If China continues to grow at its high pace and its tech giants become even bigger, it could turn into a problem for the emerging markets index, according to River and Mercantile’s Al Bryant.

Global funds are free to invest across a range of geographies, but have typically invested predominantly in developed markets like the US and Europe. But as Chinese tech giants become larger portions of the global index, more global funds are adding to their Chinese equity exposure.

Some of the top performing global funds from the likes of Baillie Gifford, Morgan Stanley and GAM investments have material exposure to well-known Chinese firms like Alibaba, Tencent and Meituan-Dianping.

Indeed, global investment giant BlackRock has gone so far as to label the country “an investment destination separate from emerging markets”.

China has long been regarded the growth engine of the world. It is seen as a global superpower and has the second highest GDP after the US. It also boasts the second highest number of billionaires.

With its rapid recovery from the coronavirus pandemic and growing interest of investors towards investing in Chinese technology companies, why do investment managers still have to technically treat the world’s second largest economy like a developing nation?

Al Bryant, who is head of emerging markets at River and Mercantile, said that ultimately the reason why China still sits in emerging markets is go back to what the IMF and World Bank say about standards of living.

The World Bank assesses whether a country is high-income or ‘developed’ by a looking a threshold for gross national income (GNI) per capita, which was $12,535 as of last year. China's latest GNI per capita figure stands at $10,410, which puts it below the threshold.

“China is not there yet,” Bryant said. “As much progress as they've made, it's still by those standards an emerging market. However, Korea actually is above that threshold but it's still in the emerging index, so they're sort of playing both sides of it.”

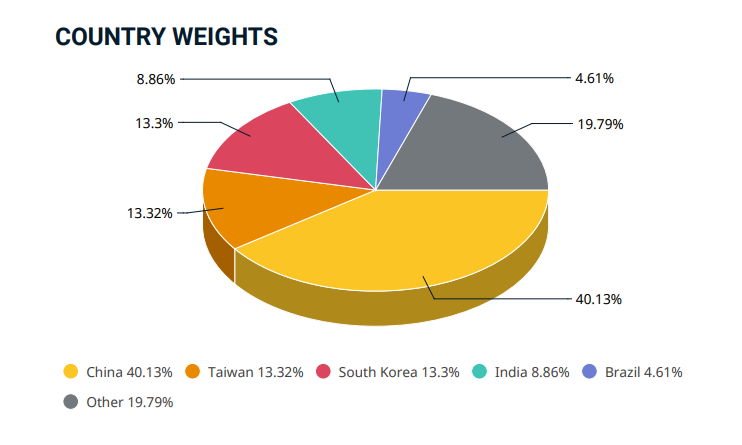

China currently makes up over 40 per cent of the MSCI Emerging Markets index. China, Taiwan and Korea together account for around two-thirds of the index.

“If the index composition of China continues to progress at the same pace that GDP premiums persist, at a certain point it's just going to become an absurd construct for an index,” Bryant said.

MSCI Emerging Markets Index Weights

Source: FE Analytics

In the past, investors were focused on BRICs - the common moniker given to four major emerging markets: Brazil, Russia, India and China.

Bryant said that now investors are all more focused on China: “There is certainly some connectivity between all these markets, but the drumbeat is increasingly all coming back to China.

“If I squint into the future, I can see the active management world moving towards almost a cleaving of US exposure in portfolios - thinking about that discreetly - and then thinking about China exposure, and then thinking about rest of the world.

“The way that the global economy is moving, the stock markets are being dominated by these digital champions and they are, whether we like it or not, domiciled in the US and domiciled in China. As long as rates remain where they are, those are going to be the 1,000lb gorillas in the index.

“I think the most important decision - whether it's a global portfolio or an emerging markets portfolio - is going to be what side are you on for these 1,000lb gorillas?”

Bryant, who has been investing in Asian markets since 2007, recalled how in the past investors who wanted to invest in Asia were hesitant to invest in China.

“Now we have, ‘I don't have enough China or China's too big and too diverse, and so I need multiple avenues to get in’. I think that the problem is that there's limited space in everybody's portfolio,” he said.

“It's a complex region, you’ve got over 22 countries, you've got 4,000 plus companies in that and a lot of different sectors, and the composition of the sectors has changed quite a bit. In the last 10 years, it's gone from being a very cyclical index to a very digital index, and that's primarily thanks to China, a little bit to Korea and to Taiwan as well.”

However, because of the ‘Great Firewall’ that regulates the Chinese domestic internet, the digital champions of China don't have the same capacity to go serve the rest of the emerging world.

This is why there is an uprising of more ‘digital champions’ in each of the other emerging markets. South Korea has Auction, Taiwan has Momo, India has a Facebook-Jio alliance, Latin America has Mercado Libre and there’s a whole host of similar companies emerging in EMEA.

“However, I think a lot of those markets are also somewhat served by the Amazons, Netflix and Googles of the world, so its circular,” Bryant said.

“But if you don't have a manager who can go around those 20 plus different countries and identify those opportunities, you're missing out on that as well.

“So I think it's really a case of buyer beware and don't replicate, because it'll be very easy to replicate, but at the same time you also can leave a giant hole in your portfolio if you don't have somebody trying to fill that space.”

Performance of MSCI China versus rest of world over 2 years

Source: FE Analytics