Baillie Gifford has dominated the most-researched investment trusts by readers in 2021 but previously unheralded names such as Geiger Counter, Miton UK MicroCap and Canadian General Investments have seen the greatest surge, according to the latest figures.

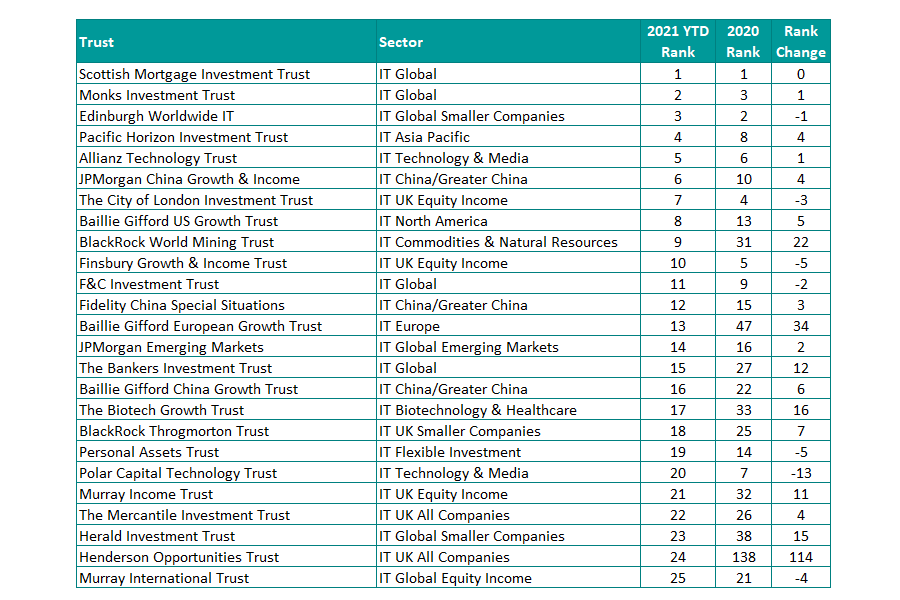

Comparing page view data with 2020, the familiar names of Scottish Mortgage, Monks Investment Trust and Edinburgh Worldwide hold on to the top-three spots.

Holding onto top spot was the £18.7bn Scottish Mortgage Investment Trust, accounting for 8.5 per cent of Trustnet readers’ research. It was revealed in March that manager James Anderson will leave Baillie Gifford in April 2022, having managed the fund since 2000, stoking a renewed interest in the UK’s largest investment company.

Over his tenure, Anderson has overseen a 1,178.7 per cent return compared to a 470 per cent gain for the average IT Global sector peer, but experts have suggested the fund is in safe hands, with co-manager Tom Slater taking over at the helm.

Monks Investment Trust, which was third overall in 2020 is now up to second in 2021 year-to-date. The £3.3bn Baillie Gifford strategy is overseen by FE fundinfo Alpha Manager, Spencer Adair and Malcolm MacColl.

The trust has been a good performer for investors in recent years, returning 209.9 per cent over the past five years, more than double its FTSE All-World benchmark’s 92.4 per cent gain.

Slipping one place, but remaining in the top-three, the £1.4bn Edinburgh World Investment Trust - also managed by Baillie Gifford – has had a difficult first half of the year, down 8 per cent, but it’s a small blip in an otherwise impressive 474.2 per cent return over 10 years.

Most viewed trusts on Trustnet in 2021

Source: FE Analytics

Across the top 25, there have been several names that have broken into the list from lower standings last year, including some trusts that have jumped from quite modest positions a year ago.

Henderson Opportunities Trust, which sat in 138th in 2020, is now up to 24th year-to-date – a jump of 114 places. The £112.9m trust is managed by James Henderson and Laura Foll and performance was hit hard after the sell-off in March, with its net asset value (NAV) total return declining by more than 40 per cent in the first quarter of 2021 while its share price fell 50 per cent.

However, it has recovered well and has started to outpace the IT UK All Companies sector average since ‘Vaccine Monday’ in November.

