Income investors focusing solely on the UK market could be left behind in the coming decade and would miss out on the highest-paying region, research by Trustnet has found.

The UK has been a stalwart of income investing for years, with several well-known and high-paying dividend companies such as Shell, BT and Rolls Royce, dominating the market.

Indeed, at present the UK has the highest current dividend yield versus other markets such as the US, Japan, Europe ex UK, emerging markets and the wider global market.

Source: Hargreaves Lansdown

But when taking the dividend growth rate into consideration Trustnet found that the UK may not be the best option over 10 years.

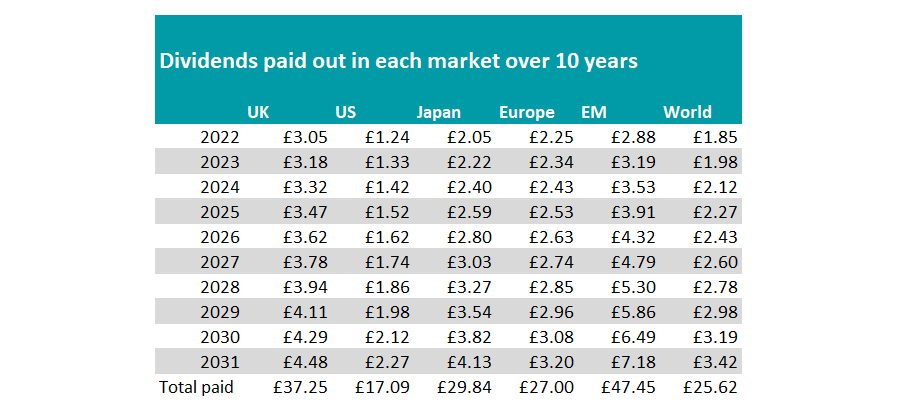

Using data provided by Hargreaves Lansdown, we calculated the average 10-year dividend growth rate for each of the six regions over the past decade.

Over the past decade, the emerging markets has had the highest dividend growth of 10.7%, while Japan is in second with a rate of 8.1%. Global dividends have grown by 7% per annum, as have US dividends. Despite higher initial yields, the UK (4.4%) and Europe (4%) have grown much slower.

Using this, we then extrapolated it into the future to forecast how much investors would be paid over the next 10 years. Past performance, however, is not a guarantee of future returns.

If each dividends continued to grow at the same rate for the next decade, by 2032 investors would have made more from the emerging markets.

Based on an initial £100 investment, those invested in the emerging markets would make £47.45 in dividends over the 10 years. The UK would follow behind at £37.25, with Japan bringing in £29.84, Europe ex UK at £27, Global at £25.62 and the US with £17.09.

Source: Trustnet

Emma Wall, head of investment analysts and research at Hargreaves Lansdown, said it used to be the case that the UK was the only fish in the pond for dividends, but now income-seeking investors are “casting their nets across the globe” in a bid to diversify their sources of yield.

Baillie Gifford Global Income Growth fund manager Toby Ross, agreed, noting that the bias towards UK income options versus global was “undeniable”, with almost three times as much invested in the former, but said it could be detrimental to investors long-term.

“It truly baffles me the amount of income investors still investing in funds which limit themselves to just the UK,” Ross said, as they miss out on the “richer” opportunities elsewhere.

“Within the UK, too many investors are focused too much on short term yield when they should be looking at long term income. It’s not about what the yield is going to be this year or even today, but where is the best dividend going to be coming from in five or 10 years time,” Ross said.

UK dividends were hit by the hard by the pandemic as companies cancelled, cut or suspended their payouts in an effort to conserve cash, forcing investors to look elsewhere.

Companies in emerging markets however had relatively lower debt – in some regions – and were able to manage the lack of revenue more easily and maintain dividends.

But it has not been a go-to destination for income-seeking investors, mainly due to the increased volatility in the market and the fact that it is less widely covered by analysts, especially outside of the large-cap space.

But Ken Leech, chief investment officer at Western Asset, said that the market is worthy of some attention, as the data indicates. The CIO said, that the emerging markets were “awash with yield” and were a great opportunity for investors.

Leech said: “It is still the only sector that has a greater opportunity compared to pre-Covid and therefore a greater opportunity relative to the other sectors, in a big way.”

