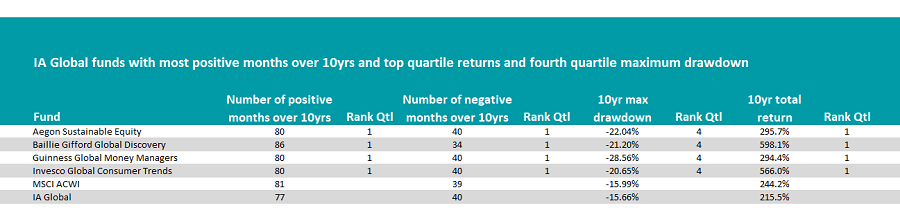

Only four IA Global funds have managed to deliver consistently top-quartile returns over the past decade while suffering the biggest losses in the sector, FE fundinfo found.

This series looks at funds which have been top-quartile for both returns and number of positive months over 10 years while undergoing the largest maximum drawdowns in its sector.

Even some of the most consistent funds can experience a wobble but for those investors that remain invested for the long-term, there can also be strong rewards for their patience.

Previously, Trustnet looked at the major UK equity sectors. This time the study looked at IA Global funds.

Source: FE Analytics

*MSCI ACWI was used as a comparison for all funds

The study revealed just four funds achieved this type of return: Aegon Sustainable Equity, Baillie Gifford Global Discovery, Guinness Global Money Managers and Invesco Global Consumer Trends.

All of them, except Baillie Gifford Global Discovery, experienced 80 positive months out of a potential 120. The Baillie Gifford portfolio had 86 positive months.

Baillie Gifford Global Discovery

A common theme among the names was a focus on growth, a style which has generally worked well over the past decade, benefiting from persistently low interest rates and monetary easing.

Baillie Gifford as a fund house has become synonymous with growth investing, as all of its funds follow the process of investing in a handful of companies they think will continue to rapidly grow their earnings for years to come.

Rayner Spencer Mills Research described the firm as “embracing risk rather than fearing losses to achieve returns.”

The Baillie Gifford Global Discovery fund is no exception to this and its bold choices have paid off with high returns. It was the second best performer in the entire IA Global sector over the past decade, in spite of its fourth-quartile maximum drawdown of 21.2%. Its 10-year volatility was 19.2% versus the sector average of 11.5%.

Performance of fund vs sector over 10yrs

Source: FE Analytics

The £2.1bn fund is run by FE fundinfo Alpha Manager Douglas Brodie and deputy managers Luke Ward, Svetlana Viteva and holds an FE fundinfo Crown Rating of five.

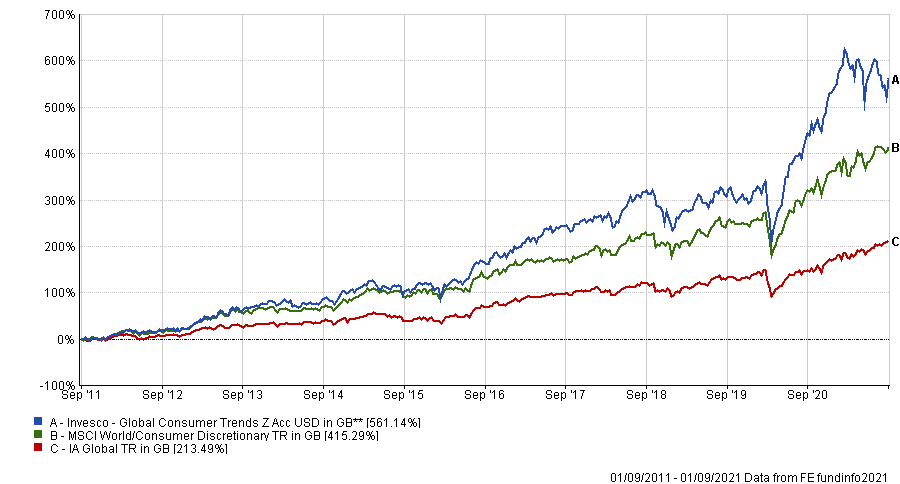

Invesco Global Consumer Trends

Another fund on the list with a strong growth bias is Invesco Global Consumer Trends. Despite a maximum drawdown of 20.7%, it still made 566% over 10 years, the third best in the IA Global sector.

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

As its name suggests the fund invests in trends which are driven by changes in standards of living, demographics and connectivity.

Managers Julian Hartsfield and Ido Cohen said that these trends are rapidly changing with the advent of new technology, particularly online.

This is causing a global transformation in how consumers spend and driving large shifts in market share between companies, “creating winners and losers”, making it an “excellent” stock picking environment.

Hartsfield and Cohen have a three pillar process to identify potential holdings. They involve research driven analysis, portfolio construction determined by diversification and sell-discipline and finally risk management.

This has led them to companies such as e-commerce giant Amazon, luxury brands company Farfetch, meal prep business HelloFresh and ride-railing company Lyft, all stocks in the top 10 that reflect the increased shift and demand to online services across aspects of daily life.

Aegon Sustainable Equity

Next on the list is Aegon Sustainable Equity, which made almost 300% over 10 years, with a maximum drawdown of 22%. Its average volatility for that time was 14.3%.

Performance of fund vs sector over 10yrs

Source: FE Analytics

However it is worth noting that the fund has only taken on a sustainable investment focus this year as part of Aegon’s rebrand of the fund and much of its prior performance was before this switch occurred.

It still follows the investment process established at its initial launch in 1987, building a concentrated and growth-focused portfolios centred around small and mid-caps, but it will now have sustainability-based exclusion.

Part of this rebrand involved a change in management, with Andrei Kiselev and Malcolm McPartlin taking over from Mike Nicol and Euan Weir this summer.

Guinness Global Money Managers

The final fund in the study is Guinness Global Money Managers, a fund domiciled in Ireland.

It’s been run by Tim Guinness and Will Riley since launch and under their management has made 296% over 10 years, with a maximum drawdown of 28.6% and volatility of 17.4%.

Performance of fund vs sector and index over 10yrs

Source: FE Analytics

The fund managers looks equally at macroeconomic activity and themes, as well as stock selection, in which they have value bias. Potential holdings must be at least $500m (£361m) in size at the time of investment.