Also breaking into the top 25 after finishing in 33rd in 2020 is the Biotech Growth Trust. The trust had a stellar 2020, returning 67.7 per cent amidst a backdrop of greater interest and popularity for the sector, although the value rally has done little to boost its growth stocks and the trust and sector as a whole have struggled in 2021.

The £567.3m Baillie Gifford European Growth Trust is another entry to the top 25 as readers took notice of the strategy managed by Moritz Sitte, Stephen Paice and Chris Davies.

The quality-growth mandate means it hasn’t performed all that well in the cyclical rally since November, but according to Winterflood Investment Companies Research, “their ability to identify and deliver outsized long-term returns has been proven in other markets.”

Cracking the top 10, the BlackRock World Mining Trust is the only portfolio from the IT Commodities & Natural Resources sector to make this list.

The fund enjoyed a particularly strong year in 2020, with a NAV total return of 31.8 per cent compared to 20.6 per cent for the MSCI ACWI Metals & Mining 30% Buffer 10/40 index, while the share price total return was 46.7 per cent.

Managers Evy Hambro and Olivia Markham have said that the outlook for 2021 is very strong given the prospects for metal demand in tandem with global infrastructure spending, as well as the role commodities will play in the energy transition to a lower-carbon world.

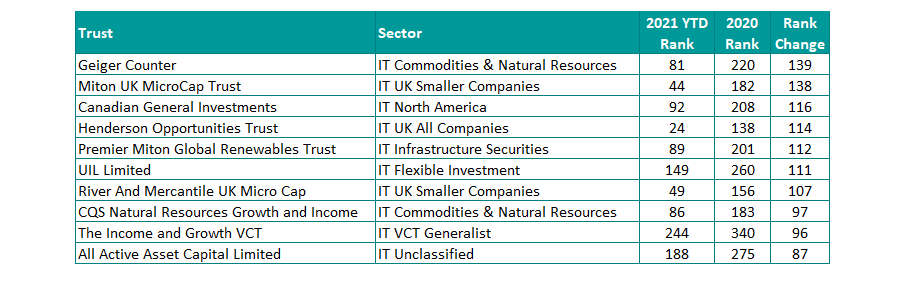

Trusts with the greatest surge in popularity

Source: FE Analytics

Finally, some trusts experienced a huge surge in popularity and research, moving up over 100 places from their standings in 2020.

Geiger Counter is at the top of this list, managed by Rob Crayfourd and Keith Watson and made a total return of 40.4 per cent in the first half of 2021, building on its 78.7 per cent gain last year.

The trust was in 220th place for 2020 and year-to-date is now the 81st most researched – a 139 place jump.

Geiger Counter invests primarily in the securities of companies involved in the exploration, development and production of energy, predominantly in the uranium industry.

Uranium mining equities rose strongly in early February 2021 and, despite giving back some early gains, the NAV of the trust ended that month up 31.6 per cent.

The £103.9m Miton UK Micro Cap trust experienced a similar jump. The trust, headed by Gervais Williams, has surged in popularity with Trustnet readers. Performance has been boosted by the strong vaccine rollout in the UK and greater certainty around the relationship with the EU post-Brexit.

James Carthew, head of investment trust research at QuotedData said: “It seemed for a long time the fund was getting left behind – but the vaccines have proved to be a great catalyst for this being re-rated.”

The environment for UK micro-caps is conducive to this outperformance. Williams added: “I’ve never known a market quite like this. I’m finding stunningly cheap stuff at the wrong price and the best thing about micro-caps is they can grow when the world’s not growing.”

Performance of funds since 2020

Source: FE Analytics

Finally, the £245m Canadian General Investments Trust, which has outperformed its IT North America sector over the past one, three and five years, broke into the top 100 after finishing 2020 in 208th place.

It is currently trading on a 32.5 per cent discount to its NAV, but this is fairly consistent with the five-year average.

Since 2020, it has made a total return of 53.3 per cent, while Miton UK MicroCap has made 82.2 per cent and 129.1 per cent for Geiger Counter.