue to benefit from the lower (for longer) global bond yields given their long duration.”