Savers are feeling the pinch as resilient inflation and the prospect of further interest rate cuts from the Bank of England have hit the savings market.

This morning’s UK inflation figures showed headline CPI rose by 3.4% in the year to May, while core inflation (which strips out energy and food) stood at 3.5%.

There are also concerns that escalating tensions in the Middle East and the upward pressure this is putting on oil prices could mean inflation is higher again in June.

Caitlyn Eastell, spokesperson at Moneyfactscompare.co.uk, said higher prices are “eroding savers’ money in real terms”, as the amount they can buy with their cash is falling.

However, there was some good news for savers. Richard Carter, head of fixed interest research at Quilter Cheviot, noted the Bank of England is widely expected to keep interest rates on hold this week, as policymakers will be wary of cutting rates too soon given the inflation backdrop.

“Greater clarity on the inflation outlook will be needed before the Bank feels confident enough to make its first move,” he said.

The Bank has been under pressure to cut rates this year to encourage economic growth. Since August 2024 it has lowered rates by 25 basis points four times to the current 4.25% level today. But cutting rates also brings with it inflation.

Rob Morgan, chief investment analyst at Charles Stanley, said: “Vanquishing inflationary forces is complicated. The BoE has been in a dilemma for some time about whether it places more emphasis on deteriorating labour market trends and the lacklustre growth picture, or on possible engrained wage rises that stand to stoke the inflationary embers.

“Presently, it seems the economy is strong enough for companies to pass on higher employment costs and the inflationary momentum continues. But their ability to do so hangs in the balance with the growth in the economy, or lack of it, the crucial factor. An August rate cut is very possible, but it’s far from nailed on.”

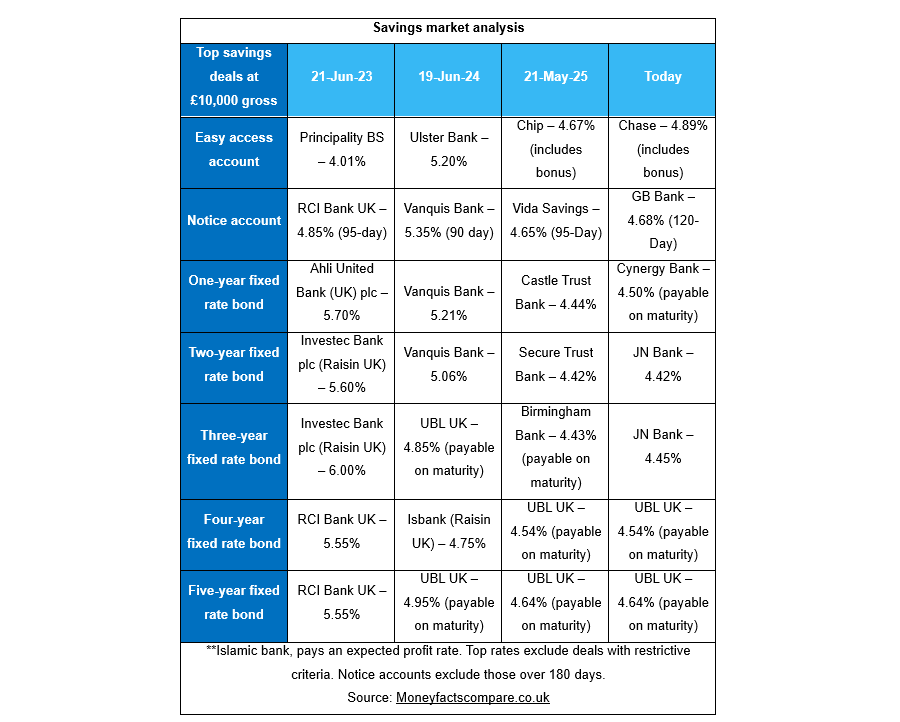

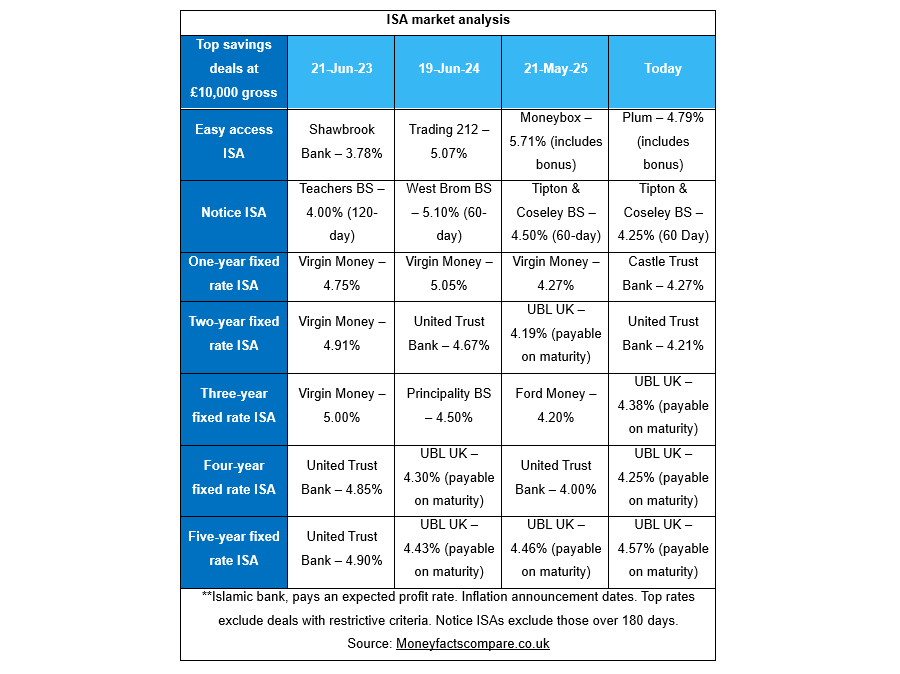

This uncertainty has been reflected in cash rates, with the best non-ISA deals creeping up slightly since last month for variable and short-term fixed rates, while most fixed ISA rates rose.

The top easy-access savings account from Chase now pays 4.89%, some 22 basis points higher than the best offer last month from Chip.

Short-term fixed-rate bonds also have risen slightly, with the top one-year bond from Cynergy Bank now paying 4.5%, 6 basis points more than last month.

Eastell said: “Challenger banks and app-based providers are rife among the top tables as competition continues to attract new customers. Consumers need to consistently search for the best accounts to avoid receiving a raw deal and act swiftly so they can grab the most popular deals before they are pulled or worsen.”

But savers have been hit by the Bank’s rate cuts over the past six months, with all of the top rates significantly lower than a year ago.

“Those consumers with a variable account or [who] only fixed for a year may now be feeling the pressure,” said Eastell.

There is a slightly different trend among cash ISAs, however. The top longer-term rates are up versus last month and are in some cases now ahead of where they were a year ago, as the below table shows. Meanwhile, easy-access accounts pay less than they did last month and significantly less than a year ago.

Some £14bn was put into ISAs in April, according to data from the Bank of England, but Eastell noted almost £300bn is sat in non-interest paying accounts.

“With longer-term rates out-pacing short-term deals it may be a good time for savers to consider the benefits of locking away their cash for the next five years,” she concluded.