There are almost 30 ‘hidden gem’ emerging market funds available to investors who are willing to take a risk on those with less money to allocate, Trustnet research has found.

The asset class is enjoying something of a renaissance in 2025, with the average IA Global Emerging Markets fund outperforming the average IA Global fund year to date, according to FE Analytics data.

This might tempt some investors to consider expanding their exposure to emerging markets or buying in for the first time. While there are several large funds to choose from, investors may also wish to consider unheralded names as well.

To help with this, Trustnet has examined the emerging market funds that have delivered supranormal performance compared to their average peer but have gone under the radar, with less than £250m in assets under management (AUM).

We looked at the aforementioned IA Global Emerging Markets sector, as well as the IA India/Indian Subcontinent, IA Latin America and IA China/Greater China

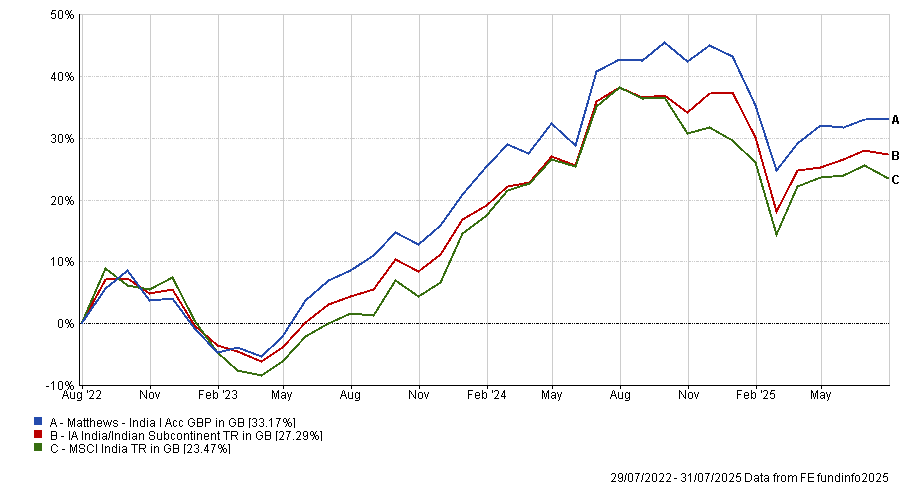

Source: FE Analytics. All figures in Sterling. Data accurate as of 31 July

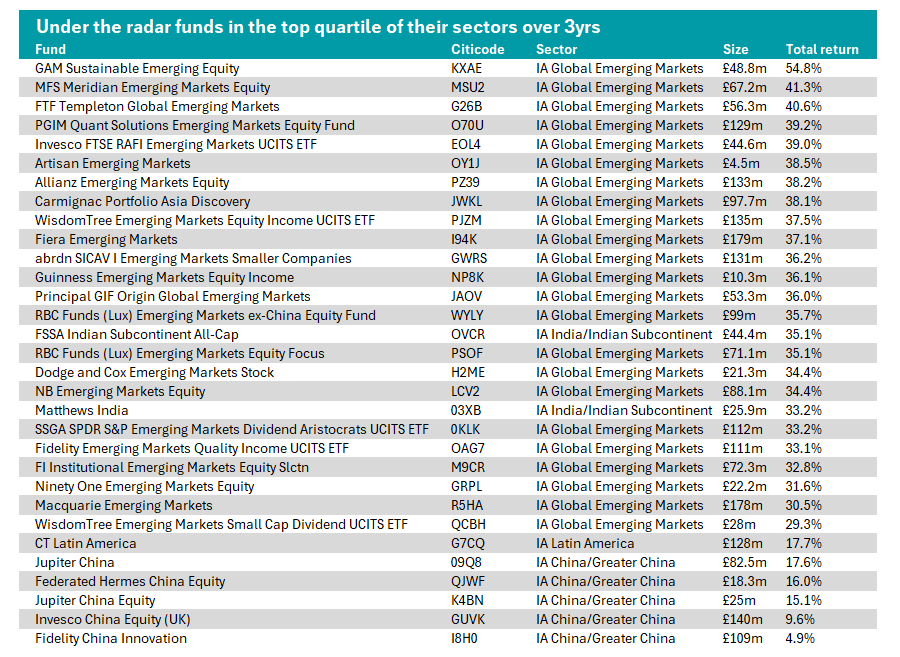

Topping the chart is the GAM Sustainable Emerging Equity Fund, led by Ygal Sebban, which invests with through an environmental, social and governance (ESG) lens, excluding certain stocks due to their environmental impacts.

