All but one of the Trustnet editorial team’s 2025 fund picks beat the global stock market in the first half of the year, despite many of the journalists’ early assumptions around the US being proved wrong.

With half of 2025 behind us, now is a good time to see how our picks are faring, although it must be stressed that these are in no way investment recommendations. Uncharacteristically given the team’s recent form – we didn’t do great in 2024 – most of our picks are outperforming.

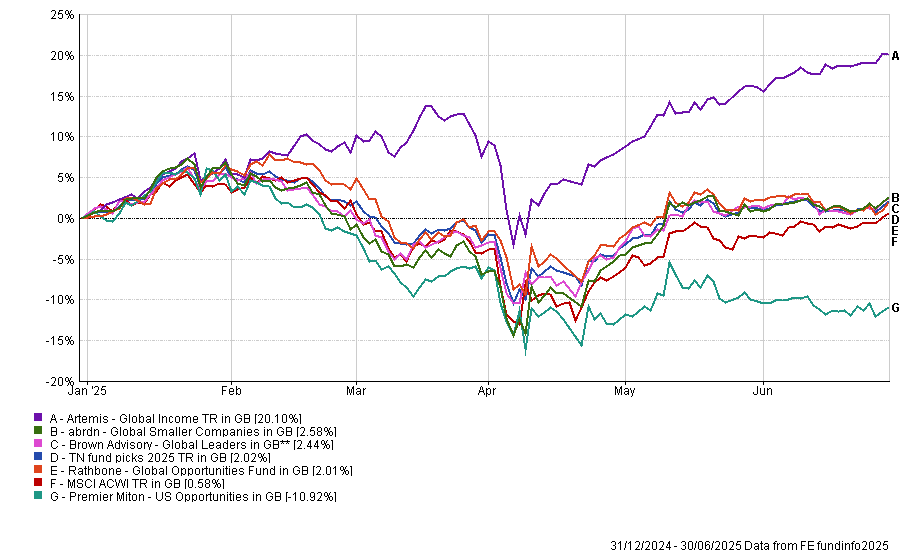

At the end of June, a portfolio of the team’s five fund picks had made a total return of 2%, outpacing the 0.6% gain from the MSCI AC World index. This is more of a happy coincidence, however, as we chose the funds individually, not as a portfolio.

In the lead by a clear margin is Artemis Global Income, which was picked by Trustnet reporter Patrick Sanders. It made a 20.1% return in the first half of 2025, making it the best-performing member of the IA Global Equity Income sector.

Sanders chose the fund as he had already met with managers Jacob de Tusch-Lec and James Davidson, leading him to have a good understanding of its process. This is often touted as a core tenet of successful investing, as Warren Buffett said: “Never invest in a business you cannot understand.”

Artemis Global Income has prospered in 2025 thanks to its underweight to the US. While around 65% of the MSCI AC World index is allocated to the US, the fund has just 24.5% in US stocks, with Europe ex UK being its largest weighting at 35.6%.

This has aided performance in 2025 so far, as the US exceptionalism narrative began to crack due to issues such as tariff threats from US president Donald Trump and increased fiscal stimulus in Europe.

In a recent update, de Tusch-Lec said: “US exceptionalism is not going to change overnight. US shares should trade at a premium. But that does not mean they – or the dollar – should be as overvalued as they were (and still are).

“By common valuation methods, even with the recent falls, US equities still look 25% to 30% overvalued. The dollar could come down 20% before being considered ‘fair’ value or ‘cheap’.

“I am quite comfortable still running with a big US underweight – the Artemis Global Income fund went into this with less than 30% there. I really do not want to be standing in front of these flows when the tide turns.”

Performance of Trustnet’s fund picks in H1 2025

Source: FE Analytics. Total return in sterling between 1 Jan and 30 Jun 2025.

In second place is abrdn Global Smaller Companies, the pick of FE fundinfo head of editorial Gary Jackson. It made 2.6% in 2025’s first half, putting it in the top quartile of the IA Global sector.

This is another fund with an underweight to the US, although not as pronounced as Artemis Global Income: 43.2% of the portfolio compared with 51.8% of the MSCI AC World Small Cap index.

Jackson wanted exposure to global small-caps as he expected them to outperform as the global economy stabilised and sentiment improved. This hasn’t exactly panned out, with the MSCI AC World Small Cap falling 1.4% over the past six months while the large-cap index made a 0.3% return.

However, manager Kirsty Desson runs abrdn Global Smaller Companies with a focus on quality, which means it buys companies with strong balance sheets and good management teams while avoiding those making a loss or running up debts. This tends to help support returns in more challenging markets, like those of 2025.

Not too far behind is former Trustnet News editor Emma Wallis’ pick Brown Advisory Global Leaders, which made a second-quartile 2.4% total return.

Wallis liked the fund because of its underweight to the US, a focus on companies that are solving problems for their customers and taking market share, and a process that means it has to either buy more or sell out if a stock falls more than 20%.

Managers Mick Dillon and Bertie Thomson recently explained how they are adapting to the new market environment: “One mantra we revived from Covid-times is ‘update, recalibrate and compare’. When we see a sudden shift, such as a global pandemic or the introduction of tariffs, then the playing field has changed for some, if not all, of our investments.

“Hence, we need to update our base case five-year free cashflow estimate ranges, taking into account the new economic reality. We also need to recalibrate our probability of achieving this base case range; if it has changed (most likely widened) then do our probabilities need re-estimating too? (NB, if it hasn’t, why not?). Lastly, we compare our new probabilities and payoffs to other options for capital within the portfolio or on our ready-to-buy list. Probability versus payoff is a core part of our weekly capital allocation process.”

Rathbone Global Opportunities, the 2025 pick for Trustnet editor Jonathan Jones, came next with a 2% total return. This puts the fund in the second quartile of the IA Global sector.

Jones liked the fact that manager James Thomson is overweight the US, saying “with Donald Trump becoming president in 2025, things could be on the up in the US”. While this wasn’t the case for most of 2025 so far, the S&P 500 and Nasdaq have been rallying harder than markets like the UK, Europe and Japan over the past couple of months.

Rathbone Global Opportunities is a well-respected fund with a strong long-term track record. Analysts at Rayner Spencer Mills Research said: “Its focus on developed markets and large-cap stocks provides exposure to the primary industry sectors, and whilst the investment approach is high conviction, the risk-aware approach and restrictions around individual stocks have worked to deliver steady outperformance.”

The only Trustnet 2025 fund pick posting a negative return in the first half was Premier Miton US Opportunities, chosen by deputy editor Matteo Anelli. It lost 10.9% over the past six months, putting it in the IA North America sector’s fourth quartile.

Anelli picked the fund because he wanted exposure to US small-caps, which he thought would benefit from new domestically focused policies. As it turned out, the IA North American Smaller Companies sector was the worst-performing peer group over the period under consideration.

At the start of the year, manager Hugh Grieves, while noting that predictions are “really hard”, said: “Overall looking out to the next 12 months, we are confident things are looking good for investments in the US. Especially when you look around the rest of the world, the US looks like a shining light of growth and health compared to other markets – even with the uncertainty of having Donald Trump as president.”

However, in a recent update, Grieves conceded that 2025 so far has been “snakes and ladders, with plenty of snakes at the beginning” but thinks that the second half of the year will be more about the health of the US economy and companies rather than the actions of the Trump administration.