There are 63 open-ended funds and investment trusts that are ahead of their benchmark by more than 10 percentage points over 2021 so far, Trustnet research has found.

This year has brought a challenging set of circumstances for investors to navigate, as the global economy opens up from 2020’s coronavirus lockdowns and stock market leadership oscillates between value and growth stocks.

However, this hasn’t held back some funds as FE fundinfo data shows some have risen significantly above their benchmarks over this time. But which are outperforming by the most?

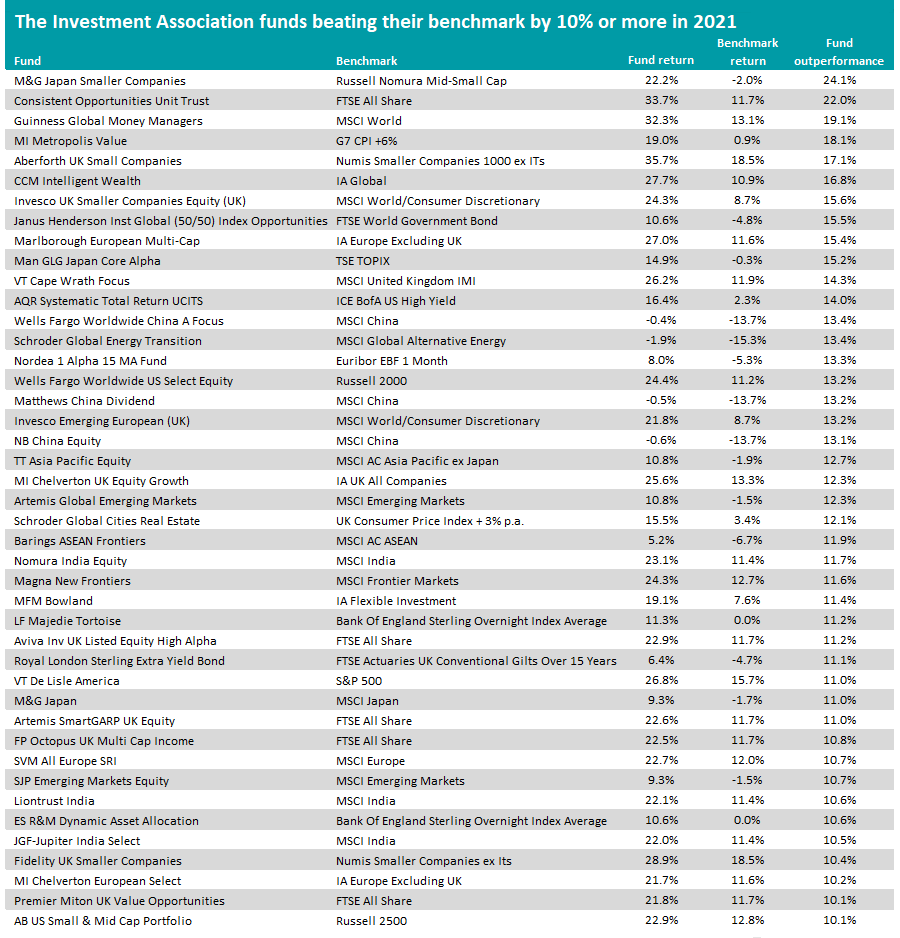

Starting with the Investment Association universe, we found that 43 open-ended funds are beating their benchmark by 10 percentage points or more over 2021 to the end of July.

Source: FinXL

Carl Vine’s £96m M&G Japan Smaller Companies fund sits at the top of the list (which is ranked in order of outperformance) with its 2021 total return of 22.2 per cent. This is 24.1 percentage points higher than the Russell Nomura Mid-Small Cap index, which has made a small loss over 2021 to date.

Vine has a bottom-up approach when building the portfolio, seeking out companies trading on n low valuations relative to their history and the market. The fund also maintains a close working relationships with its investee companies, especially when it comes to establishing better governance processes.

In M&G Japan Smaller Companies’ latest annual report, the manager said: “We continue to see valuations in Japanese companies as highly supportive for prospective returns. More importantly, given the significant variation in valuation between stocks, there are ample opportunities for us to identify mispriced growth stocks, that we believe could go on to re-rate significantly.

“This, combined with continued restructuring at the company level, leaves us excited about the opportunity to add additional value through our stock picking and engagement approach.”

In second place is Consistent Opportunities Unit Trust. It’s 33.7% total return this year is 22 percentage points over that made by the FTSE All Share.

Managed by Jay Patel and Nicholas Pritchard, the £18m fund resides in the IA UK All Companies sector and value bias, investing in high-quality companies with strong balance sheets and stable market positions but trading at appealing valuations.

It’s not the only UK value strategy to make it onto the above list, as both VT Cape Wrath Focus and Premier Miton UK Value Opportunities fit into this bracket of fund.

Guinness Global Money Managers comes in third place, thanks to a total return of 32.7% beating the MSCI World by 19.1 percentage points. As its name suggests, the fund invest in asset management companies – which have benefitted from the bull market that followed in the coronavirus pandemic’s wake.

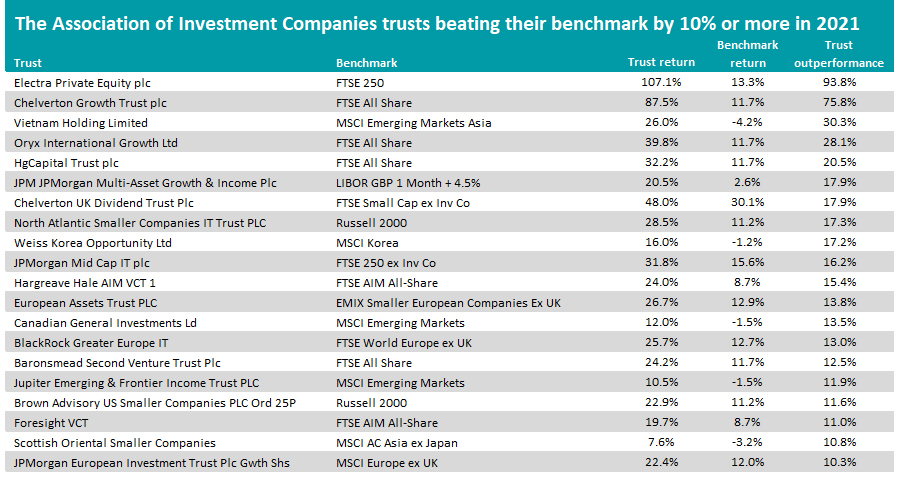

Source: FinXL

Turning to the Association of Investment Companies universe, Trustnet research found there were 20 trusts outpacing their benchmark by at least 10 percentage points this year. They can be seen in the above table.

Electra Private Equity comes in first place. Its 107.1% total return is 93.8 percentage points above that of its FTSE 250 benchmark this year.

The trust is approaching the final stage of its winding up and is currently following a realisation strategy, which aims to crystallise value for shareholders. This means it will not be making any new investments “but will continue to support its existing investments to the extent required in order to optimise returns”.

Chelverton Growth Trust appears in second place. It invests in UK smaller companies, which have been one of strongest parts of the market over 2021 so far and helped power the trust past its FTSE All Share benchmark.

In third place is Vietnam Holding, which is up 26% while the MSCI Emerging Markets Asia index fell 4.2%. Vietnam has been the strongest Asian market in 2021, after masses of retail investors started investing in the country’s equities.