It posted a total return of 54.8% in the past three years, the second-best result in the IA Global Emerging market sector. This outpaced the MSCI Emerging Markets index by almost 30 percentage points.

Performance of fund vs sector and benchmark over past 3yrs

Source: FE Analytics. All figures in Sterling. Data accurate as of 31 July

Over the past decade, it only failed to beat the index in two years (2018 and 2015). As a result, it has also delivered top-quartile results over the past one, five and 10 years. Yet it has just £48.8m in AUM.

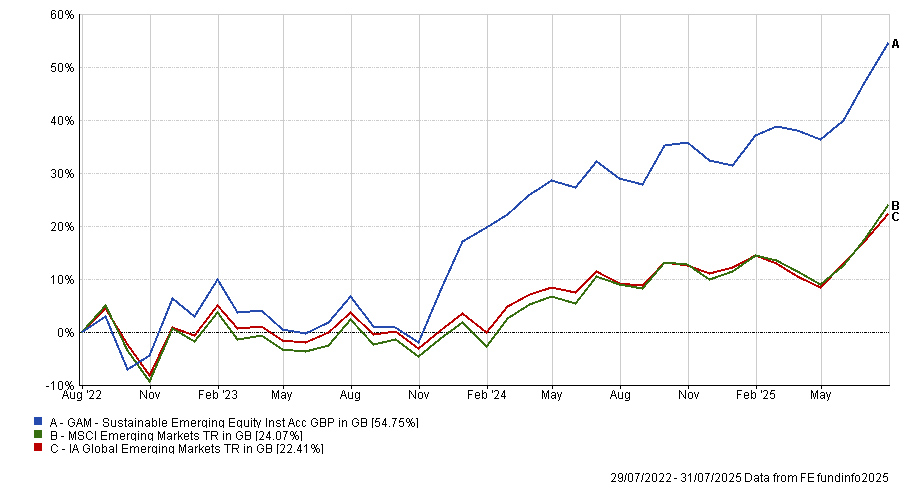

Following just behind is the MFS Meridian Emerging Markets Equity fund, which delivered a 41.3% total return. Managed by Rajesh Nair and Lionel Gomez, this is another top 10 result within the IA Global emerging market sector, beating the average peer by 19 percentage points during this period.

The fund has delivered a top-quartile return each calendar year since 2023. However, due to bottom 25% performances in both 2022 and 2021, the fund failed to beat the index over the past five and 10 years.

Performance of the fund vs the sector and benchmark over past 3yrs

Source: FE Analytics. All figures in Sterling. Data accurate as of 31 July

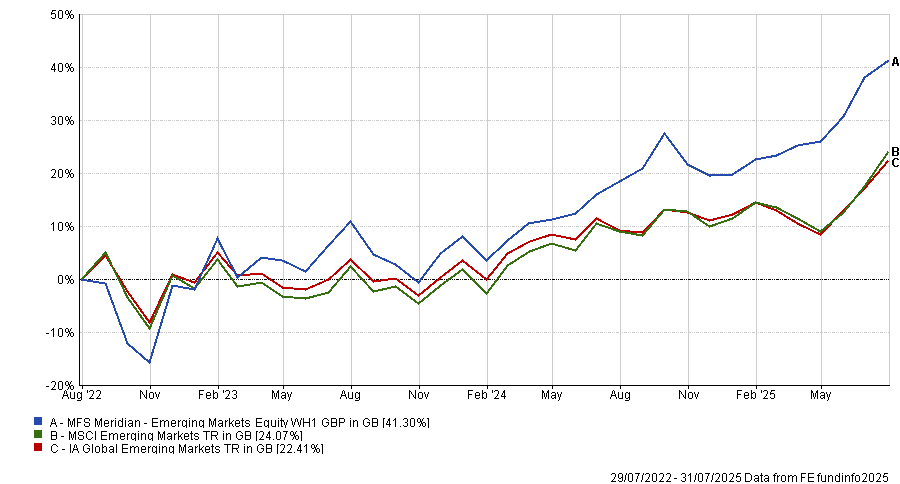

Away from the broad emerging market funds, in the IA India/Indian Subcontinent sector one portfolio matched our criteria – the £25.9m Matthews India fund, managed by Sharat Shroff and Peeyush Mittal.

Over the past five years the IA India/Indian subcontinent sector has surged 99.4%, attracting significant investor interest. However, over the past 12 months the average fund in the peer group is down 7.9%.

Nevertheless, the Matthews India fund has withstood this volatility, delivering a 33.2% total return over the past three years.

