As value stocks continue to rally and growth stocks extend their decline, managers of several value investment trusts reveal what stocks they favour in what could be a moment of truth for the value investment style.

Growth stocks have been outpacing the value style for much of the last decade, but the ever-widening divergence between growth and value could be finally reverting to the mean.

Rising risks of inflation is one of the major drivers of a broader rotation from growth stocks into value stocks, according to some managers.

James de Uphaugh, manager of the £1bn Edinburgh Investment Trust, explained: “A global risk we are concerned about is that the economy accelerates so strongly in late 2021 that it puts upward pressure on inflation and bond yields forcing central bankers’ hands.

“Then, just as declining bond yields were so important in powering stocks in 2020, the reverse could happen, as policymakers cut back on liquidity. This would put pressure on equity valuations.”

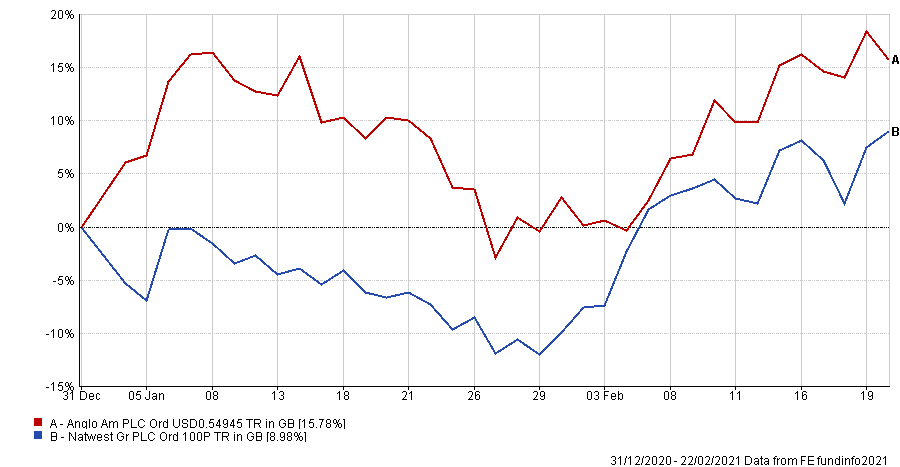

This view on inflation is why Edinburgh Investment Trust holds banks such as NatWest and commodity firms like Anglo American.

Share price performance of NatWest and Anglo American year-to-date

Source: FE Analytics

Anglo American is pivoting its businesses towards commodities such as copper, which de Uphaugh highlighted as “crucial for the electrification necessary if the world is to achieve environmentally sustainable growth”.

The trust has also supported equity raises in the likes of Polypipe, a manufacturer of plastic piping systems needed for underfloor heating and energy-efficient ventilation. De Uphaugh said Polypipe sits within “the sweet spot of sustainability”.

Alasdair McKinnon, manager of the £558m Scottish Investment Trust, is also placing emphasis on stocks that can pass on price raises due to inflation.

“Even better, these ‘value’ stocks are severely out of favour,” he said. “Banks (Santander, Lloyds), energy (BP, Shell) and miners could all be beneficiaries of this.

“We have also added to some of the most impacted industries like the high street, where we find some restaurants and clothing retailers with good brands and balance sheets that we think will allow them to re-emerge from the pandemic as long-term winners.”

Scottish Investment Trust’s largest two holdings, however, are in gold miners Newmont and Barrick Gold. “You can’t print gold and we expect its value to increase in line with the ballooning money supply,” McKinnon said.

Alex Wright, manager of the £720m Fidelity Special Values trust, pointed out that although the rotation into value started in late 2020, the dispersion in returns between growth and value stocks still remains unprecedented.

“We are particularly optimistic on the medium-term outlook not only due to the number of investment opportunities on offer and their upside potential, but also because we are not having to compromise on quality,” he said.

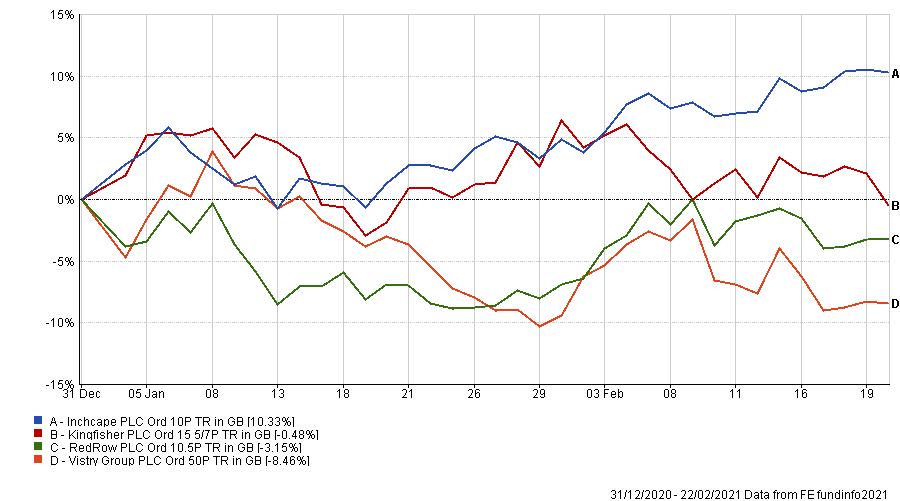

As such, the trust has significantly increased its exposure to specialist retailers (Halfords), car distributors (Inchcape), DIY stocks (Kingfisher) as well as housebuilders (Redrow and Vistry).

Share price performance of Inchcape, Kingfisher, Redrow and Vistry year-to-date

Source: FE Analytics

“These are all areas that are seeing increased demand as households reassess their priorities and, importantly, where we believe the changing dynamics caused by the virus are likely to be longer lasting than currently factored in,” Wright explained.

“We continue to favour life insurers, which are well regulated companies with good risk management and which are seeing strong demand for bulk annuities and pension de-risking.”

Fidelity Special Values’ two largest holdings are a 5.5 per cent stake in Legal & General and a 4.5 per cent stake in Aviva. Wright continued: “The sector offers an attractive combination of cheap valuations, strong demand/supply fundamentals and growing earnings.”

Elsewhere in the broader financial sector he is less optimistic. The trust holds an underweight stake in mainstream banks: “While cheap, they lack a medium-term catalyst to re-rate given the low interest rate environment,” Wright said.

“Instead, we have bought into UK-listed emerging market financials Bank of Georgia, TBC Bank and Kaspi, which are able to generate strong returns in the current interest rate environment but have been overlooked or lumped in with the mainstream banks.”

Wright is also underweight energy having sold down his exposure to UK oil majors Shell and BP, which have cut their dividends and are embarking on a “complex” and “high-risk” transition towards a more diverse energy mix.

Gary Moglione, manager of the £64m Seneca Global Income and Growth Trust, also revealed one stock that he thinks will do well in a value rally: UK Mortgages (UKML).

“UKML had a difficult start after launch as market conditions meant they did not invest the initial capital very quickly which led to an uncovered dividend and a declining NAV,” he said.

“They took a new strategic direction last year and are now focusing on the higher yielding mortgage books whilst selling the lower yielding.

“They essentially buy or initiate mortgages and when the number of loans reaches a reasonable size they will securitise them, locking in returns and freeing up capital to initiate more mortgages.”

A second value play Moglione highlighted was Ediston Property Investment Company (EPIC), which focuses on out-of-town retail parks.

He said: “The property market has been ravaged by Covid as many retailers struggle and some use company voluntary arrangements to force landlords to accept lower rents.”