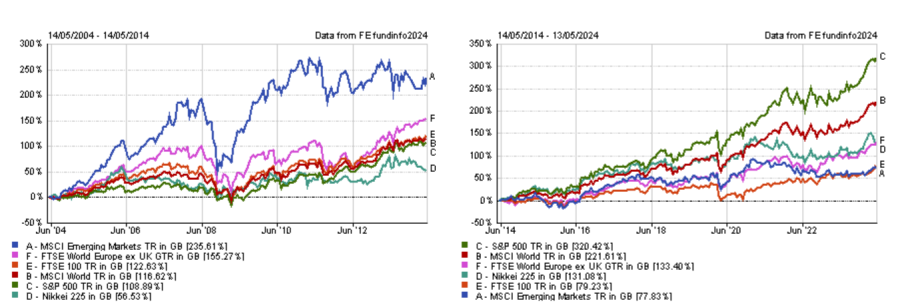

Emerging market equities have been on a rollercoaster ride during the past two decades. While they trounced developed markets in the 2000s, they have lagged behind in the 2010s.

Given this contrasting track record, seasoned managers who have weathered various market conditions may have advantages when it comes to navigating volatile markets.

Below, Trustnet researched funds in the IA Emerging Markets, IA Asia Pacific Excluding Japan, IA Asia Pacific Including Japan, IA Latin America, IA China/Greater China and IA India/Indian Subcontinent sectors that have been managed by the same person since 2004 or earlier and have produced top-quartile returns over the past three years.

Managers who ticked these boxes have been through it all and continue to make top returns.

Performance of indices from 2004 to 2014 and from 2014 to 2024

Source: FE Analytics

In the IA Emerging Markets sector, James Donald and Rohit Chopra are the only ‘veteran’ managers to have fulfilled our criteria.

They have both been in charge of Lazard Emerging Markets since 1999 and were joined by Monika Shrestha in 2006 and Ganesh Ramachandran in 2020.

Together, they look for financially productive and sensibly-priced companies, but may also consider businesses with improving returns.

Analysts at Square Mile said: “The team has followed companies and the evolution of markets for many years, and has learnt to be appreciative of the threats and opportunities that come around over time.

“In essence, the managers look for companies with high or improving financial profitability as long as they are at acceptable and attractive valuation levels. This can mean building exposure to companies, sectors or markets that have been overlooked or ignored.

“Whilst this is a good discipline to have, this relative value approach can add a higher element of volatility, in what is already a volatile asset class.”

Indeed, Lazard Emerging Markets has been relatively more volatile than the average fund in the IA Global Emerging Markets sector over the past decade, although it has done significantly better in that regard over three years, according to FE Analytics.

Performance of fund over 3yrs (to last month end) vs sector and benchmark

Source: FE Analytics

In the IA Asia Pacific Excluding Japan sector, Richard Sennitt is the only manager who has met our requirements.

He joined Schroders in 1993 and has been managing Schroder Asian Income since 2001 as well as other Asian funds.

Sennitt seeks companies in the Asia Pacific region that can deliver both income and capital growth and has a particular focus on those with earnings growth, sustainable returns and valuation support.

The portfolio typically holds between 60 and 80 stocks with a bias to high-dividend paying companies.

Analysts at FE Investment said: “The Schroder Asian Income fund does not purely buy companies in only the highest-yielding sectors – capital appreciation is equally important. The fund has managed to grow the dividend payment consistently, even through periods like the financial crisis and 2020’s global Covid restrictions, where many companies slashed dividends.

“From a portfolio perspective, this fund offers diversification benefits to income investors as mainstream equity income funds available in the market are typically focused on the UK or on developed markets.”

In terms of geography, the fund has a bias toward the more developed countries in the region, such as Australia, Taiwan and South Korea, at the expense of China and India.

Performance of fund over 3yrs (to last month end) vs sector and benchmark

Source: FE Analytics

In the IA China/Greater China sector, Martin Lau and Louisa Lo are the only two veteran managers to have made top-quartile performance over the past three years amidst a particularly challenging period for Chinese equities.

Martin Lau has been at the helm of FSSA Greater China Growth since 2003 and was joined by Helen Chen in 2019.

The fund’s mandate allows the managers to look for opportunities in Mainland China, Hong Kong and Taiwan.

Rayner Spencer Mills Research analysts said: “The benchmark-agnostic approach means that the managers avoid compromise by avoiding large constituents of the index which may not possess the superior levels of stewardship that they are seeking – this also means that the sector allocations are a residual of the stock selection process. The process emphasises absolute rather than relative returns and risk is thought of in an absolute way rather than versus the benchmark.”

Performance of funds over 3yrs (to last month end) vs sector and benchmark

Source: FE Analytics

Louisa Lo has managed Schroder ISF Greater China since 2002, which also invests in the whole Greater China region and does not specifically focus on mainland China.

Although FSSA Greater China Growth has done better over three years, Schroder ISF Greater China has slightly outperformed over the past decade. However, FSSA Greater China Growth has generally been less volatile.

No veteran managers in the IA Asia Pacific Including Japan, IA Latin America and IA India/Indian Subcontinent sectors have met our criteria.