Threadneedle UK Equity Income, Jupiter Emerging and Frontier Income and JPMorgan Mid Cap are just some of the buy options experts picked for income investing in 2022.

The past two years have been intense for income markets with 2020’s lockdowns causing a widespread cancellation of dividend payouts as companies tried to manage the ramifications of the pandemic, while 2021 was a year of recovery, with dividends restarting as global economies reopened.

This year the Janus Henderson Global Dividend Index Report, which is a long-term study of global dividend trends, found that dividends jumped by a record 22% on an underlying basis this year, reaching an all-time high of $403.5bn (£303bn) in the third quarter.

It also found that 90% of companies either raised or held their dividends steady, which Janus Henderson called a “very strong reading”. These were all signs of a strong recovery in the income market.

Turning to the UK, the Link Dividend Monitor – which just looks at the domestic income market – reported “soaring” dividends in this year’s third quarter, recovering 89.2% on a headline basis year-on-year.

Combined these reports paint a very positive outlook for income in 2022, as Janus Henderson analysts said that global dividends should be fully recovered from Covid by the end of this year.

Below, fund pickers highlight five income options for dividend-hungry investors.

JOHCM UK Equity Income

First up is the £2bn JOHCM UK Equity Income, which Sam Buckingham, investment analyst at Kingswood Group, said not only provided an “attractive” level of income but was a portfolio he had “optimistic” capital growth expectations for.

“We believe this fund should provide some protection on the downside, but also has the potential for above-average returns on the upside,” he said.

The fund has a contrarian investment approach, focusing on companies’ yields that must be higher than that of the FTSE All Share Index. This latter point is central to managers, James Lowen and Clive Beagles’, process, as they will sell any stocks that yield the same as the market.

This has served them well long-term, with the fund making 150.3% over 10 years, the 14th-best returns in the IA UK Equity Income sector, where the average return was 114.5%.

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

Threadneedle UK Equity Income

Sticking with the UK, Adrian Lowcock, an independent commentator, picked the Threadneedle UK Equity Income.

While the outlook for income next year is positive, Lowcock pointed out that there are potentially still a lot of headwinds and the economic impacts of the pandemic are still coming through.

As such Lowcock recommended putting your income investment into a safe and “experienced set of hands”, like Richard Colwell and his £4bn Threadneedle UK Equity Income fund.

Lowcock said Colwell’s “pragmatic approach” combined with a “flexible mandate” made it ideal for weathering potential unknown challenges in 2022.

The manager invest in companies with strong cash generation that are out of favour with the market, creating what Lowcock called a “balanced portfolio”. Although Colwell prefers less popular stocks he pays a lot of attention to fundamentals, ensuring he does not end up with sub-par names.

It has consistently ranked in the top-quartile over three, five and 10 years, generating a total return of 154.2% during the latter.

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

JPMorgan Mid Cap

A third UK income option was JPMorgan Mid Cap investment trust, which Jason Hollands, managing director of Bestinvest, said was a good, discounted option for gaining exposure the UK market.

Hollands said he preferred the UK for income currently because it was “cheaper” compared to its developed market peers and offered a “hefty yield premium over bonds”.

The trust is currently on a 9.4% discount and has a significant exposure to consumer cyclicals and industrials.

It is co-run by Georgina Brittain and Ketan Patel and over 10 years has made 366.6% total returns, the ninth-highest in the IT UK All Companies sector during that time. The sector average for the same time period was 162.8% and the benchmark’s return were 195.9%.

