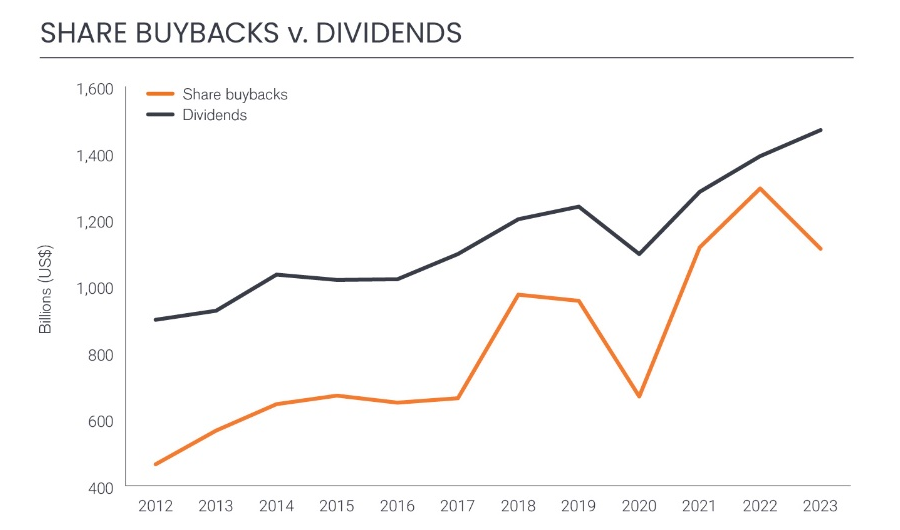

Companies focused more on dividends than share buybacks in 2023, according to data from Janus Henderson’s Global Dividend Index, with the $1.1trn spent on repurchasing shares last year some $181bn lower than in 2022.

This is a decline of 14% year-on-year and means 2023’s buybacks total was below even the 2021 level, although it remains far ahead of pre-pandemic marks.

Ben Lofthouse, head of global equity income at Janus Henderson, said higher interest rates have played a role in the decline of share buybacks.

“When debt is cheap it makes sense for companies to borrow more (as long as they borrow prudently) and use the proceeds to retire expensive equity capital,” he said.

“With rates at multi-year highs, that calculation is more nuanced; some companies are paying down debt at this point in the cycle, using cash that might otherwise have gone to buybacks.”

Buying back shares is a key tool for companies to reduce the amount of stock in issuance and therefore enhance the share price. It is a way of returning value to shareholders through capital gains.

Some prefer this to dividends, which is income paid out to investors, as share buybacks can be more flexible; whereas once a company starts paying dividends, shareholders expect to be paid at least the same amount every year – if not for the income to increase.

Source: Janus Henderson Global Dividend Index

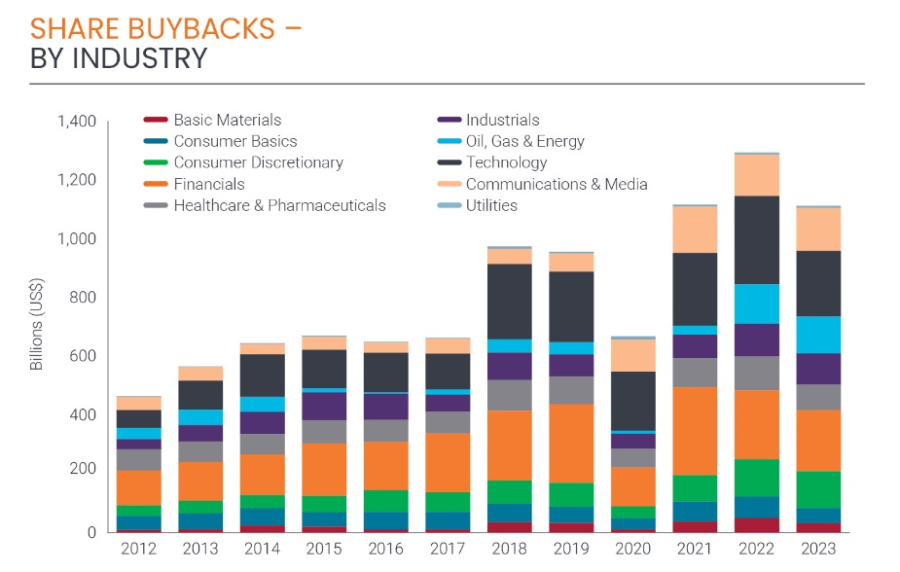

Lofthouse said: “Many companies use buybacks as a release valve – a way of returning excess capital to shareholders without setting expectations for dividends that might not be sustainable long term. This is especially appropriate in cyclical industries like oil or banking.

“That flexibility explains why buybacks are more volatile than dividends. It also means there is no real evidence that buybacks are taking over from dividends.”

US companies bought the most shares last year. American companies are known for preferring buybacks to dividends and they accounted for some 70% of all share repurchases last year, with a total of $773bn.

This was down some $159bn on the previous year (or 17%) but remained 1.2x larger than the value of dividends paid by US companies.

Source: Janus Henderson Global Dividend Index

Outside the US, companies in the UK were the biggest buyers of their own shares, accounting for $1 in every $17 of the global total in 2023, the report found.

A total $64.2bn in repurchases was 2.6% lower year-on-year and equalled 75% of dividends paid, with oil major Shell leading the way. It is the largest non-US buyer of its own shares, (accounting for almost a quarter of the UK total).

However, the firm cut back last year, as did the likes of BP, British American Tobacco and Lloyds, among others. This was counterbalanced by an increase in share buybacks from banks such as HSBC and Barclays.

Share buybacks are also becoming more prominent in Europe, the report found, where the total paid rose 2.9% to $146bn in 2023, although it remains less of a tool for Asian stocks.

Dividends or buybacks?

Lofthouse noted the relative size of buybacks when compared to dividends shrank in every region except Japan and the emerging markets, suggesting dividends remain the most coveted option by companies and their shareholders.

However, he was quick to ward investors off assuming the trend for share buybacks was over.

“It’s tempting to extrapolate a new trend of decline for buybacks. But one down year from multi-year highs is not evidence that this is happening. It is all about companies finding the appropriate balance between capital expenditure, their financing needs and shareholder returns via dividends, buybacks or both,” he said.