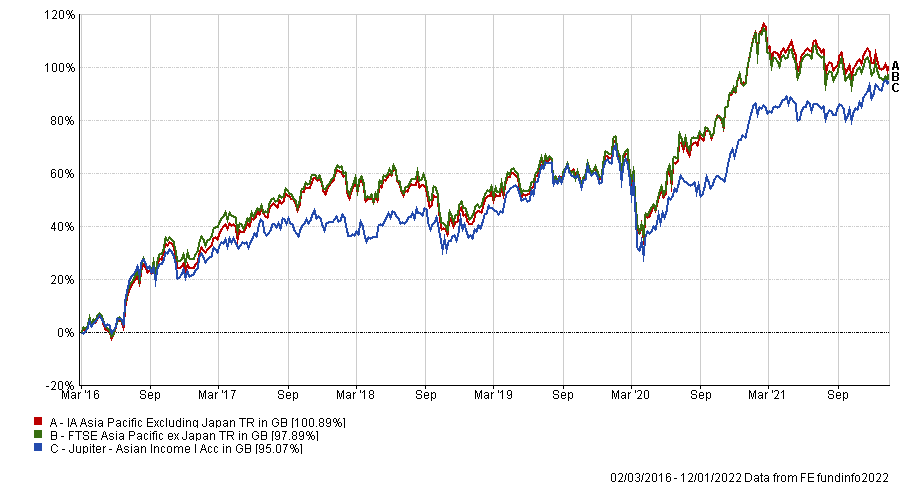

Examining the emerging market income funds on offer, Wall highlighted the Jupiter Asian Income fund, which she said had an “experienced and talented manager” in Jason Pidcock and would act as a “good diversifier” for any income portfolio.

Pidcock applies a relatively cautious approach as a way to manage the more volatile market he invests in, holding companies where dividends are a central element to a company’s ethos and are led by strong management teams.

Since Pidcock launched the fund in 2016 it has slightly underperormed both the IA Asia Pacific Excluding Japan sector (100.9%) and the FTSE Asia Pacific ex Japan benchmark (97.9%), returning 95.1%.

Performance of fund vs sector and index since launch

Source: FE Analytics

However, it made the sector’s eleventh best returns (11.6%) in 2021, thanks to its significant underweight to China. It has a dividend yield of 3.6%.

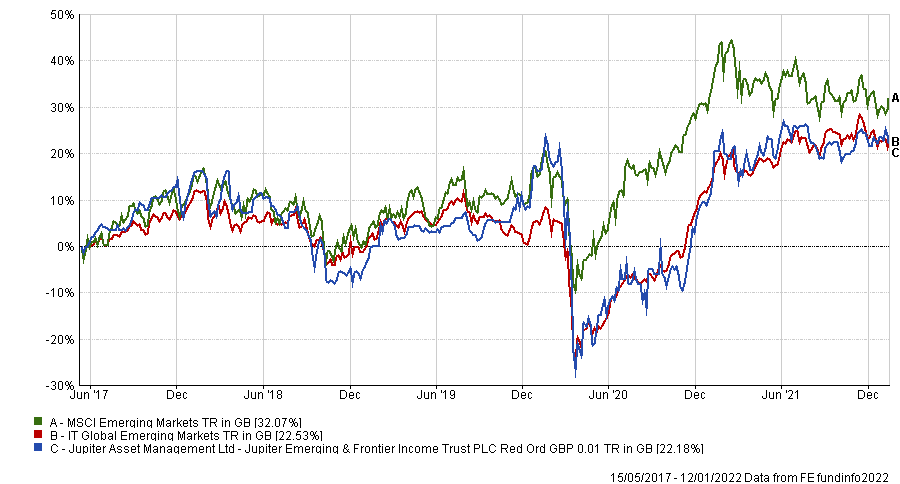

Another option is the Jupiter Emerging and Frontier Income, which offers the highest yield in the IT Global Emerging Markets sector at 4.4%.

James Carthew, head of investment companies at QuotedData, said that the fund’s lead manager, Ross Teverson, is confident about the outlook for several niche emerging markets post Covid, including Mexico, emerging Europe, large parts of Africa, and Pakistan.

“Many of those areas would not feature much in most emerging markets portfolios but find a place in a true stock picking fund like this one,” he said. The analyst also picked the trust as his income pick for 2022, backing it as a strong option for the coming year, especially if sentiment towards emerging markets takes a positive turn.

Performance of trust vs sector and index since launch

Source: FE Analytics

The trust has also fallen just short of the sector and benchmark’s returns, making 22.2% since it launched in 2017.