The UK currently offers “exceptional” value, sitting at its biggest discount to world equity indices in the last 30 years, according to Philip Matthews, manager of the TB Wise Multi-Asset Income fund.

The UK has been one of the worst-performing major developed markets this year. Whereas the S&P 500, Topix and MSCI Europe have already rebounded past their starting valuations (in sterling terms) for 2020, the FTSE All Share is still down by more than 10 per cent, hampered by its large exposure to cyclical sectors such as financials and oil & gas, as well as continued uncertainty over Brexit.

Performance of indices in 2020

Source: FE Analytics

Yet Matthews said that rather than get depressed about the lowly performance of the domestic market, investors should view it as a buying opportunity.

“The UK equity market currently sits at its biggest valuation discount to world equity indices in the last 30 years,” he noted.

“The discount is now nearly twice as wide as in previous troughs. Within the UK market, investors need to go back to the early 1980s to see similar valuation discounts being applied to value stocks.

“Moreover, the premium being paid for defensive stocks over cyclical stocks is as wide as it was during the financial crisis.

“Despite the uncertainty over how the Covid-19 crisis and Brexit negotiations will unfold, we believe this valuation backdrop provides an exceptional foundation upon which to build a value-based investment portfolio.”

Matthews focuses heavily on balance sheet strength, which led him to ditch many of his holdings that had most to lose from a prolonged Covid-19 related lockdown.

Yet despite this caution, he pointed out valuations across a number of more domestically exposed sectors, such as banks and housebuilding, have fallen to such an extent that, if they were to return to the depressed levels they reached immediately after the 2016 Brexit vote, their share prices would actually rise. This is despite negative downgrades to earnings forecasts due to Covid-19.

“The recent contrast between the disappointing share price performance in some of our holdings and the positive trading statements being made by these very same companies is frustrating,” he continued.

“However, we expect this to quickly reverse on the back of any stabilisation or improvement in the current depressing macro news flow and a return of economic confidence. Any positive developments with regards to a breakthrough in Brexit negotiations could provide the necessary catalyst.

“In many regards, the current market sentiment mirrors that of the end of August 2018 when gloom around a hard Brexit was pervasive and global growth had hit a cyclical air-pocket.

“Cheap valuations coupled with a change in outlook saw a sharp period of outperformance for value investors. Moreover, increasing positive statements around dividends mean investors are getting paid while they wait for a capital uplift.”

To illustrate his point about valuations, he cited the example of Aviva. The insurer has decided to focus on the three countries (UK, Ireland and Canada) in which it is dominant, so sold its Singapore division – at a price far above what the market currently values the entire group.

And there is good news coming from other financial holdings, too. For example, insurer Chesnara increased its “already generous dividend” by 3 per cent and said it expects the current market to be a fertile hunting ground for acquisitions. Stockbroker Numis Securities makes money when its client companies issue new shares and so has done well from the uncertainty of the last few months.

“Another insurer, Randall & Quilter Investment Holdings, continues to trade robustly and acquire new business streams at bargain prices,” Matthews continued.

“All the above are in a deeply unloved sector. The market has treated all these companies as if they would be lucky to survive the current crisis, but their trading updates tell a very different story.”

To take advantage of the UK value opportunity, the manager has recently added Temple Bar Investment Trust, Aberforth Smaller Companies Trust, Polar Capital Global Financials Trust and Standard Life Investments Property Income Trust to his portfolio.

He said all of these provide exposure to existing value themes within the portfolio at substantial discounts to their underlying asset values, while their investment trust structure allows them to maintain dividend payments. They were funded by reductions in similar direct investments where he had less confidence dividends would return.

But if investors’ money does come flooding back into the UK, where is it going to come from? Here Matthews made another contrarian call.

“Sell-side analysts are growing increasingly concerned about tech,” he said. “JP Morgan recently told clients that although tech stocks are likely to deliver robust earnings in Q4 2020, this could be the high watermark for tech earnings versus other sectors.

“The portents are looking, perhaps for the first time, ominous. In September, the uninterrupted upward performance of tech stocks showed the first signs of cracking – at the start of September, Tesla notably fell 21 per cent in one day and the Nasdaq fell 5.1 per cent over the month.

“While longer-term shifts to a more virtual world are inevitable, there is a gathering sense gravity might catch up with valuations.

“While we recognise the attraction of companies exposed to growth end markets, we maintain a valuation discipline to our process.”

The manager said this is why his portfolio has a bias to UK equities with a greater sensitivity to either Covid-19 disruption or the resolution of Brexit negotiations.

“More volatility lies ahead,” he added, “but this exceptional window of opportunity will not stay open forever.”

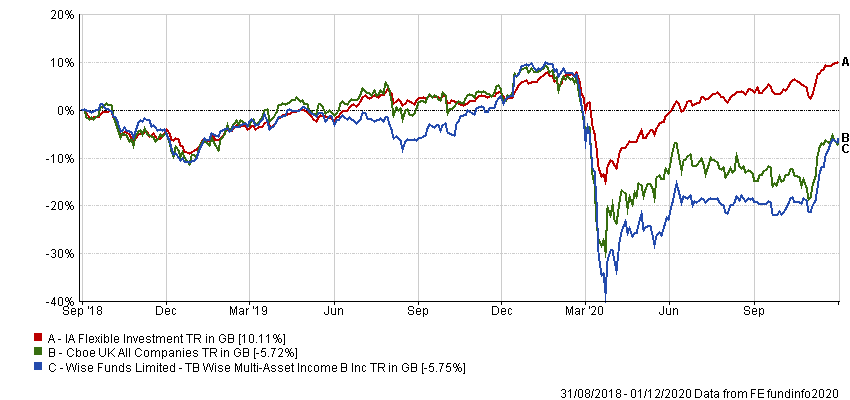

Data from FE Analytics shows TB Wise Multi-Asset Income is down 5.75 per cent since Matthews joined in August 2018, compared with gains of 10.11 per cent from the IA Flexible Investment sector and losses of 5.72 per cent from its CBOE UK All Companies benchmark.

Performance of fund vs sector and benchmark under manager

Source: FE Analytics

The £77m fund has ongoing charges of 0.88 per cent and is yielding 3.9 per cent.