Rising fuel, metal and agricultural prices have brought renewed interest into commodity companies, but not all fund managers are equally as bullish for the sector.

Some have predicted a ‘super-cycle’ could be about to take place, with prices skyrocketing as demand spikes during the Covid-19 recovery, while supply is lower due to companies conserving cash and failing to spend on new projects.

Ian Williams, manager of the DMS Charteris Premium Income fund, is one who believes this. He said there would be a five-year “mega bull market” for crucial commodities such as copper, where this supply imbalance has been prevalent.

“If you tried to get a permit to build a copper mine in America or somewhere today, you’ll probably find environmentalists objecting to it,” he said. “But hang on, you need the copper - without that without the copper, you don't have your electric cars.”

Indeed, Rio Tinto and BHP’s proposed Resolution Copper project in Arizona, has been trying to get the necessary permits for almost 15 years. It is estimated that the project has the potential to supply up to 25% of all the US’s copper demand.

Williams said that car manufacturers might find themselves in a similar situation with copper or nickel as they found themselves during the semiconductor shortage last year.

Another problem with the supply of copper is that many of the big mines that produce the commodity have a finite supply, a big problem for the rise of electric vehicles and other eco-initiatives.

“The very point at which the government all these Western governments are targeting to make the big transition from petrol and diesel cars to electric cars almost coincides hand in glove with when a lot of these copper mines all start to go into quite serious decline,” he said.

He said South Africa’s gold supply was a good example of how finite of a resource metals can be.

“South Africa used to be the world's predominant gold mining country by a mile,” he said. “But South Africa is nowhere near the world's top gold producer these days because most of the gold is gone.

“The same thing is going to happen with the copper mines. They are finite resources.”

Georges Lequime, manager of the TB Amati Strategic Metals Fund, also noted how there was not enough supply of various metals, copper included, to meet future expected demand.

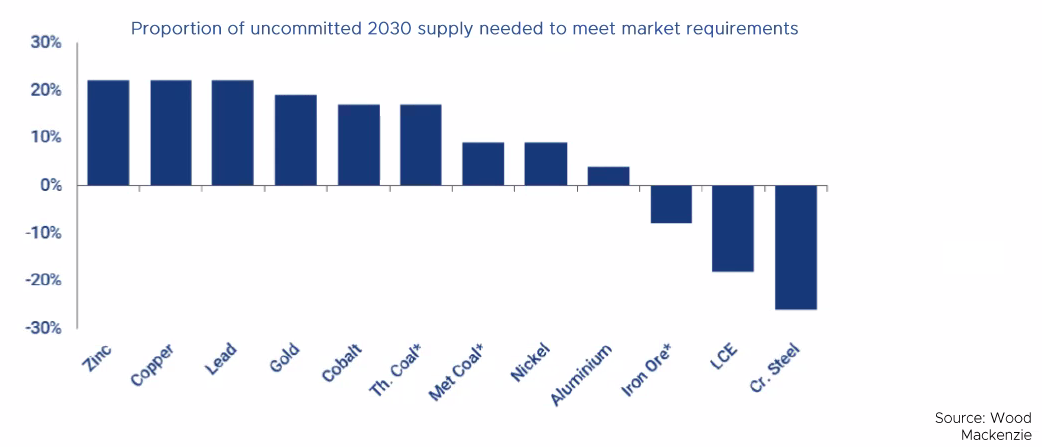

The chart below shows how much uncommitted supply of various metals needs to be increased to meet market demand in 2030.

According to research firm Wood Mackenzie, the market needs more than 20% additional copper than exists in all the projects that have been approved up to 2030.

“Supply is tight,” Lequime said. “It will have to come from new projects, new discoveries, or unapproved projects. Whichever way you look at it, if we want to build a more sustainable planet going ahead it all requires metal.”

One reason for this shortage is because too much capital has been directed to other sectors instead of mining and resource companies for too long.

Ever since the financial crisis of 2008, which caught many mining companies off guard with too much supply, there has not been enough investment into new mining projects.

“Basically, shareholders don't spend anymore,” Lequime explained. “What we've had since then is: China's chugging along consuming a lot of metal, and you’ve got the West and emerging markets consuming a lot as well.

“The BlackRock’s and Vanguard’s of the world that own so much stock and are so big - they’re pushing these mining companies and saying, ‘I don't want you to develop new projects’.”

He said that some mining companies are being discouraged from spending on new mine and exploration projects because of the hit to free cash flow – which would reduce their dividend payments.

“Right now, we are in that holding pattern where the mining companies are telling me they want to spend the money, but the large shareholders are saying no just hold back, keep the dividends,” he said.

Despite this tightening supply, Lequime cautioned investors from just piling into mining companies.

“You don't want to get suckered into buying copper companies at the height of this mini wave,” he added. “It's kind of like a tide coming in, but you have these small waves, and you just don't want to catch the top.”

He also does not believe the commodity market is in a true ‘super-cycle’, despite how useful it would have been in pitching his fund to new investors.

“I think we just came through a horrific drop in economic activity last year where there was a lot of destocking - and now you're getting restocking taking place,” he said.

In fact, in the short term he expected there to be some overstocking in the future because of the anticipation of very strong economic growth over the next 12 months.

The TB Amati Strategic Metals Fund invests in both strategic metals such as copper and nickel – crucial for the energy transition- as well as precious metals such as gold and silver.