In their 25th year in Europe, exchange-traded funds (ETFs) are more dynamic than ever. More and more investors are using ETFs for their core allocation, tactical and active asset allocation or portfolio construction.

They are leveraging the advantages of liquidity and price efficiency across all asset classes to maximise their returns. Especially in these volatile times, the liquidity and risk management advantages of ETFs can make all the difference.

We are convinced that this will benefit not only passive or alternative index strategies, but also active management.

The European ETF market recorded a record volume of $2.3trn at the end of 2024, with ambitious forecasts of $4.5trn by 2030. Current trends show that 2025 will be dominated by active ETFs, environmental, social and governance (ESG) solutions with low tracking errors and further rising demand from digital platforms and private investors.

Trend 1: The rise of active ETFs

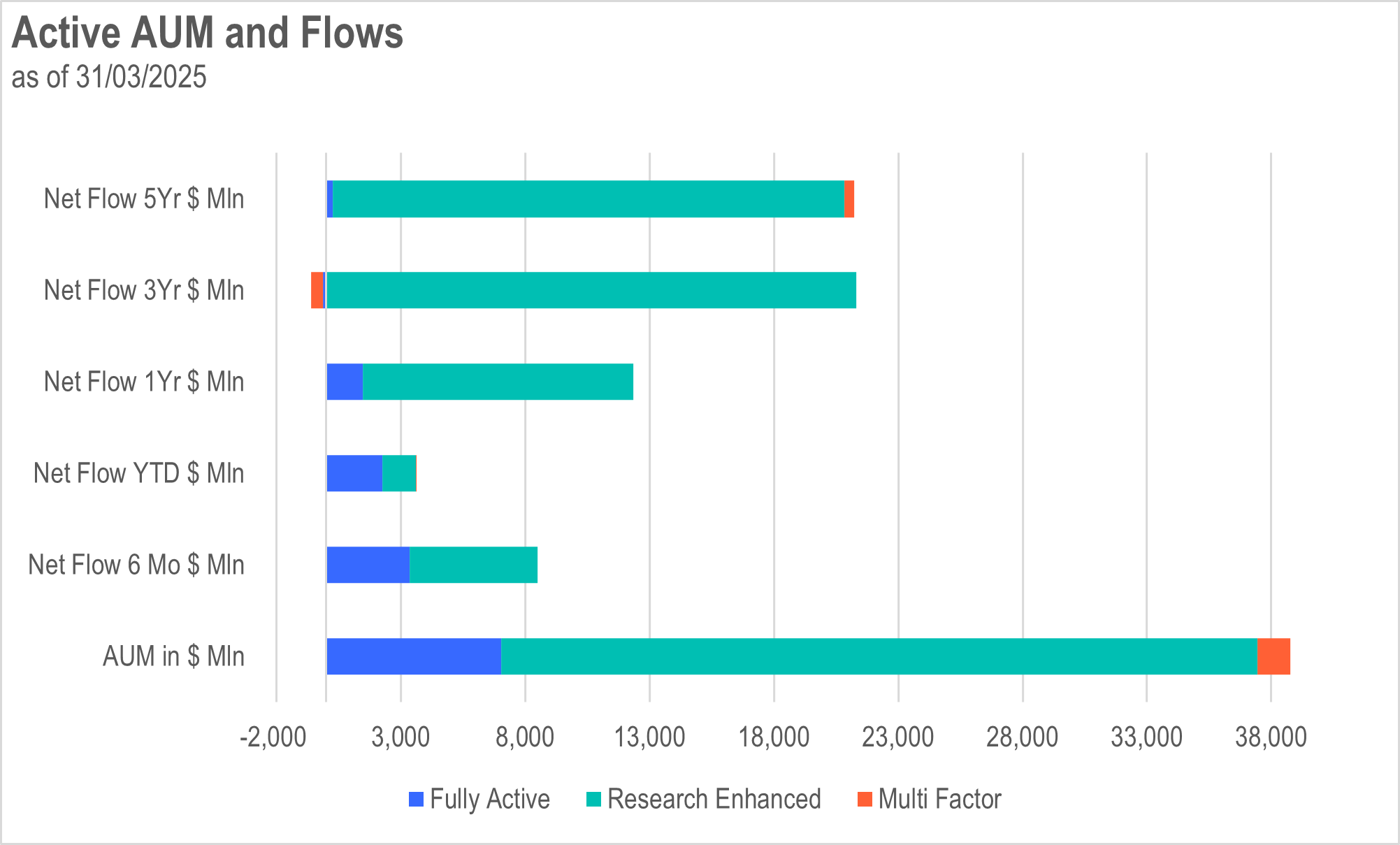

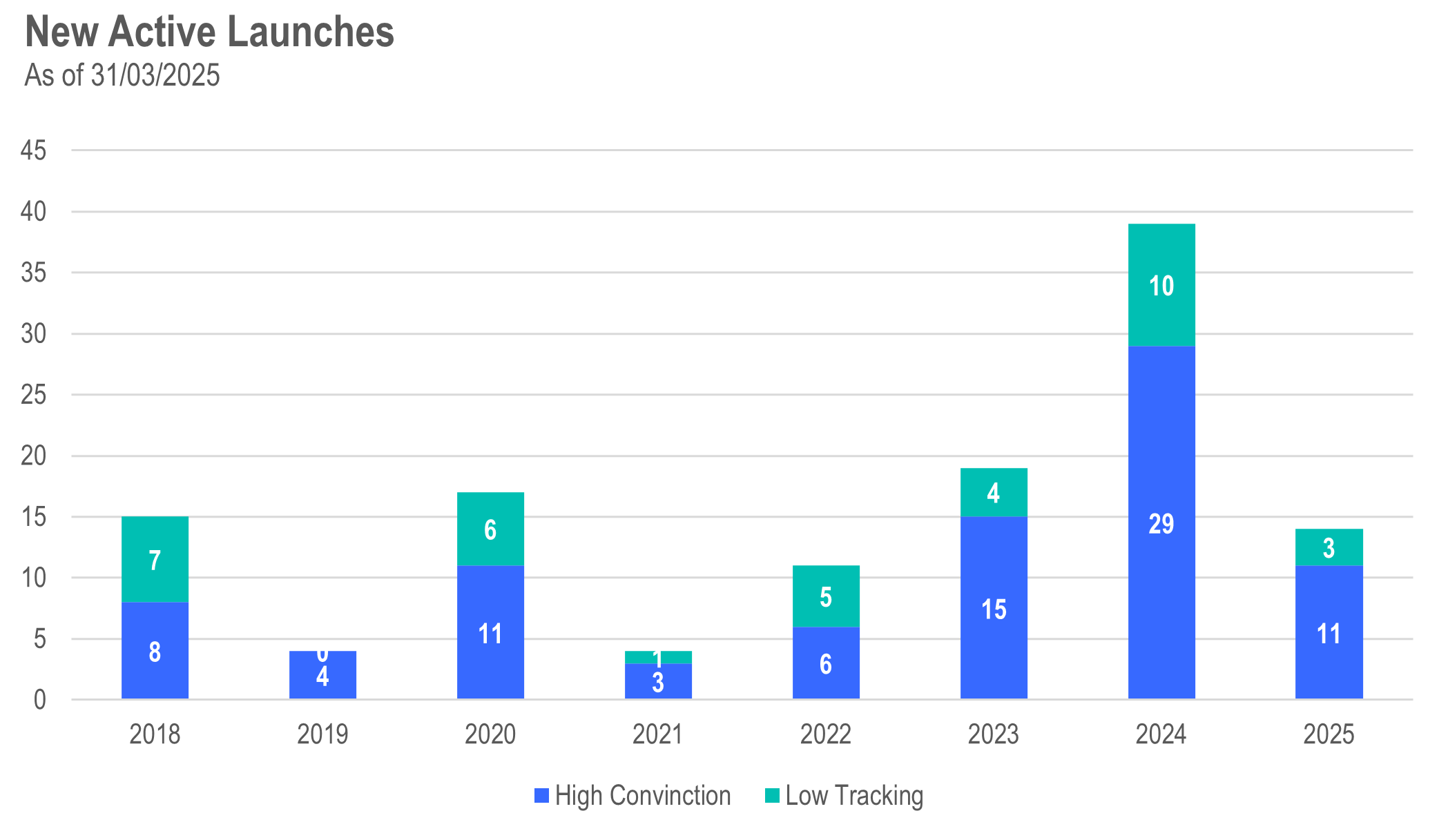

Active ETFs recorded their highest inflows ever in 2025. In the first quarter, active strategies accounted for around 8% of all net inflows, even though they represent only 2.5% of the total market.

Fully active equity ETFs with a high degree of conviction (‘high conviction’) were particularly successful, accounting for 63% of year-to-date inflows.

