Frostrow Capital’s Worldwide Healthcare trust has been a leader in the IT Biotechnology & Healthcare sector, delivering peer-topping returns of 355.6% over the past decade, but a poor performance last year may have disappointed investors.

Despite the pandemic putting pressure on the healthcare sector in 2020, the trust was up almost 20%, double that of the MSCI World Healthcare benchmark, but this momentum was lost last year when the index began to recover. While the benchmark rebounded 20.9% throughout the year, the trust made losses of 1.4%.

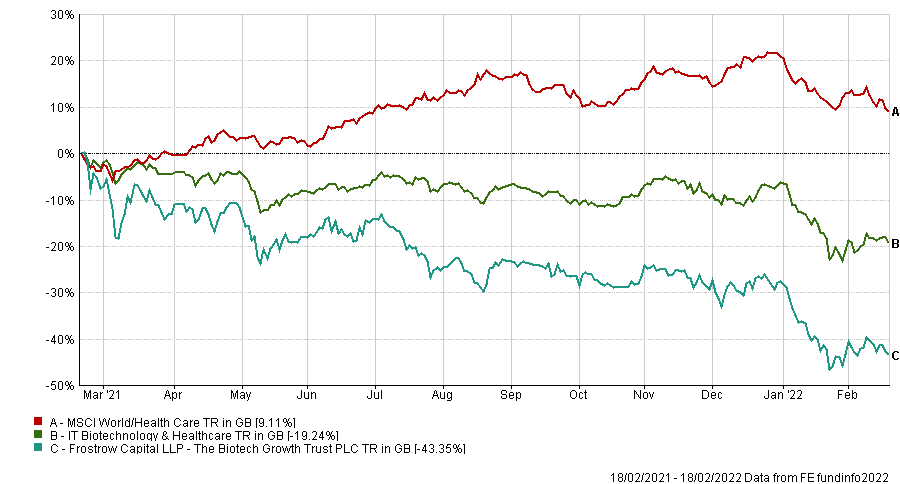

Total return of trust in 2021

Source: FE Analytics

Valuations have sunk further in the two months since the end year report was published, with the trust now down 19.2% over the past year.

Overall, it means the trust is now just 4.9% higher than at the start of 2020, a below-average effort among its IT Biotechnology & Healthcare peers.

Managers Sven Borho and Trevor Polischuk said that last year’s results were “truly humbling”, adding that “one of the best years ever for excess performance has been followed by a year that is a total reversal”.

“Much of the healthcare sector has shifted from fundamentally driven share price moves to macro-driven ones (e.g., interest rate speculation, growth-to-value rotations, etc.). This has resulted in a mismatch in our investment style and has impacted returns.”

The managers also said that the poor performance of two key overweights – small-cap biotechnology and China healthcare – have hampered the portfolio’s returns over the past few months.

However, with 88 underlying holdings, the trust is well diversified and somewhat better protected from drawdowns than more concentrated portfolios.

Emma Bird, research analyst at Winterflood, said: “Worldwide Healthcare Trust provides broad exposure to healthcare, whilst also offering a significant allocation to the higher-growth biotechnology segment (30% of the portfolio at 31 December 2021) but with lower volatility than biotechnology-only funds.”

Other portfolios in the IT Biotechnology and Healthcare sector with fewer holdings were hit much harder by 2021s slow performance, with Frostrow’s Biotech Growth trust down 43.4% over the past year.

Total return of trust over past year

Source: FE Analytics

Andy Merricks, fund manager at 8AM Global, agreed, noting that the mix of biotechnology, pharmaceutical, medical devices and healthcare services stocks within its portfolio, gave it a “semblance of diversification across the healthcare sector”.

The poor performance of the fund at the close of last year led to a 6% share price discount – an anomaly as the trust typically trades at close to par. This has come back in since, and is now at 2.9%, still an attractive entry point for a trust that has been top of the pile for a decade and should continue to do well over the long term.

Bird said: “We continue to be attracted to the secular growth offered by the healthcare sector, with fundamental drivers, such as scientific innovation, remaining positive.

“We think that Worldwide Healthcare Trust offers well-managed exposure to the healthcare sector and we would anticipate it continuing to outperform over the longer term. As such, we recommend it for investors looking for diversified healthcare exposure”.

This opinion was echoed by Merricks, who is personally invested in the trust. He agreed that the negative results of last year are forgivable considering its high returns over the long term.

He said it was “one of the best ‘one-stop’ healthcare shops” in the market, an area that will become more popular as people live longer and therefore require better care.

“If, like me, you consider healthcare to be a beneficiary from global demographics as well as a heightened awareness of most aspects of healthcare after the couple of years we’ve been through, any underperformance represents, in my opinion, an opportunistic entry point for this trust,” he said.

Priyesh Parmar, research analyst at Numis Securities, said the firm has recommended the trust since 2012 and it remains “our favoured vehicle for diversified exposure to the listed healthcare sector, despite the recent underperformance”.