Royal Mail, the best performing stock in the UK over the past year, would have beaten most of the US’ tech behemoths but investors are still unsure if the domestic market is the best place for their cash.

The letter and parcel carrier made 112.7%, putting it ahead of US tech giants such as Apple (28%), Microsoft (41%), Google parent Alphabet (82%) and Netflix (14%) over the past year, data from trading platform eToro found.

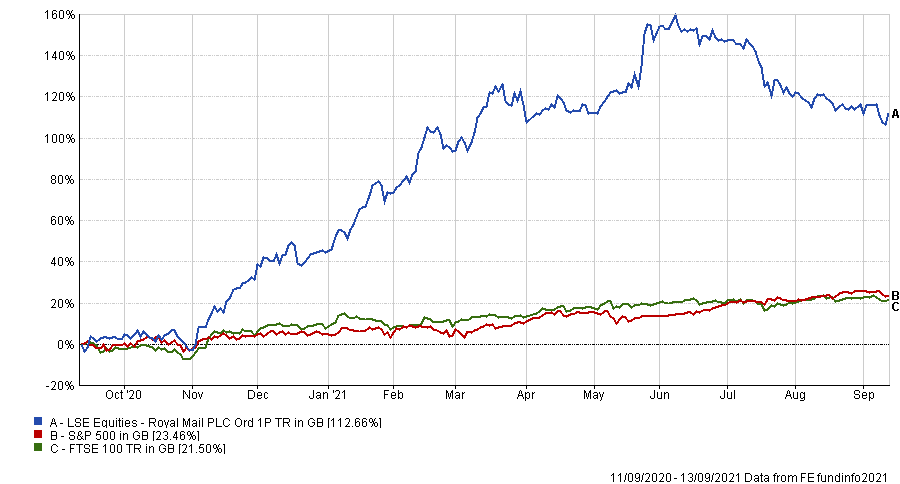

Performance of Royal Mail vs S&P 500 and FTSE 100 over 1yr

Source: FE Analytics

The company was one of several UK brands to beat the returns of the top US stocks. Ladbrokes, Gala Bingo owner Entain, and NatWest also surpassed some of the S&P 500’s biggest names.

But this outperformance from UK names during the past 12 months doesn’t mean investors are backing the UK market.

In a recent eToro survey of 6,000 investors, only 14% said the UK was the best place to invest, only ahead of Japan, which received 12% of the vote.

In contrast 39% said the US was the best buying opportunity for the remainder of 2021, closely followed by Europe on 38%. China was third with 24% of the vote, with investors seemingly undeterred by the recent wave of government legislation on education and tech stocks, which has derailed market returns.

Ben Laidler, global markets strategist at eToro, said that it was interesting but not very surprising that UK stocks rank so low on investors’ preferences.

He said that while the FTSE 100 lacked the “glitzy tech stocks” that have made the S&P 500 incredibly popular over the past few years it does hold companies that are “likely to perform well as economies recover from coronavirus”.

This mainly refers to the products and services of miners, banks and oil companies, sectors making up a big part of the UK large-cap market.

Laidler said there will be a demand for these types of companies “as the shackles are released from major economies,” post Covid-19.

This could lead to a “reversal of fortune,” for the FTSE 100 over the coming months, Laidler said, with investors attitudes subverting the “unloved” sentiment they’ve held since the 2016 Brexit Referendum.

Indeed, the UK market has lagged its international peers since that Brexit vote, however there could be a change, he added, as UK firms “can offer returns equal to – and better than – even the fast-growing firms in the US and other high-growth markets”.

Performance of S&P 500 and FTSE 100 since Brexit vote 23/6/2016

Source: FE Analytics

The strategist said that investors should avoid using a “broad brush approach” when it comes to stock picking, and not “discount” a company just because it’s domiciled in the UK.

“This increases the chance that you’ll miss out on companies offering the best returns,” he added.