The underperformance of UK small-cap funds relative to the index should be taken with a pinch of salt, according to experts, with the tide set to change amid a shifting macroeconomic outlook.

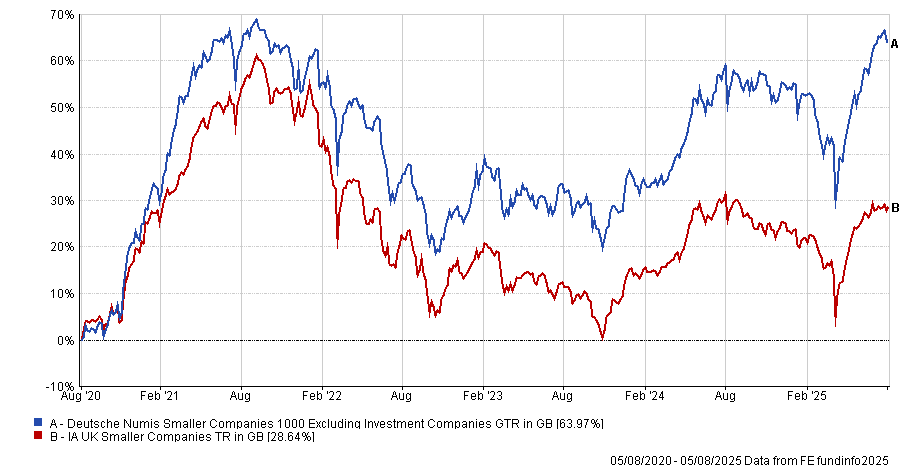

The IA UK Smaller Companies sector has been outperformed by the Deutsche Numis Smaller Companies 1000 Excluding Investment Companies over one, three, five and 10 years – a trend that is continuing in more recent months.

IA UK Smaller Companies vs Deutsche Numis Smaller Companies 1000 Excluding Investment Companies

Source: FE Analytics

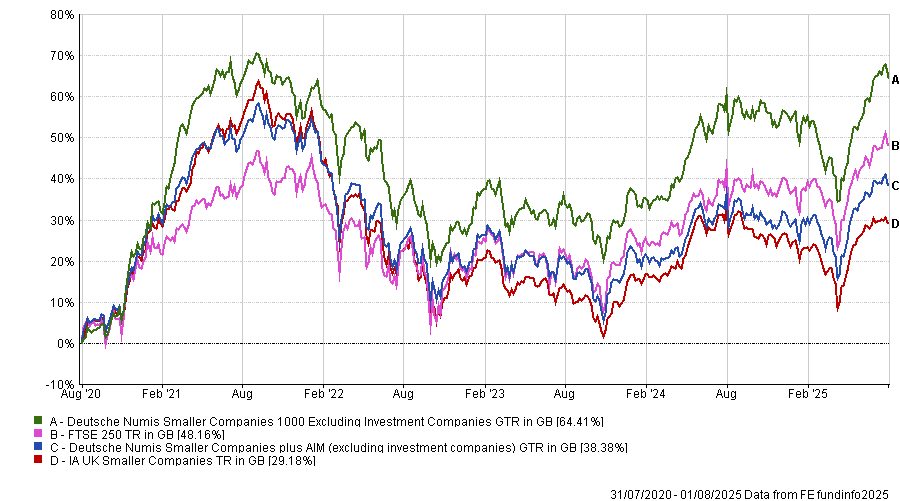

However, Jason Hollands, managing director at Evelyn Partners, said it is important to consider the variety of exposures these funds have in order to get a more accurate view of what is fuelling this relative poor performance.

He said that active funds’ exposure to the AIM market – and the inclusion of micro-cap funds in IA UK Smaller Companies funds – “is the main explanation for underperformance”.

In addition, the larger UK small-cap funds often have some mid-cap exposure – and mid-caps have also underperformed the Deutsche Numis Smaller Companies ex Investment Companies over five years.

So, for a clearer picture, it’s best to look at the above combined.

IA UK Smaller Companies, Deutsche Numis Smaller Companies 1000 Excluding Investment Companies, Deutsche Numis Smaller Companies plus AIM and FTSE 250 over 5yrs

Source: FE Analytics

“The UK Smaller Companies sector average has performed much closer to the Deutsche Numis Smaller Companies Plus AIM Index,” Hollands said.