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

Jupiter Emerging & Frontier Income

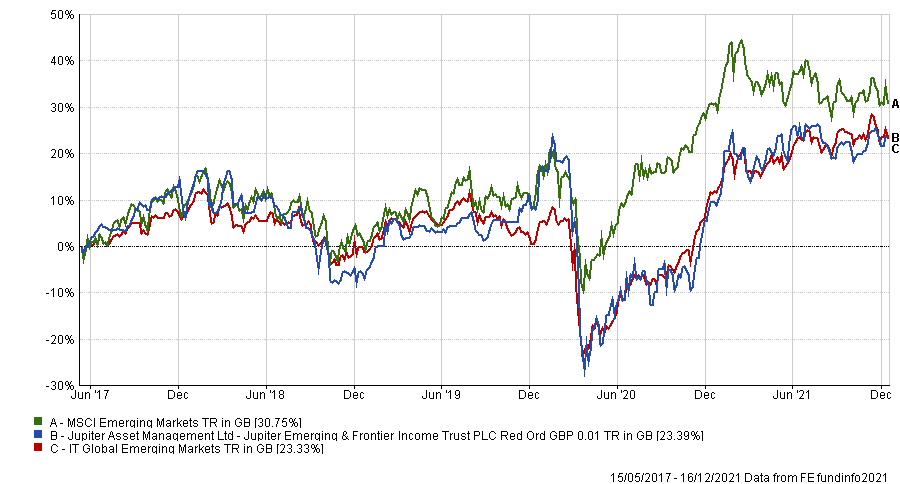

For those investors not wanting to invest in the UK, James Carthew, head of investment companies QuotedData, picked the Jupiter Emerging & Frontier Income trust, as an “adventurous pick”.

The trust is not for the faint-hearted, investing in a more volatile region, and has relatively high volatility versus its MSCI Emerging Markets benchmark (25.5% versus 14.1%).

But Carthew said if sentiment towards the emerging market sector changes for the better in 2022 “the trust could do well”.

It is currently on a 7.9% discount and has a 4.4% yield. Over 10 years it generated middling total returns (23.4%), which was better than the sector’s average returns (23.3%) but underperformed the MSCI Emerging Markets index (30.8%).

Nearer term though the trust has done better, mainly because it has below average exposure to China, a big driver in emerging markets but a region that has had a tough year following strong regulations on its education and technology stocks and the ongoing Evergrande saga.

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

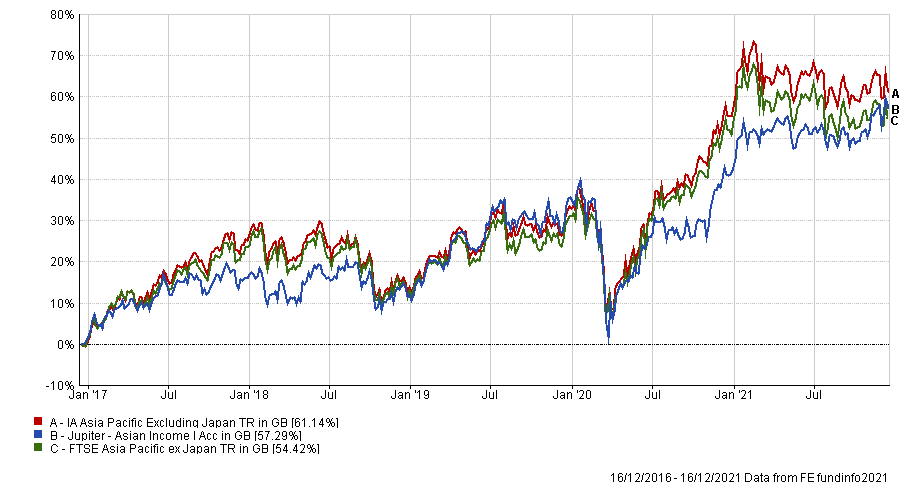

Jupiter Asian Income

Another option for investors who want to diversify from the UK but are a bit more prudent, is Jupiter Asian Income, according to Ryan Hughes, head of active portfolios at AJ Bell, recommended.

“Manager Jason Pidcock is a cautious investor,” Hughes said, investing in high-quality companies that have strong management and governance as well as a clear focus on the shareholder, to ensure dividends are a central part of the company’s strategy.

Hughes said that Asian companies in general were lower on debt, which helps to support a dividend. On the Jupiter Asian Income fund the current dividend yield is 3.6%.

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

The fund is also significantly underweight on China, which has attributed to its top quartile performance in 2021. Over five years the fund made 57.3%, just behind its average sector peer, shown in the graph below.

| Portfolio | Sector | Fund Size(m) | Fund Manager(s) | Yield | OCF |

| JOHCM UK Equity Income | IA UK Equity Income | £2,061 | James Lowen, Clive Beagles | 3.82% | 0.79% |

| JPM JPMorgan Mid Cap IT | IT UK All Companies | £300.30 | Georgina Brittain, Katen Patel | 2.30% | 0.88% |

| Jupiter Asian Income | IA Asia Pacific Excluding Japan | £793.80 | Jason Pidcock | 3.60% | 0.98% |

| Jupiter Emerging & Frontier Income Trust | IT Global Emerging Markets | £91 | Ross Teverson, Charles Sunnucks | 4.41% | 1.35% |

| Threadneedle UK Equity Income | IA UK Equity Income | £3,910.40 | Richard Colwell | 3.01% | 0.82% |