Source: Franklin Templeton

Trend 2: ESG remains in demand – but in a more differentiated form

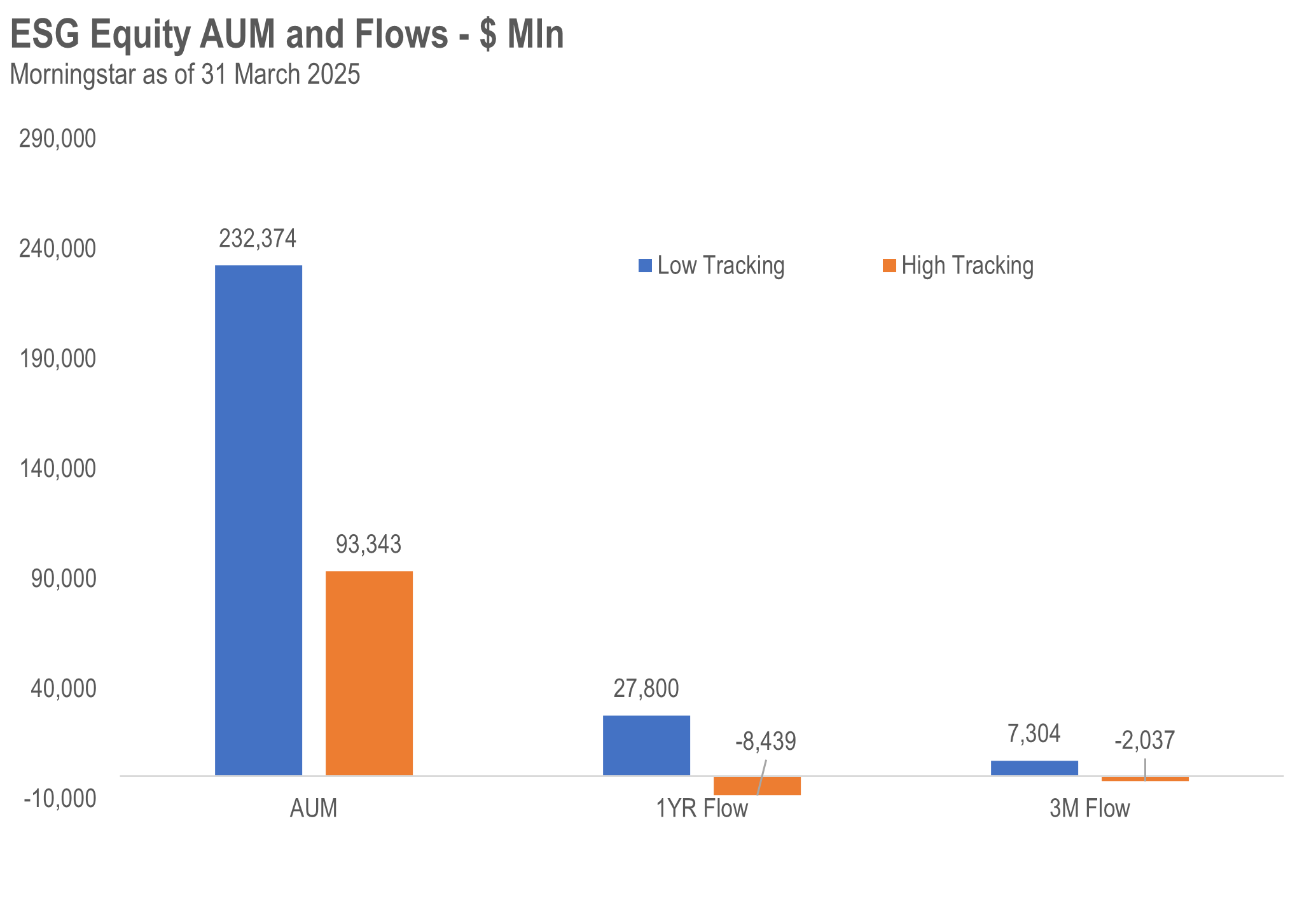

ESG ETFs continue to gain in importance, but investors are increasingly differentiating between them: strategies with low tracking error, such as CTB and climate ETFs, recorded significantly higher inflows than SRI or ESG leader products with higher tracking error.

Overall, ESG ETFs attracted around $9bn in inflows in the first quarter of 2025, representing around 10% of the total.

Source: Franklin Templeton

Trend 3: Focus on factor strategies and model portfolios

Factor ETFs are making a comeback: with inflows of $8bn in 2024, mainly in dividend and equal-weighted strategies, interest in targeted market segments is growing.

At the same time, ETF model portfolios are establishing themselves as an efficient management tool for investment decisions, particularly in digital advisory solutions.

Trend 4: Digitalisation, new players and model portfolios

The number of ETF providers is growing, as is their use via digital platforms. Private investors are increasingly turning to portfolio models – a trend that is further accelerating growth.

ETFs are thus finally evolving from passive ‘index trackers’ to tailor-made portfolio components with strategic added value.

Conclusion

The year 2025 marks a significant step forward in the evolution of ETFs. Investors are increasingly turning to active and ESG-oriented strategies with a clear data basis, while digitalisation and model solutions are facilitating access.

Once purely passive products, ETFs are thus becoming high-precision tools for portfolio management – and shaping a new era of investing.

Lotfi Ladjemi is vice president of ETF distribution at Franklin Templeton. The views expressed above should not be taken as investment advice.