Performance of fund vs sector and benchmark over past 3yrs

Source: FE Analytics. All figures in Sterling. Data accurate as of 31 July

In Latin America, the CT Latin America fund is the only strategy to qualify as a ‘hidden gem’ in the IA peer group. Led by Perry Vickery, the fund aims to outperform the MSCI EM Latin America 10/40 index over rolling three-year periods.

While it is unrestricted by size or sector, it tends to focus on larger companies and will generally have a portfolio of around 65 holdings.

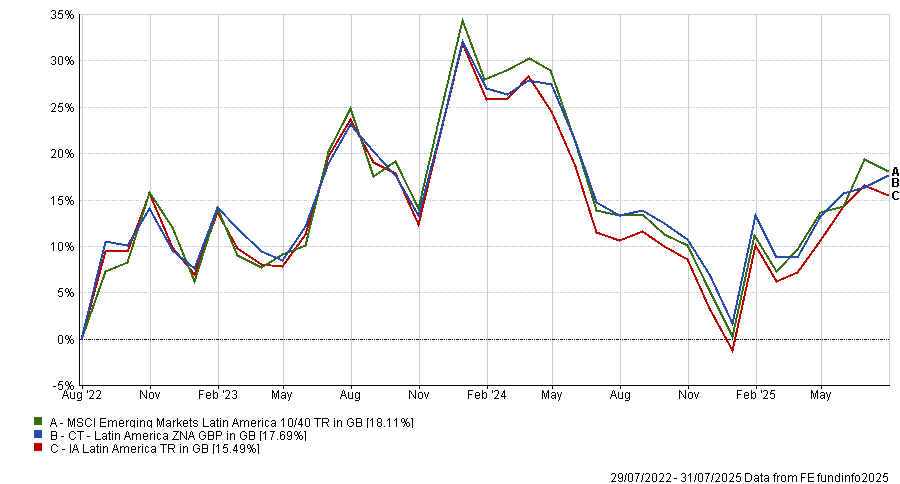

This approach has broadly paid off over the past three years, with the fund’s 17.7% total return the second-best result in the IA Latin America sector. However, as demonstrated by the chart below, this was below the benchmark.

Performance of fund vs sector and benchmark over past 3yrs

Source: FE Analytics. All figures in Sterling. Data accurate as of 31 July

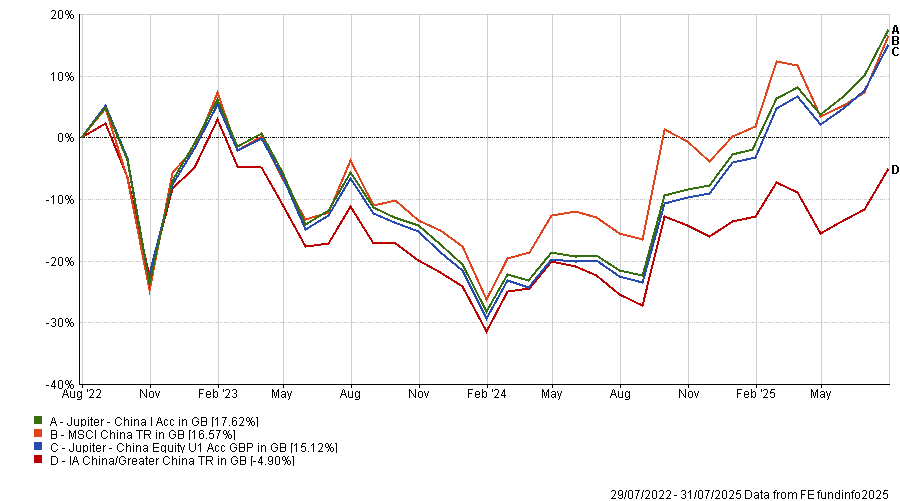

In the IA China/Greater China sector, five funds matched our criteria. The top hidden gem is the £82.5m Jupiter China fund, led by Ross Teverson.

The fund aims to outperform the MSCI China index by investing at least 70% of its assets in Chinese-domiciled shares. However, the portfolio reserves 30% for investment in non-Chinese companies that have most of their earnings in the region. For example, it holds British multi-national bank Standard Chartered as one of its’ top 10 holdings.

While the average fund in the IA China/Greater China sector is down 4.9% over the past three years, Jupiter China is up 17.6%. It has built on this strong performance so far this year, ranking as the top fund in the sector despite trade tension between China and the US for most of 2025.

Its stablemate, Jupiter China Equity, also delivered a top-quartile return as seen in the chart below.

Performance of funds vs the sector and benchmark over past 3yrs

Source: FE Analytics. All figures in Sterling. Data accurate as of 31 July