A punt on Bitcoin has helped the Ruffer Investment Company deliver its best annual total return in more than a decade.

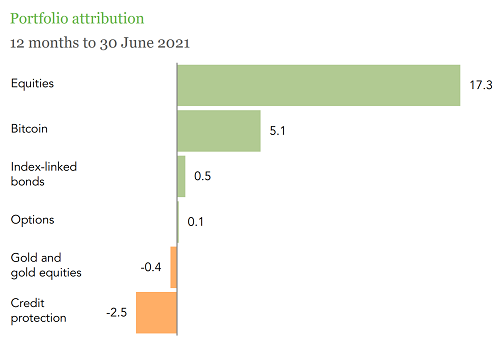

In its annual report to shareholders, released today, the trust revealed it made a total return of 19.5% in the year to 30 June 2021 – its highest since 2009 to 2010 – thanks in part to its controversial purchase of Bitcoin, which contributed 5.1 percentage points to this figure.

Source: Ruffer

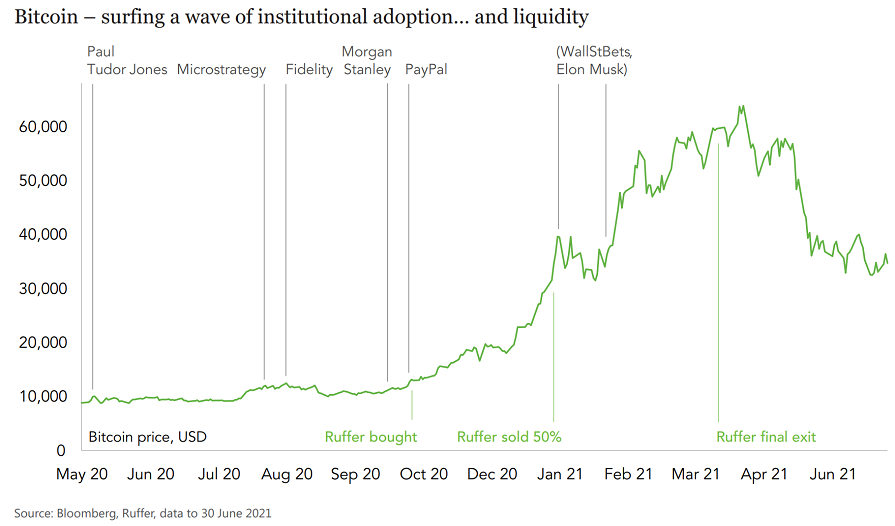

Despite the success of the cryptocurrency position, Ruffer has already sold out, with managers Hamish Baillie and Duncan MacInnes saying the motivation behind buying the asset – that it was emerging as a store of value and institutional investors would move to adopt it as ‘digital gold’ – had already played out. From a purchase price of just over $10,000 (£7,291), it rocketed to more than $50,000 within six months, leading them to take profits.

Source: Ruffer

“Bitcoin may yet fulfil its potential, but the market displayed many signs of froth – retail speculation, excessive leverage, the Coinbase IPO [initial public offering], Tom Brady’s laser eyes, Dogecoin, Elon Musk hosting Saturday Night Live, $60m non-fungible tokens (NFTs) etcetera,” the managers said.

“In the short term at least, Bitcoin was exhibiting the characteristics of a risky, speculative asset and therefore no longer fulfilled the portfolio role we had intended for it as a protective and diversifying asset.”

Yet despite their exit, the managers said that the threat that led them to buy Bitcoin in the first place has not gone away.

They previously warned that Covid had acted as an accelerant, pushing the world into a new regime characterised by greater intervention in markets and economies, which will lead to higher inflation.

Baillie and MacInnes pointed out the percentage of businesses raising prices is at a 35-year high in the US, partly driven by wage pressures, with McDonald’s paying candidates $50 to attend interviews, for example. This phenomenon is being seen across the globe.

The consensus in markets appears to be that the current bout of inflation is ‘transitory’, but the managers said this misses the point.

“If that delicious beer garden pint was £4.50 in 2019 and now it costs £6, it has inflated by 33%,” they continued. “Next year it might cost £6.25. The Bank of England might say: ‘See! Inflation was transitory, it’s only 4%, we told you!’

“But unless wages have risen by 39% since 2019, you should be feeling worse off. We fully appreciate that, due to base effects, it is highly likely that as re-opening enthusiasm wanes, inflation is likely to be lower next year.

“Technically, the transitory crew might be correct, but unless the beer reverts to £4.50, we would say it is one-nil to the inflation hawks in the real world. The price level is what comes out of your pocket, not the second derivative.”