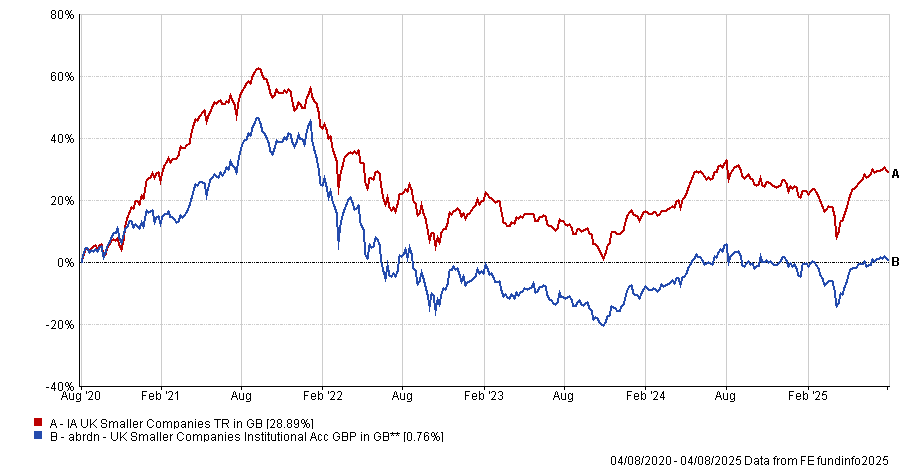

Another factor worth noting is that the IA sector averages are weighted on fund size – so the performance of a few large funds can upset the balance.

Abrdn UK Smaller Companies, for example – which is just shy of £800m – has had “a very poor five years” and holds around 18% in mid-caps, according to Hollands.

Performance of the fund vs sector over 5yrs

Source: FE Analytics

Despite this, Hollands acknowledged that small-caps have also struggled to deliver versus their larger peers.

Darius McDermott, managing director at Chelsea Financial Services, said: “Since 2022, the market environment has clearly favoured large-cap stocks, especially those with international earnings.

“High inflation, rising interest rates and geopolitical uncertainty have pushed investors towards stable, cash-generative businesses – typically found in the FTSE 100.”

In contrast, small-caps, which lean more towards growth and are often domestically focused, have been “left behind”, he said.

The structural shift towards passive investing has also disproportionately impacted small-cap stocks, McDermott said, “where liquidity is thinner and index representation is lower”.

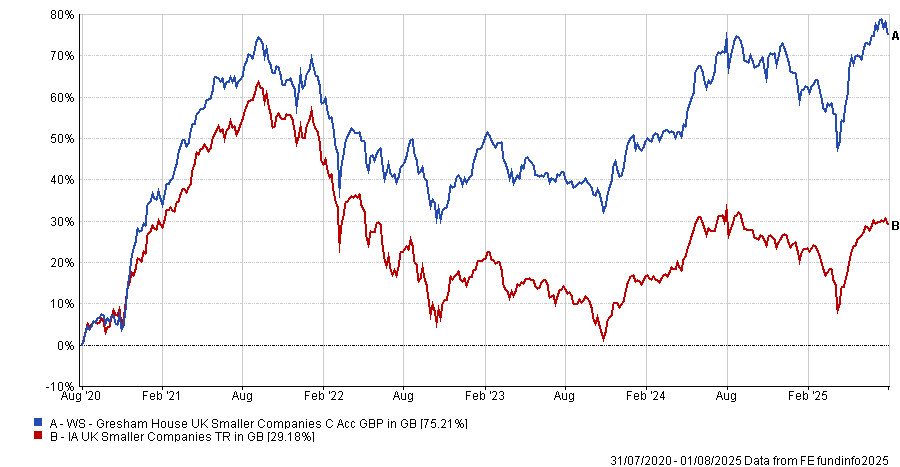

UK small-caps have been trading at a sustained and significant discount – whether compared to UK large-caps, US peers, private market valuations or historical averages – since Brexit, said Cassie Herlihy, co-manager of the WS Gresham House UK Smaller Companies fund. She said this has “deepened over the past three years amid consistent outflows from UK equity markets”.

As a result, valuations have become “disconnected” from underlying fundamentals, she said, which weighs on performance – albeit “providing an attractive buying opportunity for long-term investors”.

Despite recent performance, McDermott said the “tide may be turning”.

“The peer group has bounced 13.7% over the past three months, and we’re seeing green shoots in institutional appetite for UK small-caps,” he said.

In addition, the FTSE 100 hitting all-time highs in recent weeks shows that “investor confidence in UK assets is returning”, McDermott said. “Historically, this kind of large-cap rally often marks the beginning of a broader market recovery.”

Despite concern around the “de-equitisation” of UK markets, whereby fewer companies are listing, Herlihy argued that the UK is offering a broader and more attractive universe than was the case back in 2021, when IPOs were coming to market at elevated valuations.

“Today, we are finding more businesses that meet both our quality and valuation criteria – recent additions like GlobalData and Trainline are prime examples,” she said.

Performance of the fund against the sector over 5yrs

Source: FE Analytics

UK small-caps could also be set to benefit from a wider rotation against US stocks.

“Growing uncertainty around 2025 policy direction is beginning to challenge the narrative of US exceptionalism,” Herlihy said.

“In contrast, the UK – long overlooked by investors – is emerging as a relative safe haven, supported by political stability, improving economic data and a government signalling a renewed focus on investment and growth.”

Given their lower liquidity, small-caps tend to rebound more sharply, she said – meaning even just a “stemming” of outflows or modest inflows will have a significant impact on share prices.