In the event that analysts and policymakers have underestimated the driving forces behind inflation, the managers said it will be difficult to bring it back under control again, with massive debt burdens across the world making significant interest rate hikes unlikely.

Yet even if they haven’t, Baillie and MacInnes claimed “the portfolio role of bonds is spent”.

“If inflation risks recede, then bond investors will earn a zero or slightly negative after inflation return,” the managers added.

“If inflation remains elevated, then the risks for bond owners are catastrophic. The US 10-year yield moving to just 3% (where it was in 2018) would cause a loss of about 15% to bond holders.”

Instead, the managers are piling into inflation-linked bonds, which currently make up 26% of the portfolio, with half in long-dated UK inflation-linked gilts. They pointed out the main driver for index-linked returns is the gap between inflation and bond yields, which they expect to widen significantly as inflation and economic growth accelerate, while central banks will ensure bond yields remain pinned to the floor.

Baillie and MacInnes also continue to like gold, despite its poor performance over the past year, in a period in which high volatility and rising inflation should have played into its hands.

On the other hand, they are avoiding the growth stocks that have done so well since the financial crisis, noting their high valuations make them particularly susceptible to a correction if inflation maintains its current trajectory.

Instead, the managers are using a range of more value-oriented stocks, such as banks, financials, oil and commodity producers.

“The problem for passive or benchmarked investors is these stocks have withered to a small percentage of the index. If you own the index, you do not own enough of them to make a difference. In 1980 the energy sector, an obvious inflation beneficiary, was 28% of the S&P 500, in 2008 it was 15%, today it is 3% – the whole sector is about half as big as Apple,” they said.

According to the managers, the bull case for commodity stocks is simple – they are a beneficiary of higher global economic activity, while the trends for growth, technology and environmental, social and governance investing have left them on low valuations.

For example, the green transition has raised the cost of capital for these industries, meaning there has been little new supply or capex for several years. Yet despite this, the demand picture looks bright.

“Global oil demand is forecast to continue to grow for at least another five years and a green world requires fixed capital and commodity investment spent upfront,” they said. “One cannot make an electric car or a smart grid without a lot of copper and cobalt or a significant amount of oil-related products. Therefore, the earnings for these stocks are potentially higher and more enduring than is currently factored into the price.”

The managers finished by pointing to two quotes which sum up their concerns about the current environment, the first of which was coined in 1810 by Nathan Rothschild: “buy on the sound of cannons and sell on the sound of trumpets”.

“One of the great ironies about investing is that the best time to invest in risky assets is when everything seems utterly bleak, like March 2020,” they said.

“A more dangerous time to invest is when everything is going well and it seems obvious. At the end of June 2021, the US market completed seven consecutive days of new all-time highs, a feat not completed since the dotcom bubble.”

The second quote is Robert Louis Stevenson’s advice that sometimes “it is better to travel hopefully than arrive”.

“Just as the Coinbase IPO marked the recent top in Bitcoin, perhaps ‘freedom day’ will mark the top in markets? That would be delightfully paradoxical. The truth is nobody knows, but we believe caution is warranted,” the managers finished.

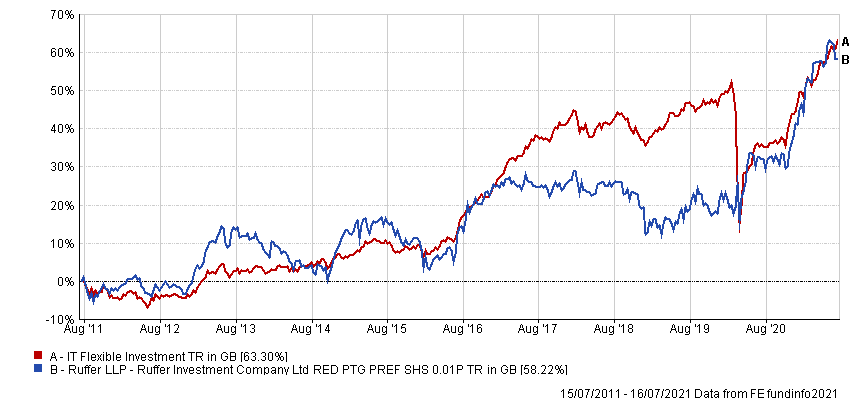

Data from FE Analytics shows Ruffer Investment Company has made 58.2% over the past 10 years, compared with 63.3% from the IT Flexible Investment sector.

Performance of trust vs sector over 10yrs

Source: FE Analytics

The trust is on a premium of 3% compared with discounts of 0.3% and 1.6% from its one- and three-year averages.

It has ongoing charges of 1.08%.